Multi-Account Users, New User Type: Read-Only, QuickBooks Contacts, Expanded Editable Transaction Values, and much more to deliver a better more streamlined experience.

Happy Spring! The TaxBit Accounting Suite team is thrilled to share with you our latest batch of product updates. Learn more about how you can take advantage of our new features — or reach out to us at [email protected] or our Zendesk help center.

And to hear more about these features from expert practitioners we welcome you to join our upcoming webinar on May 16th with Attivo and Hash Basis.

- Multi-Account Users

- New User Type: Read-Only

- QuickBooks Contacts

- Expanded Editable Transaction Values: Bitcoin and Solana

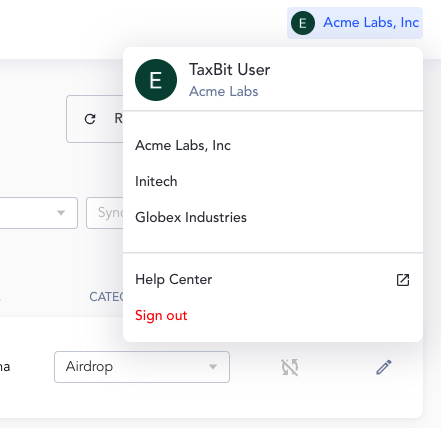

Multi-Account Users

If you manage several TaxBit Accounting Suite accounts, you can now use a single log-in across all of your instances. This is big news if you manage an enterprise with many different legal / reporting entities, if you are a valued accounting firm partner who provides outsourced solutions for a portfolio of clients, or if you are a fund administrator supporting multiple funds and LPs.

To enable it, simply contact us at [email protected] who will walk you through enabling your access.

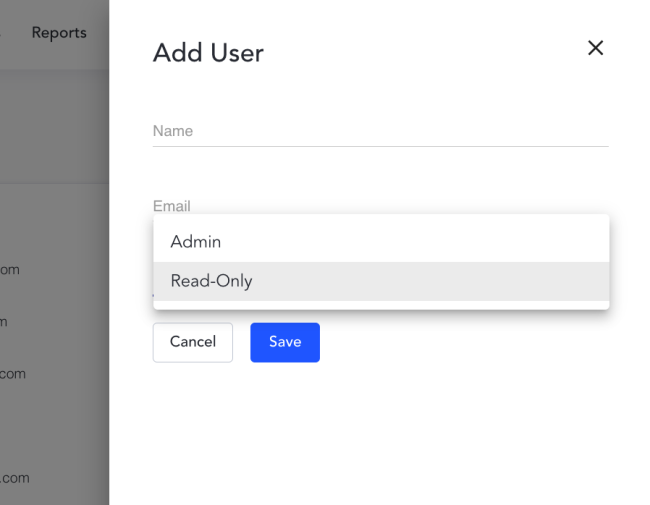

New User Type: Read-Only

The TaxBit Accounting Suite now supports “Read-Only” users who will have no direct editing capabilities. Read-Only users can view every page, download reports, and review granular transaction information.

To select, visit the “Team” page when adding new users and select “Read-Only” from the dropdown to designate a user with these restrictions. Administrator users can always change a user from Read-Only to Administrator via the Team page.

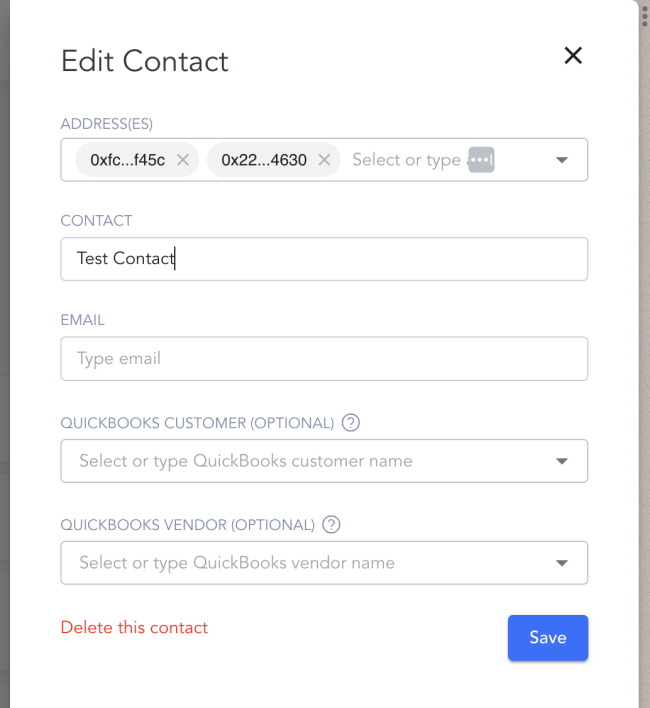

QuickBooks Contacts

The TaxBit Accounting Suite is continuing to deepen our integration with QuickBooks to increase time savings for those that use both solutions. With this release, we have added the ability to assign Contacts to QuickBooks customers for improved automation. For QuickBooks integrated accounts, users can now assign their Contacts to QuickBooks Customers and/or vendors to have them automatically populate in synced journal entries.

Editable Transaction Amounts: Bitcoin and Solana

Sometimes, data in automated entries may differ from your preferred representation. As a solution, we’ve added the ability for users to edit transaction amounts relevant to “mainchain” or “nested” smart contracts for Bitcoin and Solana.

Enter the Transaction Editor to see the mainchain transaction amount, or view the nested smart contract transactions to edit multiple transactions in line at once.

Make sure you click ‘Recompute Gain/Loss’ after your changes to ensure your values are properly applied to cost-basis calculations.

Other Updates

- Global UX usability improvements with an enhanced look & feel across all devices, clearer annotations throughout the app, and faster page loading

- Spam tokens are automatically separated from whitelisted account tokens to ensure they don’t appear in relevant account balances

- A “Type” filter has been added to the Transactions table to better identify “In”, “Out”, “Swap” or “Internal Transfer” transactions

- “DisposalSource” has been added as a new column to the Gain/Loss report to clarify the source that was responsible for the gain/loss event

- Support for the Source-Based FIFO cost basis methodology, with optional cost basis carry-over for internal transfers

The Future of Crypto Accounting

At TaxBit, we are building pioneering solutions for digital asset accounting. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks

- Support for GAAP-compliant journal entry and asset tracking

- Audit support that is built with your auditors in mind

- Transparency into transaction and accounting details

- Industry thought leaders with technical accounting expertise; former FASB/AICPA/Big4 employees working with national offices as your partners