Crypto Tax Loss Harvesting: A Complete Guide

Learn about tax-loss harvesting for cryptocurrency and potential tax savings.

Published on:

**TaxBit is solely focused on enterprise Tax and Accounting solutions and will no longer offering a consumer tax solution. We have partnered with Intuit TurboTax and getting started with their TurboTax Investor Center is easy. Simply create a new account or use your existing Intuit TurboTax account login and connect your crypto accounts to help avoid tax-time surprises.**

Cryptocurrency Trading Tax-Loss Harvesting Guide

Cryptocurrency provides the unique opportunity of being able to appreciate wealth over time while saving money on taxes along the way by taking advantage of market price fluctuations.

It is a common misconception that you should only realize capital losses right before the end of the tax year. Cryptocurrency prices can be volatile and widely fluctuate throughout the year.

Wise investors take advantage of the pricing dips throughout the year in order to capture taxable losses at the lowest points during the year.

What is tax-loss harvesting?

Tax-loss harvesting is an investment strategy that maximizes after-tax returns by taking advantage of dips in cryptocurrency market prices. Imagine if you could appreciate wealth over time while in the process increase your tax refund, or at a minimum reduce what you may owe in taxes. Tax-loss harvesting does exactly that!

Here is how it works:

A capital gain or loss is triggered anytime you dispose of (sell/trade) a capital asset. In 2014, the IRS declared cryptocurrency to be a capital asset, meaning that every sale or trade of cryptocurrency results in a capital gain or loss.

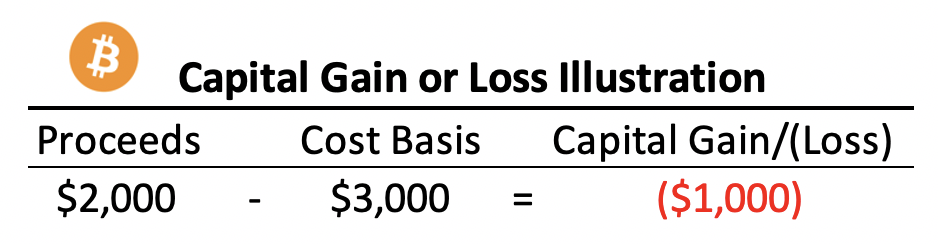

A capital gain or loss is equal to the value of what you receive at the time of disposal (commonly referred to as “Proceeds”) less the value of what you obtained the asset for at the time of purchase (commonly referred to as “Cost Basis”).

The following examples illustrate the tax position of two cryptocurrency investors (“Sam”) and (“Rachel”).

Example 1:

Sam purchased .25 BTC for $3,000 in June, Year 1. Sam has no gains or losses yet because he has not recognized a taxable event. Today, Sam continues to hold .25 BTC.

Example 2:

Rachel also purchased .25 BTC for $3,000 in June, Year 1, just like Sam. However, Rachel decided to sell her .25 BTC for $2,000 4-months later in October, Year 1.

The following illustration shows Rachel’s capital gain or loss:

In this example, Rachel generated a $1,000 capital loss that she can use to offset other gains or potentially increase her tax refund come Year 1 tax season.

However, Rachel didn’t stop there. Let’s assume that Rachel used the $2,000 proceeds that she received from the sale of her .25 BTC to repurchase .25 BTC. Unlike Sam, Rachel can claim the $1,000 loss on her taxes. Just like Sam, today Rachel continues to hold .25 BTC.

As shown in these two examples, both Sam and Rachel bought the exact same amount of BTC for the same price, only Rachel decided to sell her BTC at the low-point in Year 1 before repurchasing it. By doing this, Rachel was able to take advantage of a tax benefit in Year 1, while Sam was not. This is tax-loss harvesting.

Rachel may realize greater gains in future years when disposing of the .25 BTC because she reset her cost basis. For most investors, it is advantageous to claim capital losses in the earlier years in order to maximize wealth today. As the common adage goes, “money today is better than money tomorrow.”

Rachel could have used the money she generated from her increased tax refund or tax savings in Year 1 to purchase more BTC, while Sam on the other hand left money on the table.

How often should I harvest my losses?

Many people choose to harvest their losses annually. They look for capital assets in their portfolios carrying losses in the last month of the tax year.

Once it’s clear that an asset isn't going to show a profit before the year ends, they'll consider locking in the investment loss for tax purposes.

However, that strategy leaves money on the table! Like securities, cryptocurrencies fluctuate in price significantly over a tax year. Wise investors know that being open to taking advantage of those dips in price regularly is far more efficient than doing so only once a year.

Even if your tax situation means that you won’t benefit from your losses in the year you deduct them, it’s still a good idea to claim them. You can carry forward capital losses to future years indefinitely.

That said, crypto tax-loss harvesting can be complex, especially for those who try to keep track of each asset’s cost basis manually. It’s always a good idea to get personalized tax advice from a Certified Public Accountant or another tax professional.

What are the risks of tax-loss harvesting?

Tax-loss harvesting has two primary risks.

The first is that the costs to execute the necessary trades could outweigh the savings on your tax bill from harvesting the losses. For example, you may have to pay as much as 4% in transaction fees when buying and selling through some exchanges.

The second is that while tax-loss harvesting defers your capital gains, it doesn’t necessarily eliminate them forever.

When you harvest your losses and use the proceeds to purchase a replacement cryptocurrency (whether or not it’s the same asset), your new cost basis will be equal to your fair market value at the time of the previous sale.

By definition, that will be lower than your original cost basis. That means you’re potentially setting yourself up for an even larger capital gain if you sell the new asset at a profit in the future.

That usually works in your favor because money now is more valuable than money later. Also, you’ll ideally be in a lower tax bracket when you decide to sell the replacement asset.

However, if you sell the replacement asset at a gain when you’re in a much higher tax bracket, you may end up losing some or all of the benefits you received from your tax-loss harvesting.

A common question is whether or not there is any risk of the wash sale rules applying to crypto. At this time, wash sale rules specifically apply only to stocks and securities, not cryptocurrency.

With that in mind, you should take advantage of the fact that wash-sale rules don’t currently apply.

Is tax-loss harvesting worth it?

For many investors, tax-loss harvesting is well worth it. It can significantly increase your investment returns over the long term in two ways.

First, it can noticeably decrease your tax liability the year you harvest the losses. Capital gains tax rates can be as high as 20%. That’s lower than ordinary income rates, but it’s still as much as a fifth of your profits.

Even better, if you have capital losses left over after netting them against your capital gains for the year, you can deduct up to $3,000 of them from your ordinary income. The savings here are likely to be even higher since you can have an ordinary income tax rate of up to 37%.

Second, the tax savings free up more money for you to invest each year. Remember our example with Rachel and Sam above. Rachel reduced her taxable income by $1,000. If she was in the 22% tax bracket for the year, she generated an extra $220 that she could invest into more Bitcoin.

Of course, no strategy is beneficial in every scenario. Balance the potential benefits against the risks mentioned above.

TaxBit makes it easy to tax loss harvest

TaxBit’s, ‘Tax-Loss Optimizer’ provides your cost basis and unrealized position in real-time while showing your unrealized losses, by exchange.

The displayed unrealized losses are in accordance with IRS requirements, specifically identifying the highest cost basis assets by source.

Anytime you have an asset that is “underwater,” the current value is lower than the value at which you obtained the asset, the optimizer will recommend a tax-loss harvesting trade.

Tax-loss harvesting is a common strategy that wise investors deploy.

TaxBit has made it easy for you to take advantage of tax-loss harvesting throughout the year. Give it a try, today!

Get Started Today!

Generate your cryptocurrency tax forms now