Leverage the Taxbit Accounting Suite's Advanced Reporting module to operationalize your crypto accounting process

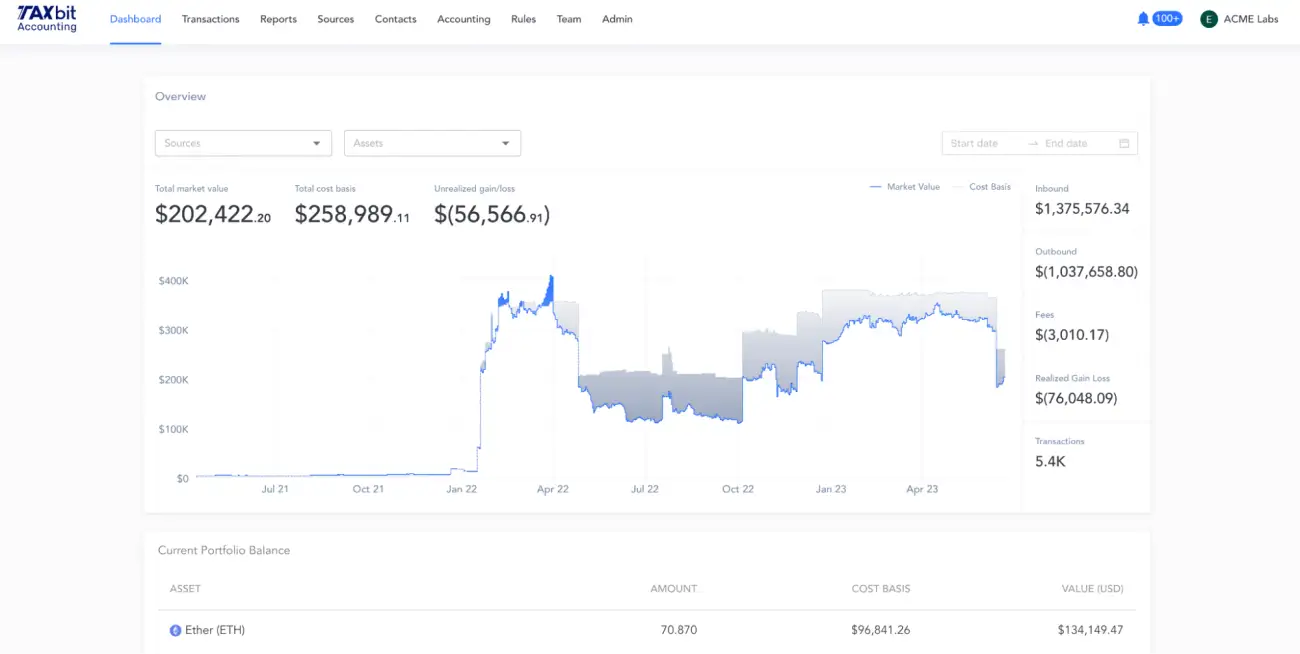

As cryptocurrencies gain popularity and become more integrated into financial systems, it is crucial for enterprises to have robust enterprise reporting capabilities to leverage their data, unlock business insight, and make more informed decisions.

Taxbit’s Accounting Suite is focused on building extensive enterprise-grade reporting in addition to providing a comprehensive solution that empowers businesses with the tools they need to achieve operational confidence in their cryptocurrency holdings and interactions. All of these reports are customizable by selecting a desired date range, filtering for specific wallets / exchanges / sources, or choosing a particular asset, and additionally the data is structured intuitively so it is easily exported and customized for specific use cases.

An overview of some of these reports are included below. Clients leverage these reports and more to provide critical data insights and operationalize their digital asset activity and reporting. Please contact us to learn more about how you can leverage the Taxbit Accounting Suite reporting capabilities.

Gain / Loss Report

The Gain/Loss Report is a fundamental feature of Taxbit’s Accounting Suite. It provides businesses with a clear overview of all gain and loss events associated with their cryptocurrency activity and allows you to view liquidation events triggering realized gains and losses. You can view all relevant details including buy date, sell date, sales proceeds, cost basis, gain/loss, and much more.

This report enables enterprises to automatically and accurately calculate and analyze gains and losses, and verify those gains and losses in your ERP, ensuring compliance.

