February 2021 TaxBit Newsletter

1099s, Tax Forms, DeFi, and Tax Optimizers!

Published on:

Wow! What a start to 2021 - we’ve seen bulls at play, with Bitcoin hitting all-time highs and a spectacular interest in cryptocurrency - even Elon Musk got in on the action!

Tax season kicked off in January, aka our busiest time of year. You may start to receive 1099s from the exchanges that you use, with 1099-Bs delivered on/by February 15th. No matter the variation of 1099 you receive, we make navigating crypto taxes easy by automating the entire process. Sign in to your TaxBit account, link your exchanges and wallets to seamlessly pull your transactions, run the appropriate calculations, and auto-generate your tax forms for the 2020 tax year.

Calling all DeFi enthusiasts!

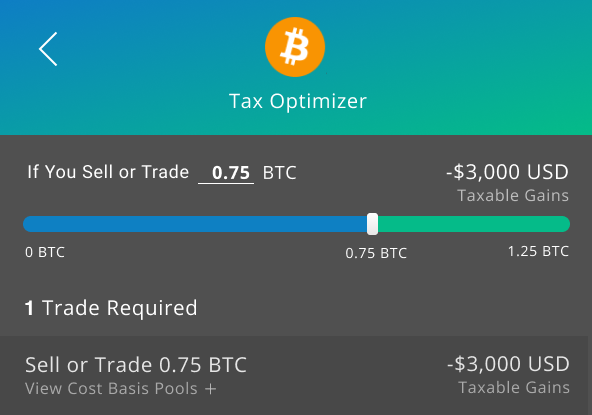

We're excited to announce two new features, Tax Optimizer and the beta launch of DeFi support for our Plus+ and Pro customers. In addition to DeFi and automating your taxes, TaxBit provides crypto enthusiasts with real-time portfolio tracking and tax optimization visibility so that you can make tax optimized crypto trades throughout the year. To give you a chance to take the Tax Optimizer for a spin we've made it available for a limited time to all customers.

Check out our recently launched Tax Optimizer in action:

If you are looking to stay IRS compliant, have real-time portfolio visibility, and save money on cryptocurrency taxes, then TaxBit is the platform for you.

As always, if you have any questions, please feel free to contact our support team.

-The TaxBit Team

Get Started Today!

Generate your cryptocurrency tax forms now