Per IRS regulations, all cryptocurrency trades or sales must be reported on IRS 8949 cryptocurrency tax form.

In 2014, the IRS declared that cryptocurrency, such as Bitcoin, is treated as property for tax purposes. In 2019, the IRS released further guidance through Revenue Ruling 2019-24, which brought cryptocurrency in even further alignment with equities and other capital assets for tax purposes. Taxpayers are required to report their capital gains and losses on the same form (IRS Form 8949) as stocks and equities. In reporting cryptocurrency transactions on the IRS 8949 taxpayers should: 1) properly report their capital gains and losses; 2) classify transactions as short or long-term; and 3) report whether the transactions were reported on a 1099-B.

How to Report Gains/Losses

Similar to equities, every purchase of cryptocurrency sets a cost basis in the asset, and every trade or sale results in taxable proceeds. To determine the gains and losses to report, taxpayers must subtract their cost basis from their proceeds. (Proceeds – Cost Basis = Capital Gain/Loss).

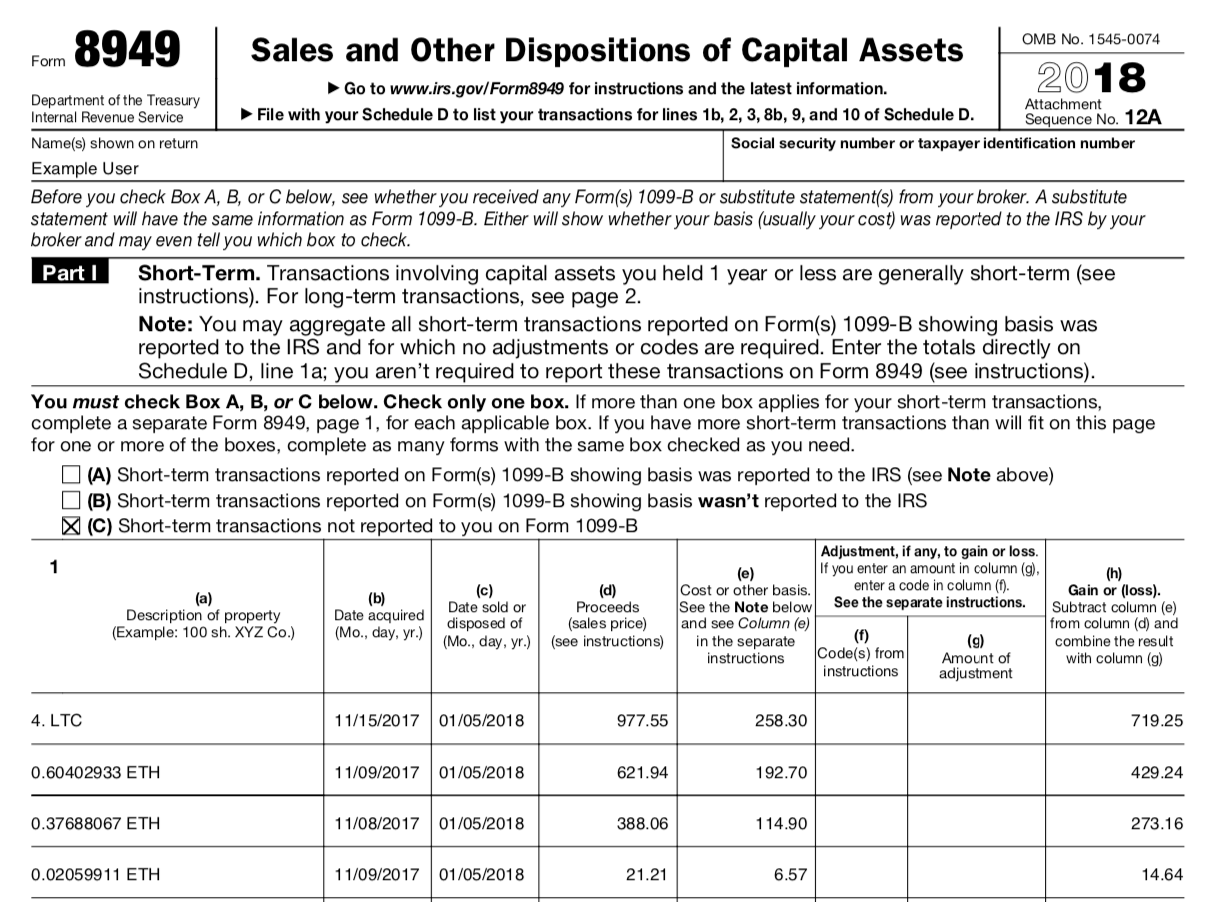

For example, if you purchased 4 Litecoin for $258.30 and later sold the 4 Litecoin for $977.55 then you will realize a gain of $719.25. (Ex. $977.55 – $258.30 = $719.25). This transaction would be reported on IRS 8949 as follows:

Because every trade or sale is a taxable event, it is common for cryptocurrency traders to have hundreds, if not thousands of transactions to report. Every transaction must be itemized and reported.