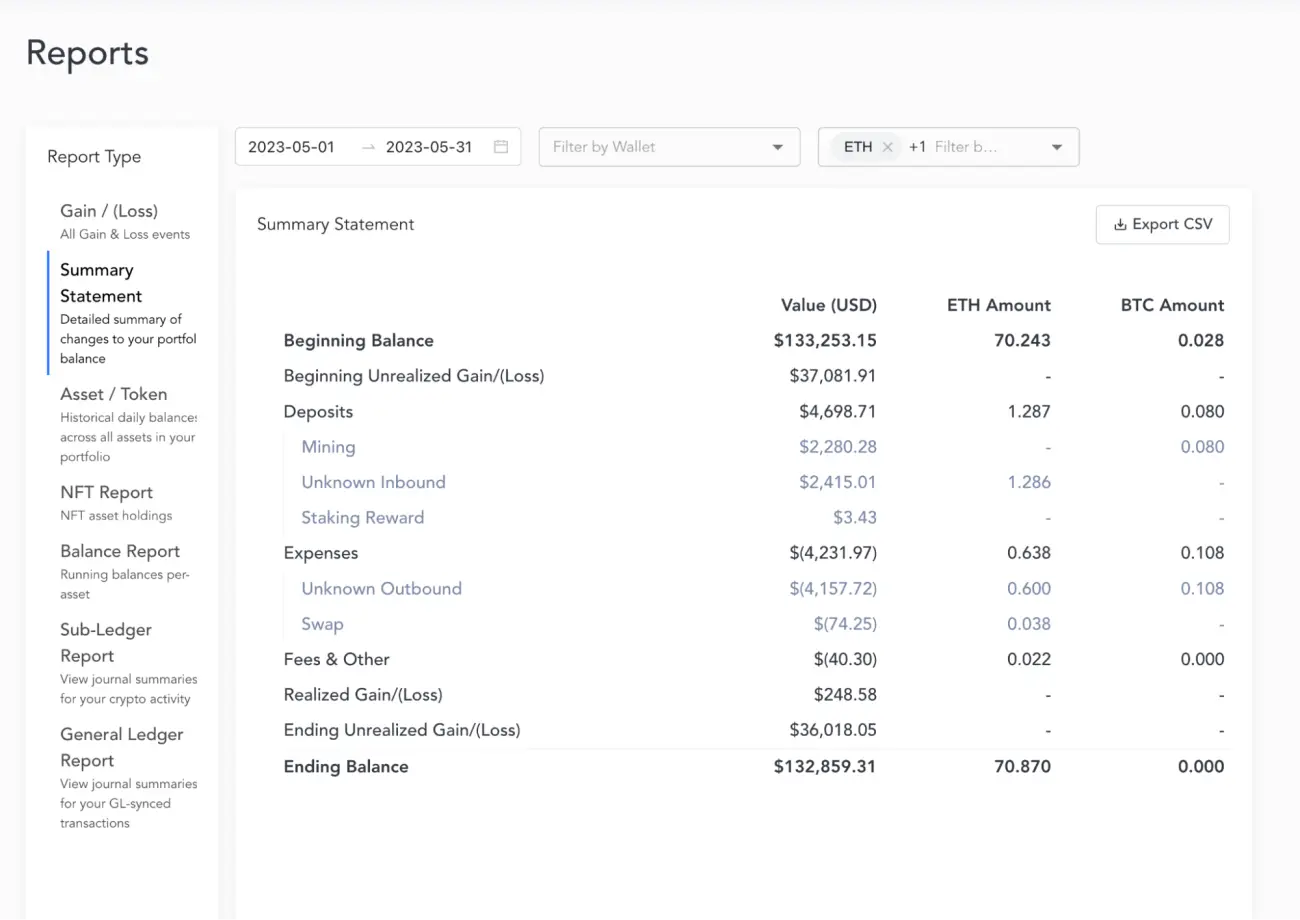

Summary Statement

The Summary Statement offers a detailed summary of changes to your portfolio balance over a specified time period or for specific assets. This report provides businesses with a comprehensive overview of their cryptocurrency holdings, including information on deposits, withdrawals, transfers, and any other activities that affect the overall balance.

By presenting a clear picture of portfolio changes, the Summary Statement allows enterprises to track their crypto assets accurately and can be used in the month-end crypto reconciliation process similar to how a bank statement is used for cash reconciliation.

