Key updates for TaxBit Dashboard, Digital W9/W8, Information Reporting and more…

Welcome to the inaugural release of TaxBit’s Tax Suite Product Update.

Your needs and those of the broader market directly inspired the update below, and we are thrilled to share them while helping you imagine how to positively impact your business.

If you would like to learn more about how to take advantage of our new features please reach out to your customer service representative, [email protected], or connect with support at [email protected] or our Zendesk help center.

Contents

- TaxBit Dashboard

- Digital W9/W8

- Information Reporting

TaxBit Dashboard

The TaxBit Dashboard functions as a centralized platform for handling vital tasks related to Information Reporting and Withholding, compliance procedures, and organized storage of personally identifiable information (PII) and transactional data of your customers. Dashboard is built with the needs of the most demanding organizations in mind – supporting role-based permissions, multi-organizational models, and secure access via multiple authentication models. Whether you’re a business serving customers or other organizations, TaxBit Dashboard is built to cater to your needs and can help maintain a single source of truth for your data.

Key features for TaxBit Dashboard include:

- Authentication: Username/Password, SSO, and multi-factor support

- Security: Role-Based Access Control Model, User Management Permissions, Organizational Model, and Org Switcher in-app

- Support: In-App Knowledge Base

Key features for the IRW Dashboard include:

- Account Search: Account ID, Name, Tax ID (last 4), and account email

- Account Overview: Account Owner Information including TIN Match and Tax Documentation Statuses

- Tax Forms Download: Information Returns and Tax Documentation (W9s)

- Account Analysis: Filterable view of all accounts and their statuses

- Transactions Summary Table: Transaction Details

- Reports: TIN Verification Report and Tax Documentation Report

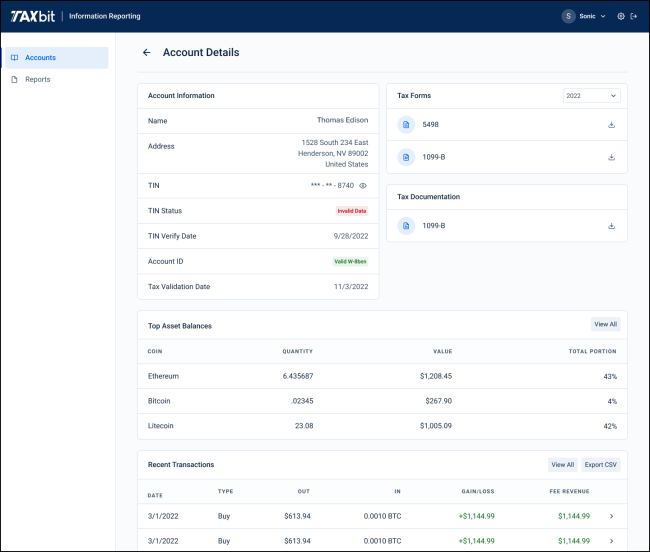

TaxBit Dashboard Account Details Screen

Digital W9/W8

TaxBit is announcing the full production release of our Digital W9/W8 module. With TaxBit, you can streamline your collection, validation, storage, and retrieval of your Form W-9 and W-8s. A Form W-9 is utilized to document a US person (individual and entity) and certify their Tax Identification number. A Form W-8 is utilized to certify foreign status and document required treaty claims by foreign nationals to avoid withholding on certain types of income.

Form W-9 and W-8s are supported via the following methods:

- SDK for out-of-the-box workflow supporting full individual and institutional support from data collection through certification and e-signature

- SDK for out-of-the-box workflow to show previously collected data and allow for certification and e-signature

- API for seamless integration into native workflows supporting individual collection, certification, and e-signature

To streamline review and operational processes, Form W-9 and W-8s can be retrieved directly from within TaxBit Dashboard. And if you’re using our API integration, you can also retrieve released tax documents for users from a new API end-point. Please refer to the API Doc for more details.

