Key considerations for operationalizing and delivering on digital asset accounting

Crypto accounting can be extremely challenging for even the most sophisticated corporate finance and accounting teams. As last year’s high-profile market failures displayed, traditional accounting systems are severely inadequate for scaling with the complexity of tracking millions of transactions and dollars worth of crypto across wallets, markets, and different blockchains.

Further, many modern crypto bookkeeping processes and solutions fall short of providing financial transparency that meets increasing scrutiny from investors and regulators. In addition, key regulatory accounting standards are evolving as we speak – and digital asset businesses need to be adaptive.

This year, major accounting reforms are on the horizon via the Financial Accounting Standards Board’s (FASB) proposed changes that will unlock fair value measurement for crypto assets and provide greater financial transparency – eroding a key administrative roadblock for businesses while promoting greater investor confidence and regulatory trust.

However, growth opportunities still require solving the broader enigma of digital asset accounting – necessitating powerful technological solutions that adapt to the regulatory landscape. Therefore, choosing the right crypto accounting software will directly impact a corporation’s growth potential in terms of audit preparedness, regulatory compliance, and accurate financial reporting.

Here at Taxbit, we are committed to providing enterprises with the right technology and expertise to meet these evolving standards and helping them unlock growth avenues. To position future industry leaders, here are some of the key items every company should consider when selecting a crypto accounting software.

Data Quality, Coverage, and Volume

Digital assets are different than fiat-based assets. Cryptocurrencies trade 24/7/365 on a variety of global exchanges and can be transacted out to eight decimal places which confound traditional accounting platforms. Accurate accounting requires access to all blockchains and exchanges the business transacts with, but also requires confidence in the accurate pricing for each transaction.

Audit-Ready Transaction Details

To be prepared for an audit with accurate and complete information, enterprises should seek a crypto accounting software that stores transaction level details and is able to track and perform calculations on individual lots in order to meet generally accepted accounting principles (GAAP). The accounting tool ideally provides the financial statement preparer and reviewer with cost basis, market value, and gain/loss detail at the lot level to ensure the total Gain/Loss at the end of the reporting period is supported with sufficient detail.

Financial Reporting

Routine and consolidated reporting is a critical requirement for any business in terms of tax and accounting, and digital assets are no exception despite the complexity involved. Beyond regulatory reporting requirements — accurate, complete, and timely reporting enables deep insight into business health and therefore enables enhanced strategic decision-making.

Security and Role-Based Access

Protecting and maintaining data integrity is crucial for all successful businesses. When seeking a crypto accounting platform, it’s important to evaluate the standards and certifications (i.e., SOC, enterprise-grade security, user-specific roles, and permissions) that help ensure the integrity of critical systems, data, and financial records.

Legal Entity Support

The establishment of legal entities is only performed after careful analysis and consideration. For accurate accounting reporting and filing, these divisions must be maintained appropriately within traditional ERP systems. Whether for holding companies or unique corporate structures that span across products, industries, or countries – accurate accounting by legal entity is a necessity for complete and accurate enterprise accounting.

Automated Transaction Reconciliation, Categorization, and Calculation

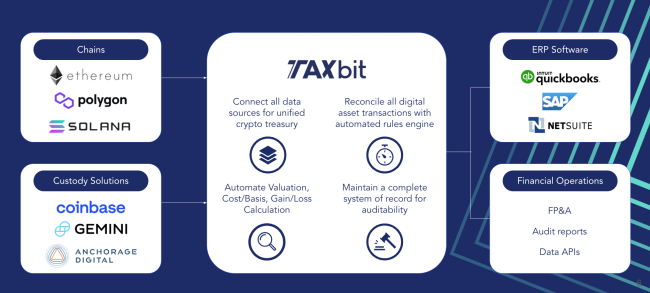

Automatically sourcing and normalizing data is critical, especially with the typically large volume of transactions for digital assets. Reconciliation tools are critical for back offices to quickly view every transaction, repair any discrepancies, add functional categorizations, and attach documentation like invoices and receipts.

Further, as a business grows it is important to have access to powerful automation, transaction categorization, and management that reduces risk and generates operating efficiencies. This can be enabled through robust rules engines that drive automated processes based upon pre-defined classifications. As rules are created, fewer transactions need to be reviewed manually while also improving detailed reporting and bookkeeping accuracy.

Traditional Accounting Software Integration

Anytime multiple tools or systems are involved in administration, broader data integrity should be a key consideration. Digital asset bookkeeping software should be seamlessly integrated with the rest of an enterprise’s accounting stack so that all transactions and associated details are posted to the correct accounts in a general ledger. That way, syncing crypto transactions to software like NetSuite and Quickbooks is as easy as clicking a button – enabling crypto transactions to post seamlessly.

Customer Support

When an issue related to money or regulations arises, it is typically time sensitive and therefore vital that your crypto accounting partner provides responsive and timely customer support. As more people are involved in closing the books, technology providers should plan to work closely with the relevant end users to ensure the client is empowered to use the tool to its best ability.

Compliance and Subject Matter Expertise

Lastly, regulations move fast. To ensure that platforms and teams are able to keep pace, it is critical that a crypto accounting software is ultimately driven by deep subject matter expertise. While regulatory clarity is emerging, digital asset enterprises will still need to navigate certain grey areas – and should be able to readily consult expert teams with years of experience collaborating with key regulatory agencies.

As crypto adoption grows and regulatory and investor scrutiny intensifies, systems like the Taxbit Accounting Suite emerge as potential game-changers to help companies meet rigorous auditing standards and navigate the complete complexity of crypto accounting. Taxbit can help improve operating efficiency, promote financial transparency, and streamline the operational burden of navigating crypto accounting complexity.

The Future of Crypto Accounting

Taxbit is building the industry-leading solution for digital asset accounting. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Support for GAAP-compliant journal entry and asset tracking

- Audit support that is built with auditors in mind

- Granular transaction and accounting detail transparency

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2 audits

- Industry thought leaders with technical accounting expertise; former FASB and Big Four employees working with national offices as your partners