Explaining 1099 tax forms issued from cryptocurrency exchanges.

It’s tax season and many taxpayers will receive tax forms from cryptocurrency exchanges. Due to some confusion in the industry, some taxpayers may receive a form 1099-K, others will receive a form 1099-B, and some may receive nothing at all. Whatever situation you fall under, Taxbit is skilled in helping.

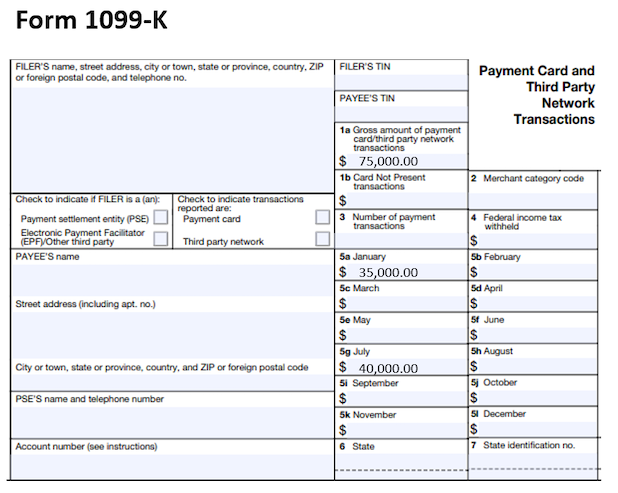

Form 1099-K

A couple of cryptocurrency exchanges have issued 1099-K’s, which is an informational return that sums up the total value a user has received throughout the year. This form leads to reporting of income when no income was actually generated on the exchange. If you receive a 1099-K from a cryptocurrency exchange then you will also likely receive an IRS CP2000 letter for unreported income in the future.

Cryptocurrency exchanges that have issued 1099-K’s report only the total value transacted, but do not include proper adjustments for cost basis. For example, if a user purchases $100,000 of cryptocurrency and then sells it a month later for $90,000, then both the user and the IRS will receive a 1099-K showing income received of $90,000 (assuming the taxpayer meets the 200 transaction threshold). Form 1099-K is intended for taxpayers who generate income on a platform, such as Ebay and Etsy sellers. Accordingly, the amount listed on the 1099-K will be much higher than a taxpayer will actually owe.

Most taxpayers correctly don’t report the inflated 1099-K amount as income on their tax return. As a result, the IRS cross checks the 1099-K against the taxpayers income and then issues a CP2000 audit letter for failing to report the income. Worse yet, Taxbit has helped many taxpayers whose accountants weren’t aware that their client’s 1099-K was inaccurate and actually reported the amount listed on a taxpayer’s 1099-K as income. Many exchanges have stopped issuing 1099-K’s due to the IRS auditing their users for unreported income. If you received a 1099-K then Taxbit can help you resolve any audits or issues you encounter related to the 1099-K tax form.

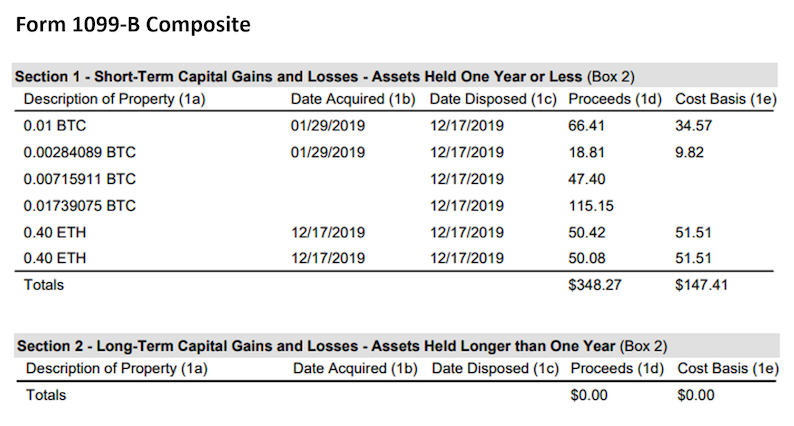

Form 1099-B

Form 1099-B was designed for capital assets. This form shows proceeds from each transaction, as well as cost basis when available. Form 1099-B has long been used in the equity and commodity space for brokers of capital assets. Form 1099-B is designed to be transposed onto an IRS 8949 (the tax form cryptocurrency traders are required to file).

Gains reported on a 1099-B are taxed pursuant to capital gains treatment instead of ordinary income. Many exchanges are seeing the problems 1099-K’s have caused and are beginning to issue 1099-B’s due to the nature of cryptocurrency being taxed as a capital asset. Issuing Form 1099-B leads to more accurate tax reporting and eliminates the automatic IRS audits for unreported income which are issued to recipients of form 1099-K.

If you only traded on a single exchange and were issued a Form 1099-B, then the tax form will be complete and you can transpose the information onto your IRS 8949. If you traded on multiple exchanges, then Form 1099-B may not report capture all of your cost basis from other cryptocurrency exchanges. Taxbit can help you aggregate your data across exchanges and resolve any missing cost basis transactions.

Conclusion

Whether you were issued a 1099-K, 1099-B, or weren’t issued any tax form at all, Taxbit can help ensure you are tax compliant.

.png)