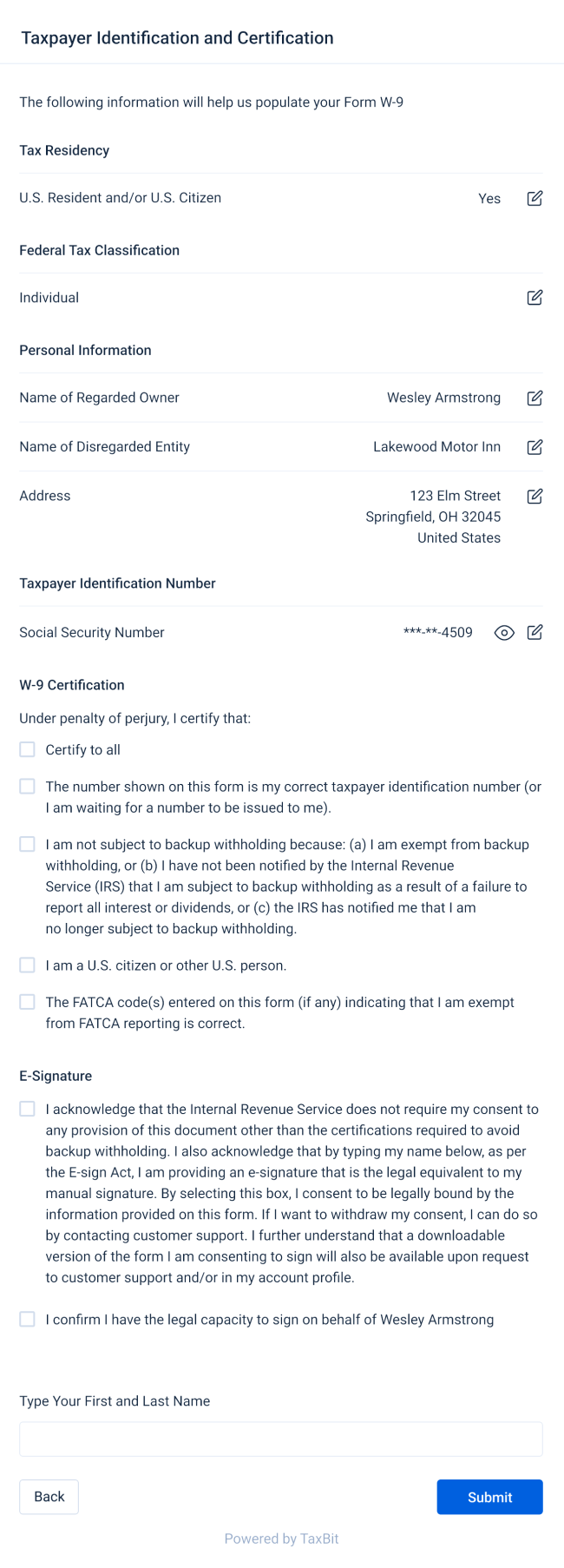

End-User Data Review and Attestation powered by TaxBit Digital W9/W8 SDK

Information Reporting

TaxBit Information Reporting automates and streamlines the generation of IRS information returns, while also preserving a record of all historical tax forms directly accessible from within TaxBit Dashboard.

Below is a list of supported forms, a description of use-case(s), and how we ingest the information.

- 1099-B: Form 1099-B reports proceeds income to users and the IRS. Broker or Barter Exchange must report proceeds paid, and in certain cases, cost basis, to recipients annually.

- 1099-MISC: Form 1099-MISC reports miscellaneous income to users and the IRS.

- 1099-DIV: Form 1099-DIV reports dividends paid to users and the IRS.

- 1099-INT: Form 1099-INT reports interest income to users and the IRS. NOTE: Crypto Earn is NOT reported on an INT.

- 1099-NEC: Form 1099-NEC reports non-employee compensation to users and the IRS.

- 1099-R: Form 1099-R reports distributions from IRAs to users and the IRS.

- 1099-K: Form 1099-K provides a transaction record from third-party payment networks such as PayPal or Venmo to users and the IRS.

- Form 5498: Form 5498 reports contributions, rollovers, Roth IRA conversions, and required minimum distributions through a broker to the user and IRS.

- Form 1042-S: Form 1042-S reports payments to Non-US Persons (US FDAP) to the user and IRS.

In Q1 we released enhancements to our existing reporting functionality, the highlights of which are listed below.

- The GET API can be utilized to retrieve specific information by specifying the user (using User UUID) and form (e.g., IRS_1099_B, IRS_1099_MISC, etc.) while providing a URL location to deliver the specified form. Additional form-specific information will also be returned, such as when the tax document was created, whether it was revised, and which year the form pertains to.The GET API opens up new user experience possibilities by allowing end-customers to specify the form themselves and simultaneously produce the desired form.

- Form Generation Client Report for reporting reconciliation purposes

To learn more about these updates and our APIs, you can access our API Release Documentation online at this link.

How TaxBit Can Help

At TaxBit, we are building industry-leading solutions for digital asset compliance. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and Fortune 500 companies with features such as:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2

- Audit support that is built with your auditors in mind

- Leading expertise from our team of IRS, AICPA, and Big-4 alumni