Data streaming, Anchorage & Gemini support, Editable Transaction Amounts, and more…

The Taxbit Accounting Suite provides the most secure, accurate, and trusted solution for all your digital asset activity. This month, we’re sharing all of the new features we’ve shipped:

- Data Streaming

- Anchorage & Gemini

- Editable Transaction Amounts

- Cost basis recomputing

- Summary Report Improvements

Data Streaming

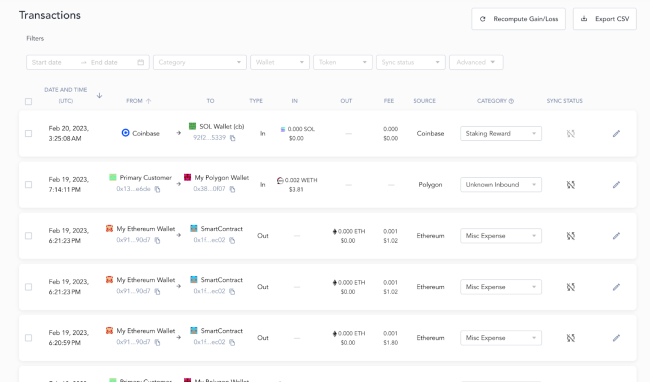

We have worked hard to improve load times for your transactions. To see the new transaction engine in action, head to the Transactions page. While you interact with your most recent transactions, your entire history will quickly load behind the scenes.

Anchorage & Gemini Sources

We now support connecting to Anchorage and Gemini. Simply navigate to Sources to connect your accounts.

Cost basis recalculation

If you’ve made changes to your transactions and want to manually refresh your cost basis — you can now do so via the Transactions page. If you do not make a manual change, the cost basis will be refreshed nightly with an updated gain/loss calculation. And, as before, if you do not click the button, the cost basis will be refreshed nightly and an updated gain/loss calculation will be performed at that time.

- Visit the Transaction page

- Click the Recompute Gain/Loss button at the top of the page to easily refresh your transactions

Editable Transaction Amounts

Sometimes, data in automated entries may differ from your preferred representation. As a solution, we’ve added the ability for users to edit transaction amounts relevant to “mainchain” or “nested” smart contracts for Ethereum and Polygon.

- Enter the Transaction Editor to see the mainchain transaction amount, or view the nested smart contract transactions to edit multiple transactions in-line at once

- Make sure you click ‘Recompute Gain/Loss’ after your changes to ensure your values are properly applied to cost basis calculations

Summary Report Improvements

Reporting is critical, so we’ve made improvements to our Summary Report feature.

- Deposit and Expense transactions are now broken out into their relevant categories on the Summary Report — in order to help you better understand your holistic crypto activity

Other Updates

- Fees are now explicitly annotated in your QuickBooks journal entries

- Users can now designate journal syncing lock dates to ensure transactions cannot be modified and resynced to QuickBooks online. Simply contact us at [email protected], and we can set your desired lock dates

- For transactions that have just occurred, we will be using the prior close day’s exchange rate to represent the transaction value until the new rate is recorded

The Future of Crypto Accounting

At Taxbit, we are building pioneering solutions for digital asset accounting. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks

- Support for GAAP-compliant journal entry and asset tracking

- Audit support that is built with your auditors in mind

- Transparency into transaction and accounting details

- Industry thought leaders with technical accounting expertise; former FASB/AICPA/Big4 employees working with national offices as your partners