Navigating the key opportunities and obstacles for incorporating digital assets into your strategy

Digital assets are quickly becoming mainstream with more individuals and businesses embracing the asset class than ever before. As corporations continue to explore, plan for, and expand their digital asset strategy, it’s important to understand the key benefits while also understanding the most difficult challenges.

Note: Taxbit works closely with the world’s top experts on digital asset tax and accounting services. This blog post is transcribed from a recent Webinar hosted by Aaron Jacob, Taxbit’s Head of Accounting Solutions, alongside two experts from top accounting firm EY: Sean Riley, Senior Manager of Financial Accounting Advisory Services, and Lindsay Long, Partner of Financial Services.

Opportunities driving top organizations into digital assets

Despite the recent decline in cryptocurrency prices, the world’s most influential organizations continue to significantly expand their digital asset strategies. Blackrock, the world’s largest asset manager, cited “increasing interest” from clients and launched a private Bitcoin trust for clients in August. The same week, after a successful pilot Instagram enabled NFT functionality for creators and users in over 100 countries.

And in May, Starbucks’ Chief Marketing Officer explained:

“We believe NFTs have broad potential to create an expanded, shared-ownership model for loyalty, the offering of unique experiences, community building, storytelling, and customer engagement.”

The world’s largest payment networks are also primed for the digital asset revolution– PayPal’s CEO mentioned that “digital assets are the future” on an August earnings call, Visa reported over $2.5 billion of crypto-linked card payments in early 2022, and Mastercard recently partnered with a consortium of Web3 companies to streamline NFT commerce.

The momentum of digital asset adoption is powerful, and there are a myriad of key opportunities for new entrants such as:

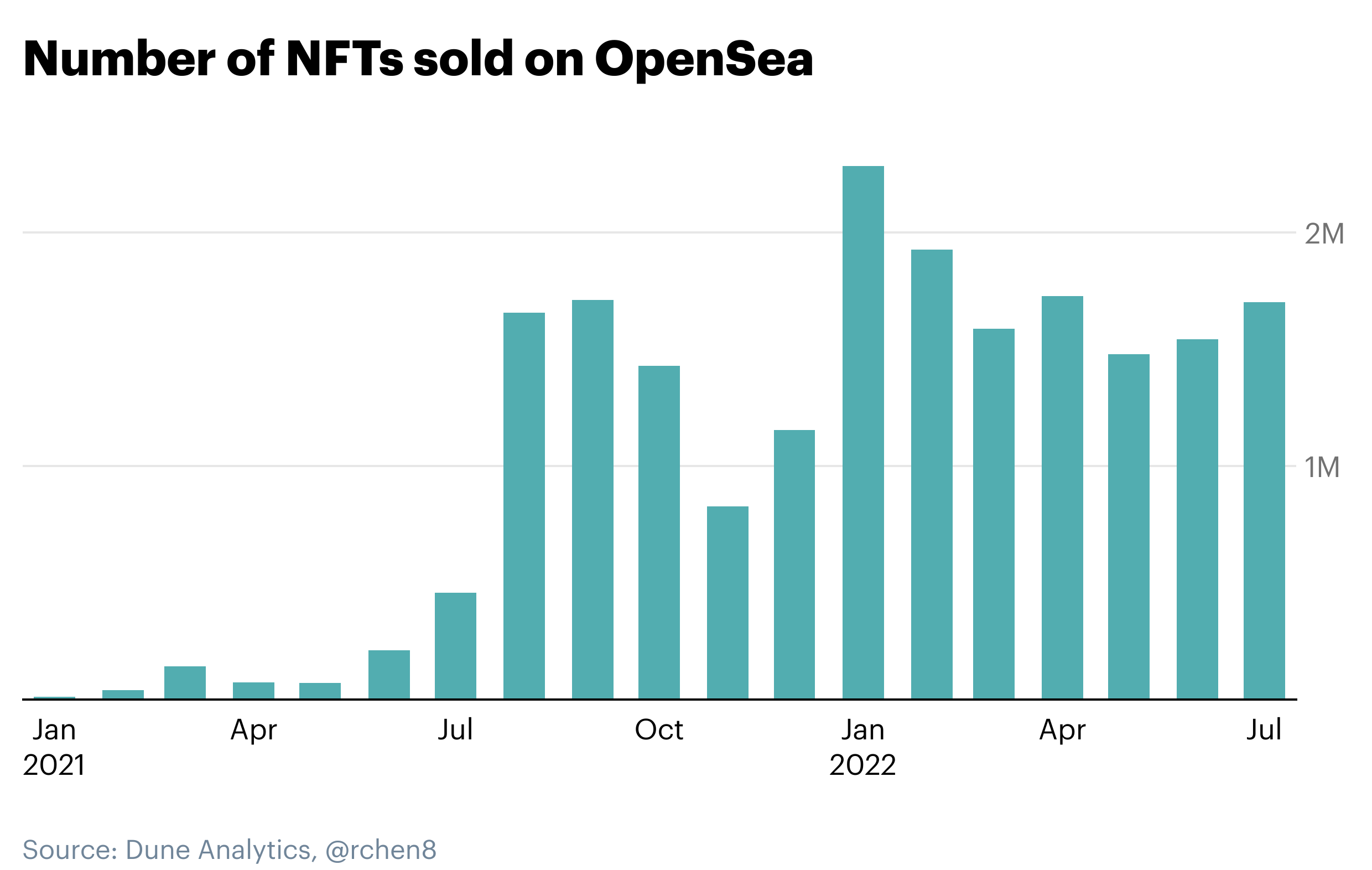

- New strategic business opportunities with NFTs: Many companies are seeing new top-line revenue generating opportunities, and innovative means of engaging customers, with NFTs. As a prime example, the NFL recently announced it would offer NFT tickets to attendees of more than 100 live games in collaboration with Ticketmaster. And last week, fashion giant Tiffany’s sold out of a collection of 250 “NFTiff” CryptoPunk pendants for $50,000 each. In July, over 1.7 million digital items were sold on OpenSea, the world’s largest NFT marketplace:

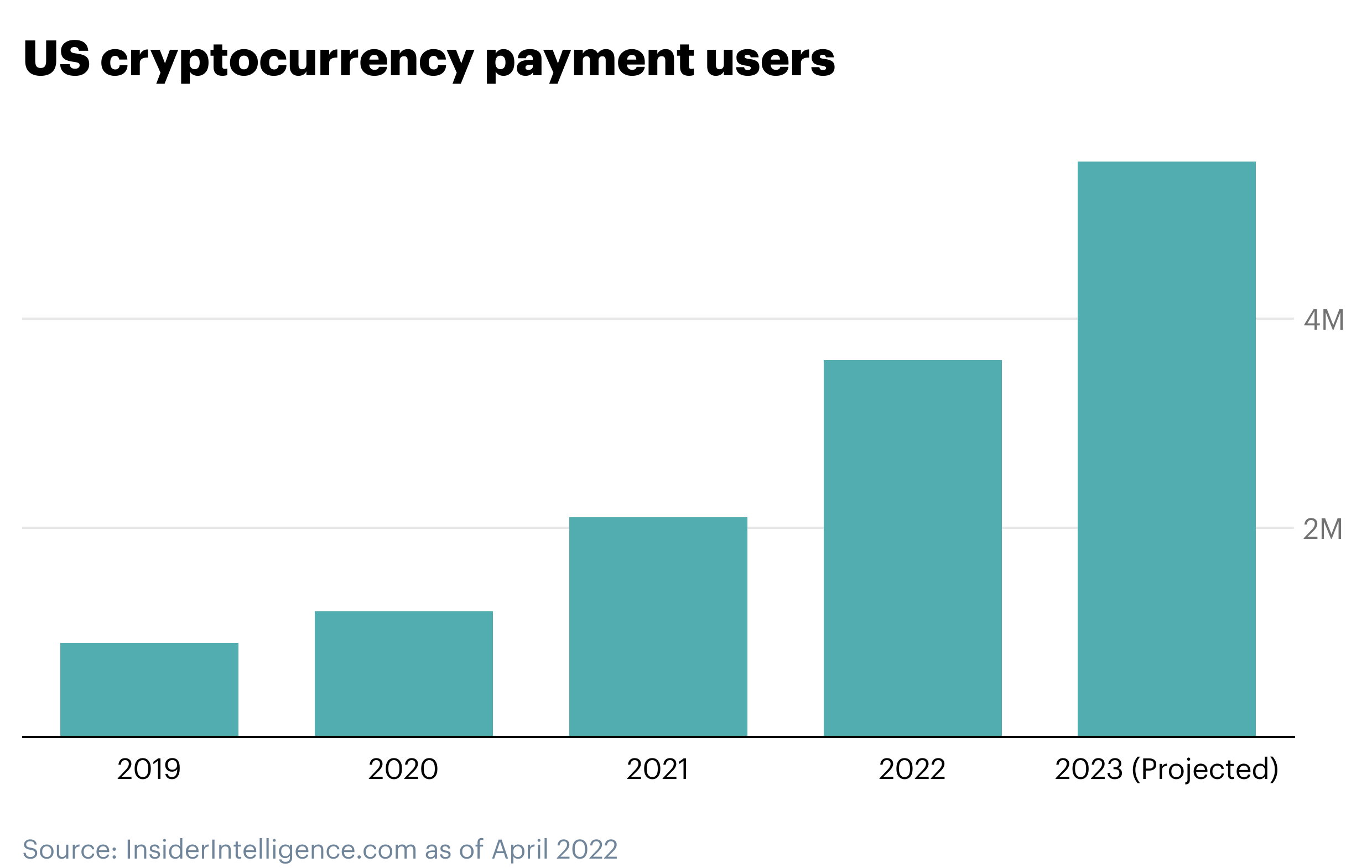

- Customer demand for crypto payment opportunities: Many companies are seeing significant demand to accept crypto as a new form of payment. The Wall Street Journal recently reported that AT&T, Overstock, and Chipotle already accept crypto payments from their customers– and a 2022 report from top accounting firm Deloitte showed that 64% of consumers want crypto payment support (while 83% of merchants expect crypto payments demand to increase). Enabling crypto payments can unlock new customer opportunities while failure to do so may isolate certain segments from your business.

