Learn how you can save time and money with Taxbit’s powerful AI-enabled rules engine for transaction reconciliation.

Accounting for and managing the increasingly complex array of cryptocurrency transactions can be complicated, time-consuming, and require extensive manual work for finance and accounting teams.

Accurate and efficient transaction reconciliation and categorization are paramount for enterprises seeking to maintain financial clarity and compliance across their cryptocurrency holdings. In this installment of our Product Spotlight series (check out our previous Reporting spotlight), we explore how the Taxbit Accounting Suite empowers enterprise accounting teams to automate rule creation and the transaction reconciliation process with our AI-enabled rules engine, saving valuable time and money while ensuring accuracy.

Why Reconcile Transactions?

Reconciling transactions is crucial in crypto accounting for several reasons:

- Complexity of Transactions: Cryptocurrency transactions often involve multiple wallets, exchanges, and sources, resulting in a high volume of data to be managed. Without proper reconciliation, discrepancies can arise, leading to accounting errors and compliance issues.

- Reporting Compliance: Enterprises are required to report their cryptocurrency transactions for tax and accounting purposes accurately. Proper reconciliation ensures that all gains, losses, and transfers are correctly accounted for, avoiding potential penalties and consequences from audits.

- Real-Time Decision Making: Reconciled and up-to-date transaction data gives businesses actionable insights to make informed decisions regarding their cryptocurrency holdings and strategies.

Use Taxbit’s Newest AI Feature to Get Started

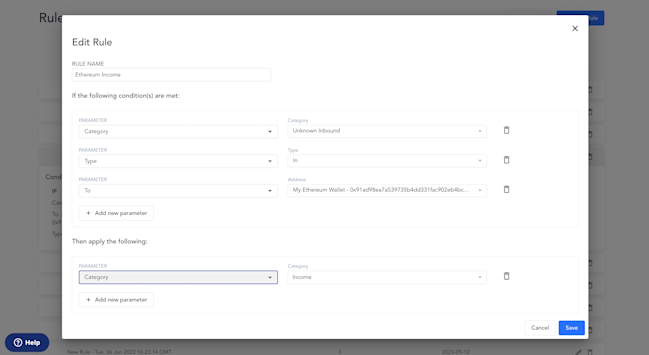

The Taxbit Accounting Suite introduces a game-changing feature known as our AI-Enabled Rules Engine. This feature allows clients to create customized, logic-based rules to automate the transaction categorization process, properly account for gains, losses, and fees, and create an automated data flow so reconciled transactions appear in the correct locations in a business’s chart of accounts.

While creating rules is the easiest way to automate the crypto accounting process, knowing which rules to create can be difficult. The Taxbit Accounting Suite software now intelligently prompts rule creation during bulk transaction editing to make rule creation as easy as possible. With this cutting-edge capability, businesses can perform bulk edits on their cryptocurrency transactions, and the system will create relevant rules based on the edits made. This is just the beginning of how the Taxbit Accounting Suite is building towards smarter crypto accounting processes and implementing artificial intelligence into accounting workflows based on the transaction data you amass in the software.

How It Works:

Transactions can first be edited in bulk by selecting a set of transactions that need to be categorized identically. As these transactions are manually edited in bulk, the engine identifies patterns based on common transaction attributes.

The system will then suggest rule templates matching your bulk edits’ patterns. These suggested rules are displayed for review and, with just a few clicks, can be created and applied to similar future transactions.

This feature streamlines the process of setting up rules, reducing the time and effort required to establish comprehensive transaction categorization. Additionally, the engine’s intelligent pattern recognition minimizes the risk of human error during rule creation, ensuring precise and consistent categorization of transactions.

Automating Reconciliation with AI-Enabled Rules

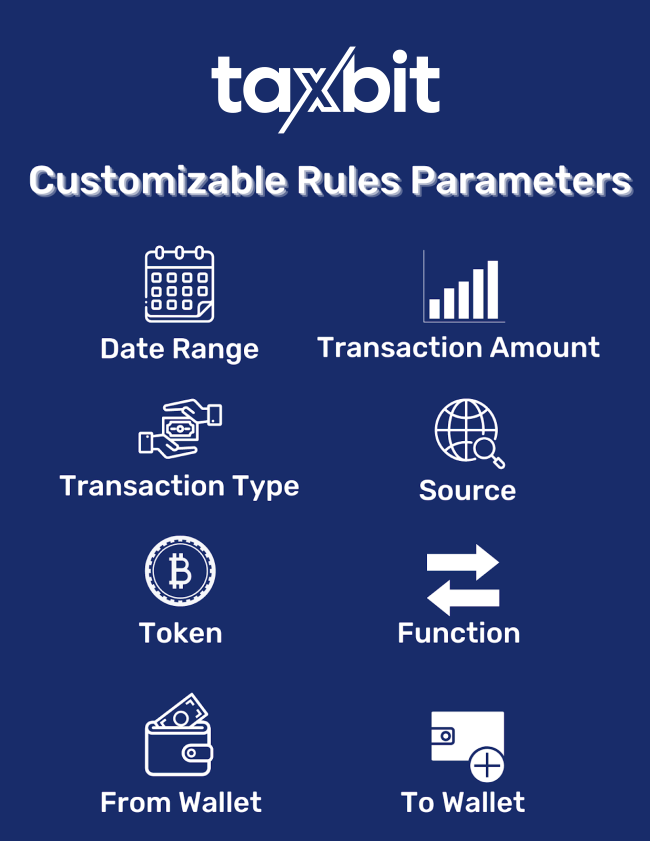

With the AI-enabled rules engine, businesses can define specific criteria based on transaction attributes. This flexible rule creation allows for a highly personalized approach to reconciliation with nearly unlimited options for customization to meet your organization’s needs.

Any combination of the above parameters and more can be used to define the set of transactions to which a particular category should be applied. The category applied to each transaction will directly impact how it syncs to the general ledger. The Taxbit Accounting Suite support team works closely with clients to ensure that categories are customized to meet the needs of each business and works to make sure even custom categories that are needed are made available.

In cases where transactions do not meet the conditions specified in the rules, the suite can flag them for manual review. This exception-handling feature ensures that any unusual or unaccounted-for transactions are promptly addressed, maintaining data accuracy and compliance.

Why Rules Matter

The Taxbit Accounting Suite AI-enabled rules engine revolutionizes transaction reconciliation for enterprises dealing with cryptocurrency. By automating the reconciliation process, businesses save valuable time and resources previously spent on manual data entry and verification.

Moreover, the accuracy and efficiency supported through an AI-assisted engine reduces the risk of human errors and ensure that transactions are accurately synced to the general ledger and chart of accounts. As a result, businesses can simplify financial reporting, confidently navigate the evolving cryptocurrency landscape, and focus on strategic decision-making to maximize the potential of their digital asset portfolios.

If your accounting team is facing the challenges of manual transaction reconciliation, contact us today to learn more about how your business can use the Taxbit Accounting Suite’s rules engine to transform your crypto accounting process, streamline your operations, and save your finance and accounting team time and resources.