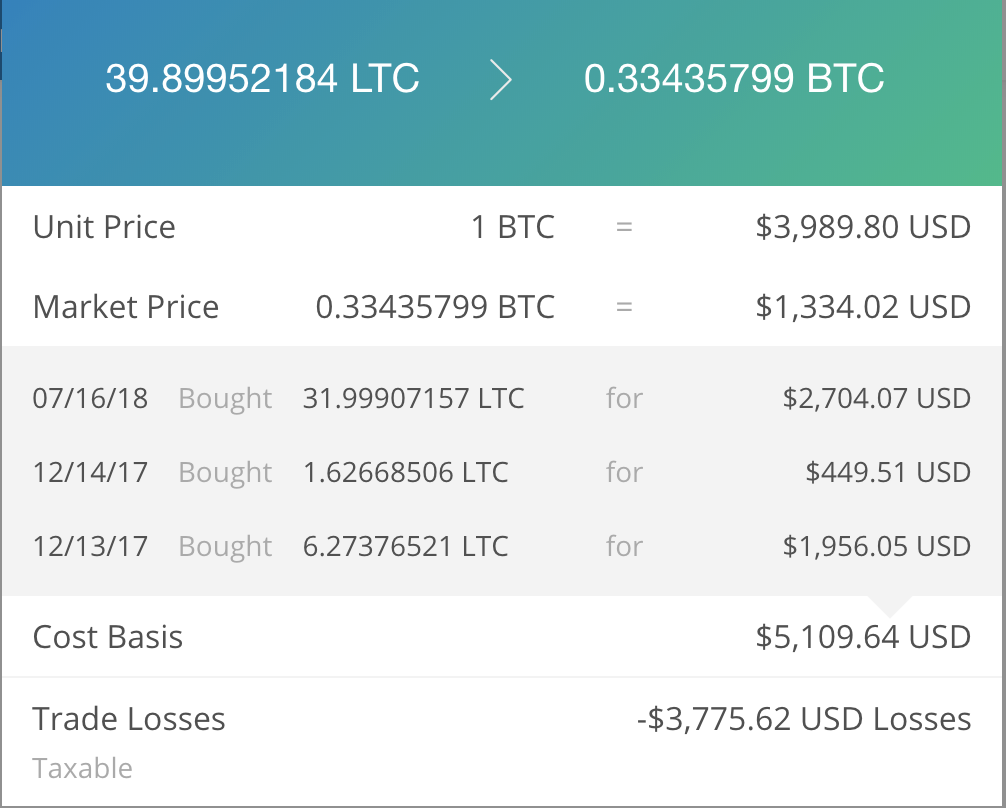

This process can be difficult to track if the cryptocurrency you are trading or selling was obtained in multiple installments. For example, if you acquired 39.89 Litecoin on three different days, then you would have three different cost basis pools that you need to track.

In the above example, you can see that the user acquired 39.89 Litecoin on three different days and then traded all of their Litecoin for .33 Bitcoin. Every cost basis pool must be accounted for in reporting cryptocurrency taxes. Taxbit tracks every movement of cryptocurrency and all cost basis information. Taxbit connects to exchanges via “read only” API’s and provides a full audit trail of all cost basis information.

Short and Long-term Transactions

The IRS 8949 tax form is divided into two sections. Assets held for less than one year will be reported in the short-term section. Short-term gains are taxed at the same rates as ordinary income.

If you hold a particular cryptocurrency for longer than one year then you are eligible for long-term tax advantage rates. Long-term gains are taxed at favorable rates, so it is beneficial to hold assets with unrealized gains for one year or longer. If you have unrealized losses, then holding period is less important and it is typically most beneficial to claim the losses to reduce your tax liability (check out this blog learn more about crypto losses tax). Taxbit automatically tracks taxpayer’s holding periods and helps taxpayers claim long-term tax advantaged rates when eligible.

Transposing Your 1099-B

Brokers of capital assets such as exchanges are required to provide taxpayers who exchange on their platforms with a 1099-B at the end of the year. The 1099-B will provide taxpayers with information regarding their cost basis and proceeds from the sale of capital assets.

The IRS 8949 tax form has three boxes. If you were issued a 1099-B with cost basis information then you should check Box “A” for short-term assets and Box “D” for long-term assets and then transpose the 1099-B onto your IRS 8949 tax form.

If you were issued a 1099-B, but the form doesn’t include all of your cost basis information, then you will check Box “B” for short-term assets and Box “E” for long-term assets. You can then add cost basis information and fix any deficiencies present on the 1099-B. For example, if the 1099-B lacks information regarding transfers onto an exchange or off of an exchange, then you can fix any assumptions when filing your IRS 8949 tax form.

Some cryptocurrency exchanges may fail to issue tax forms to their users. If this is the case then the taxpayer should check Box “C” for short-term assets and Box “F” for long-term assets indicating that the taxpayer has not been issued a 1099-B. This requires the taxpayer to enter and report their own capital gains and losses.

Taxbit automates your cryptocurrency taxes no matter which situation you fall into.

Conclusion

Taxbit automates this process and takes away the complexities involved in reporting cryptocurrency taxes on taxpayers’ IRS 8949 tax form.

Taxbit aggregates all of your trade data, tracks cost basis assignment, classifies transactions based on their holding period, reports whether a user was issued a 1099-B and whether their were any cost basis deficiencies on the form, and provides support for all calculations through a CPA designed audit trail.

-Written By Cryptocurrency Tax Attorney: Justin Woodward

.png)