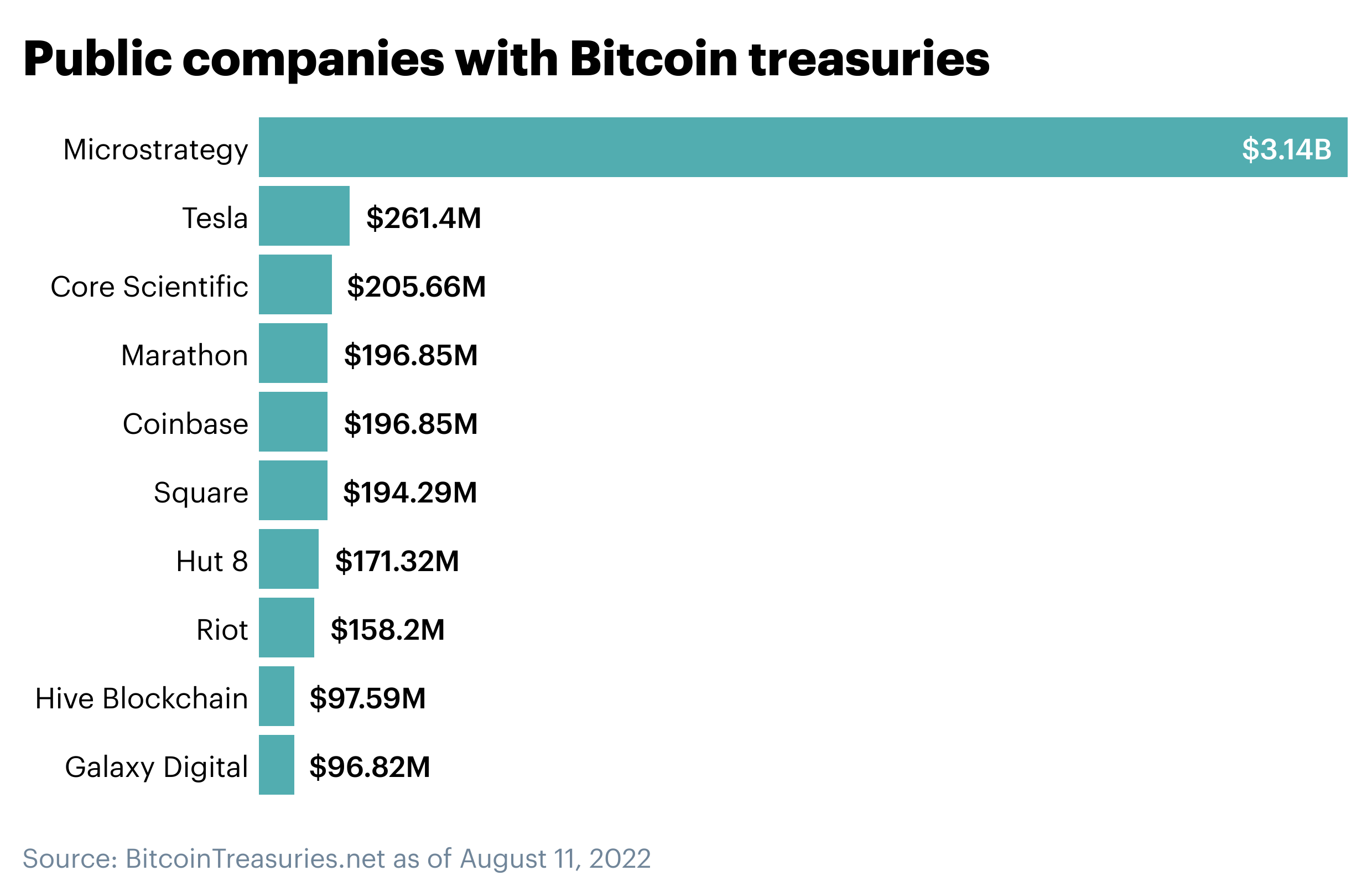

- Balance sheet diversification and innovative treasury operations: In 2021, publicly-traded companies such as Square, Tesla, and Microstrategy added Bitcoin to their balance sheets. Businesses are seeing a variety of opportunities to be strategic in their treasury operations by incorporating digital assets. Potential opportunities of building digital asset treasuries include: improving efficiency of cross-border transactions (i.e. using stablecoins for fast, low-fee transfers) in addition to capturing asymmetric risk (i.e. using crypto as a hedge against inflation) and building diversified portfolios.