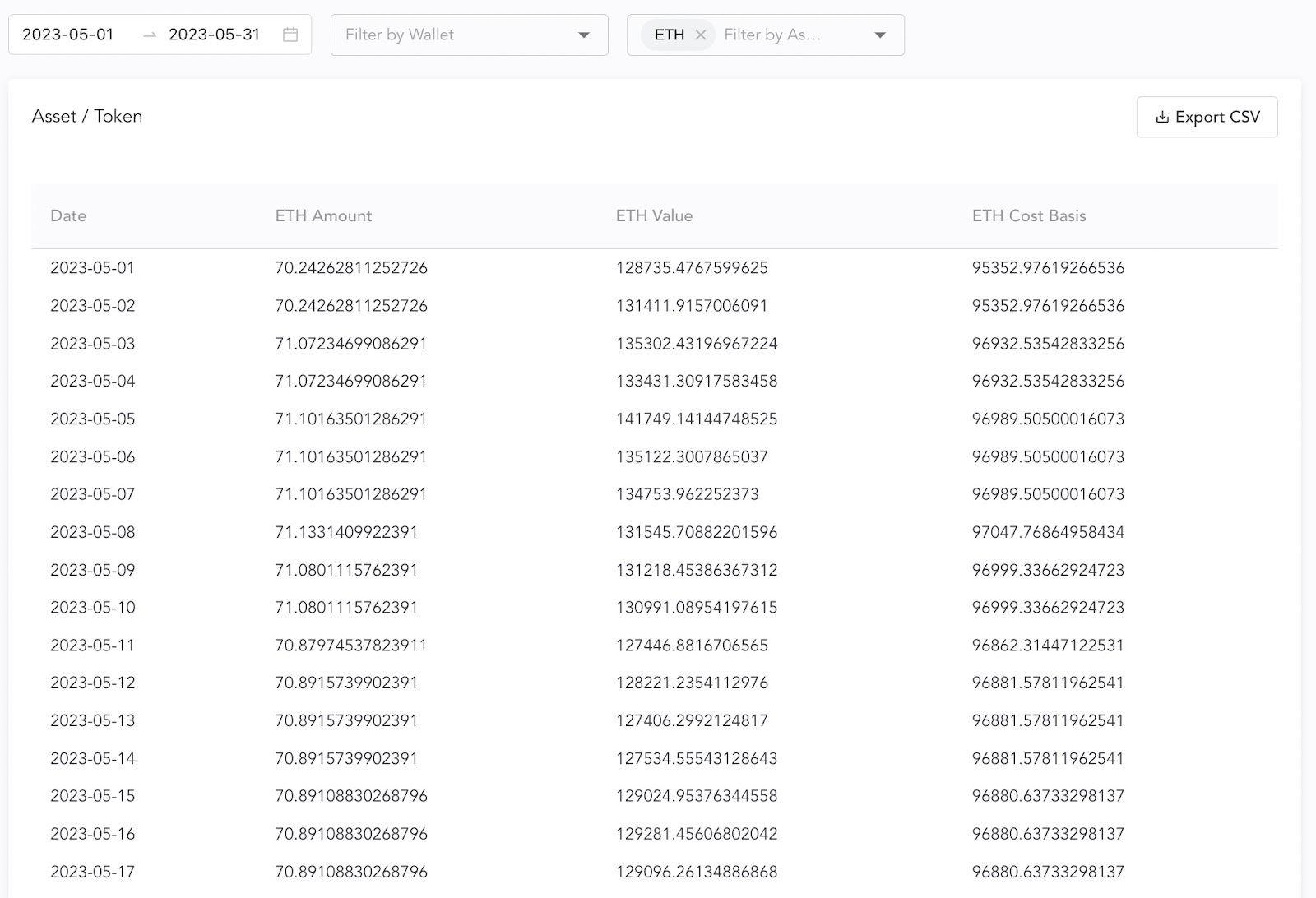

Asset Token Report

The Asset Token Report is a valuable tool for businesses to monitor the historical daily balances of all assets in their cryptocurrency portfolio. This report provides a detailed breakdown of the daily balances, allowing enterprises to track asset performance, identify trends, and make data-driven decisions.

With the Asset Token Report, businesses gain a deeper understanding of their crypto asset allocations and their impact on overall portfolio value. Businesses also frequently use this report to perform detailed reconciliations. It is instrumental in tracking balances across multiple custody sources and serves as a sanity check for wallet balances in the ERP.

NFT Report

For businesses engaging in non-fungible token (NFT) transactions, the NFT Report is an essential feature within Taxbit’s Accounting Suite. This report provides a comprehensive overview of all NFT asset holdings, including purchase history, sales, and transfers.

By centralizing and organizing NFT data, businesses can easily track their NFT investments, understand their NFT portfolio’s value, and manage their NFT transactions more effectively.

Balance Report

The Balance Report within Taxbit’s Accounting Suite offers running balances per asset, giving businesses a clear understanding of their cryptocurrency asset positions. This report provides insights into the overall holdings of each crypto asset, including historical changes and trends.

The Balance Report helps businesses reconcile their records and maintain accurate accounting of their cryptocurrency balances.

General Ledger Report

The General Ledger Report is an integral component of Taxbit’s Accounting Suite, enabling integrated enterprises to seamlessly view and download a report of synced transactions, along with the posted journal ID.

By providing a comprehensive overview of GL-synced transactions, this report streamlines the reconciliation process and ensures the accurate recording of cryptocurrency activities within the organization’s broader financial systems.

Achieve Operational Confidence

Achieving operational confidence in cryptocurrency accounting is vital for enterprises navigating the complexities of the digital asset landscape. Taxbit’s Accounting Suite offers an advanced set of reporting capabilities that empower businesses to track, analyze, and report their cryptocurrency holdings and interactions accurately and compliantly.

By leveraging Taxbit’s robust reporting capabilities, enterprises can navigate the world of cryptocurrency accounting with confidence, compliance, and ease. To learn more about how your enterprise can leverage the Taxbit Accounting Suite reporting capabilities, contact us.

.png)