Taxbit’s Tax Optimizer has helped tens of thousands of crypto enthusiasts identify tax-optimized trades to lower their tax liability throughout the year.

Taxbit’s Tax Optimizer has helped tens of thousands of crypto enthusiasts identify tax-optimized trades to lower their tax liability throughout the year. We’re excited to announce we’ve updated this tool to help you master tax-loss harvesting strategies.

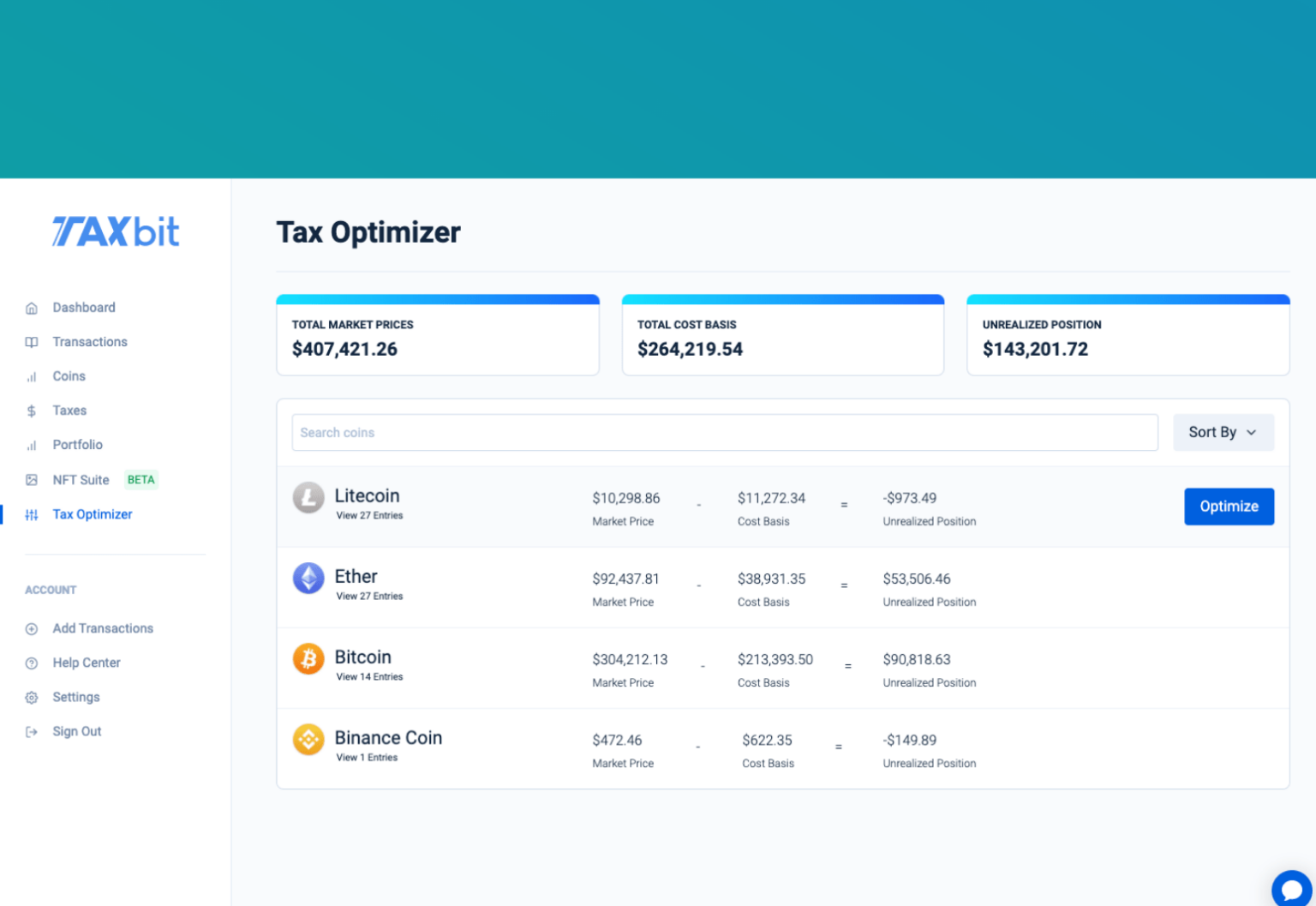

The Tax Optimizer shows the capital gains and losses for potential transactions based on real-time market values.

It allows you to easily identify crypto tax-loss harvesting opportunities—a strategy that savvy investors use to offset capital gains by selling assets at a loss.

What’s changed in the Tax Optimizer?

The Tax Optimizer now allows you to see all of your unrealized gain and loss positions at a glance—across your various assets—instead of viewing one asset at a time.

This real-time snapshot of your capital gains and losses allows you to quickly identify what losses to harvest.

How to use the updated Tax Optimizer

Step 1: Navigate to the Tax Optimizer page, where you’ll see a snapshot of Total Market Prices, Total Cost Basis, and Unrealized Position (Unrealized Position = Total Market Prices – Total Cost Basis). Here, you’ll also see these values broken down by asset.

Step 2: Next, select the asset you wish to optimize. Please note that an asset will only show if you have a current coin balance for that asset.

Step 3: Once you have selected an asset, you’ll have the option to click ‘Optimize Losses.’ From here, you’ll see what trades are required and on what exchange in order to harvest these losses.

How to use tax-loss harvesting to improve your returns

How can you get the most out of Taxbit’s Tax Optimizer? Keep these tips and tricks in mind:

- The wash sale rule doesn’t apply to cryptocurrency. When the market dips, you can sell your assets at a loss to offset capital gains, then buy them back to reset your cost basis.

- You’ll have greater tax savings when you harvest losses year-round. Crypto is highly volatile; if you wait until the end of year to harvest losses, you’re missing out on the price dips throughout the year.

- Consider the assets’ holding period when deciding what losses to harvest. The taxes on cryptocurrency gains vary depending on how long you held the asset before selling. If you have both long- and short-term capital gains, it’s more beneficial to first harvest the short-term capital losses to offset your short-term gains.

- You can deduct any remaining capital losses from your ordinary income. If you’ve already netted your crypto losses against your gains, you can deduct up to $3,000 of any remaining losses from your ordinary income.

View both your short-term and long-term capital gains

While you’re testing out the updated Tax Optimizer, be sure to check out the ‘My Taxes’ page to view a breakdown of both your short-term and long-term capital gains. For a refresher on the difference between how short-term and long-term gains are taxed, please read our article on the cryptocurrency tax rate.

About Taxbit

With Taxbit, you’ve got a trusted source to quickly calculate your taxes and a resource throughout the year that empowers you to make tax-optimized trades and lower your tax liability.

Ready to try out the updates for yourself? Create an account or login to start.

.png)