Primary challenges for corporate digital asset adoption

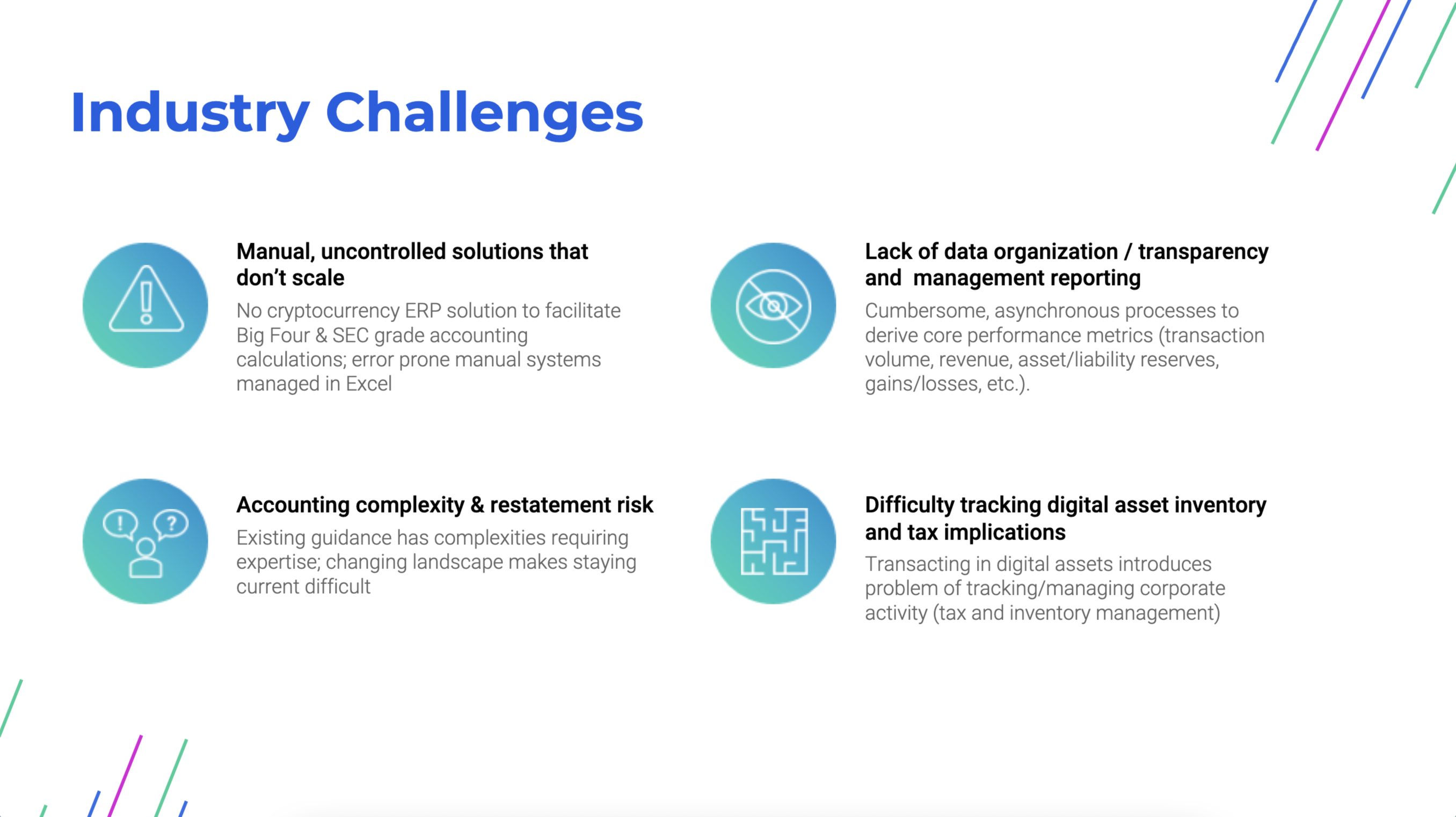

The increasing adoption of digital assets and their expanding array of use cases presents unique challenges for businesses, individuals, and regulators alike. As this new asset class emerges, the regulatory framework from both an accounting and tax perspective is continuously evolving– making compliance an ongoing challenge. In addition, enterprise leaders should carefully consider the following obstacles:

- Data aggregation and normalization: When companies utilize digital assets, they derive data from a wide variety of data sources such as centralized exchanges (i.e. FTX or Coinbase), custodians (i.e. BitGo), protocols (i.e. Uniswap), and wallets (i.e. Metamask). Aggregating and normalizing all of this data within a single platform is critical as it provides companies with a holistic view of digital asset activity. As cryptocurrencies, exchanges, and protocols operate 24/7, data sources and transaction counts can scale into the tens of millions. Making sense of this ecosystem can be exceptionally difficult for new entrants and existing players alike.

- Accuracy of accounting calculations and compliance with US GAAP: Maintaining accurate calculations for all of your digital asset activity is vital– especially when going through an audit or planning for a capital event. Companies need confidence in the accuracy, reliability, and controls of the calculations to support their digital asset accounting.

- Operationalizing your program: Accounting, tax, and finance teams should leverage best-in-class technology to operationalize their digital asset reporting needs while avoiding manual, error-prone work. Automation and operationalization via technology such as Taxbit enables teams to stay focused on strategic initiatives and their most critical value-add activities.

As cryptocurrency is generally treated as property (not currency) today, reporting can be difficult. Organizations must track cost basis (initial acquisition cost), book value (i.e. cost and impairment), and fair value (real-time market pricing) for each transaction / lot. Each digital acquisition must be tracked separately, using “lot-level” tracking and inventory queues (FIFO, LIFO, Spec ID). Further, and especially for corporate balance sheet adoption, the concept of impairment can be quite difficult.

Impairment calculations are a requirement today, although the FASB is currently evaluating whether this may continue. This means that anytime the price of your digital asset declines below the value of an individual lot’s cost basis, you must recognize an impairment event.

Successfully navigating the challenges of digital asset adoption

Despite these many challenges, the benefits for crypto adoption far outweigh the costs and momentum by the world’s top enterprises shows no signs of slowing. Digital asset technology is unlocking new revenue opportunities and innovative new ways to engage with customers.

For incumbents and new entrants however, automation and operationalization is absolutely vital to the ultimate success of a digital asset strategy. Manual digital asset reporting introduces unnecessary errors, is extremely burdensome, and provides little transparency into the audit trail after the fact.

Given the wide array of challenges facing digital asset adoption, Taxbit has built the leading enterprise-grade solution. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2 audits

- Support for GAAP compliant JE and asset tracking

- Full audit support that is built with your auditors in mind

- Full transparency into transaction and accounting details

- Industry thought leaders with technical accounting expertise; former FASB/AICPA/Big4 employees working with national offices as your partners

.png)