If you own cryptocurrency and are unsure of what the taxes on cryptocurrency gains are, keep reading. In the event of an increase in the capital gains tax rate, it’s important to understand how cryptocurrency gains are taxed, and what you can do to reduce your tax liability.

If you own cryptocurrency and are unsure of what the taxes on cryptocurrency gains are, keep reading. In the event of an increase in the capital gains tax rate, it’s important to understand how cryptocurrency gains are taxed, and what you can do to reduce your tax liability.

Not long after President Biden floated the proposal of increasing the capital gains tax on the wealthy, cryptocurrency investors began to wonder what impact this would have on them. The proposal, which aims to increase the long-term capital gains tax rate from its current rate of 20% to 39.6% for those earning at least $1 million of annual investment income, is raising questions among the crypto community.

What does this mean for crypto investors and traders? How can you minimize your capital gains taxes? To answer these questions, let’s start by examining how taxes on cryptocurrency gains are calculated.

Do you pay capital gains tax on cryptocurrency?

Yes, because cryptocurrency is taxed as property much like stocks, you are required to pay a capital gains tax when disposing (selling, trading, or using as means to purchase) of your cryptocurrencies like Bitcoin, Ether, or Dogecoin.

What are the taxes on cryptocurrency gains?

To determine taxes on cryptocurrency gains, start by calculating your capital gains (check out this article on crypto cost-basis for a walkthrough of this process).Then, identify your tax rate. Your tax rate will vary based on two things: how long you held the asset (aka your holding period) and your income. Depending on how long you held the asset for, your tax rate will either be equivalent to your income rate or the long-term capital gains tax rate. Let’s take a closer look at holding periods and tax rates:

What is the cryptocurrency short-term capital gains tax rate?

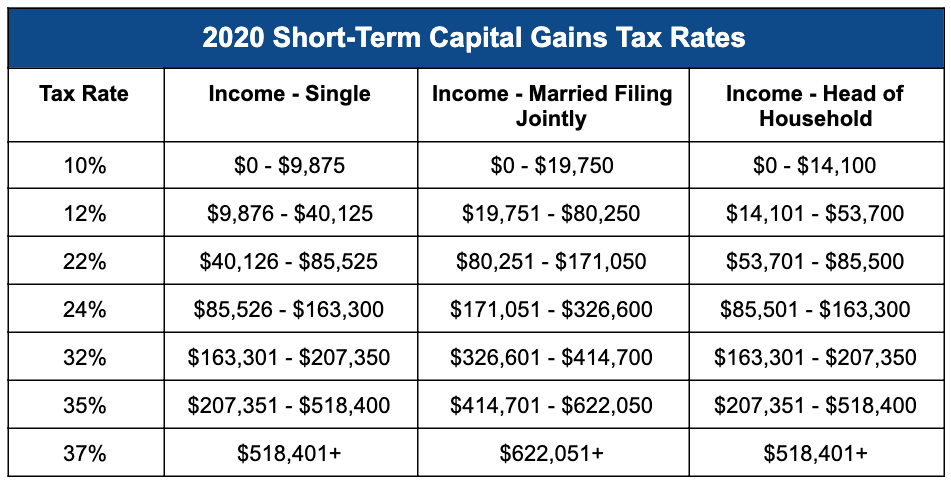

If you sold your crypto after holding it for less than one year, the profits, or gains, earned would be subject to the short-term capital gains tax rate. This rate is fairly straightforward: your short-term capital gains tax rate is the same as the ordinary income tax rate, which ranges from 10% – 37%. To calculate your taxes for any short-term capital gains, you would add these gains to your current income, and apply the appropriate tax rate using the table below.

When it comes to cryptocurrency, any income earned from mining, staking, airdrops, or getting paid in crypto is also taxed at the ordinary income rate.

What is the cryptocurrency long-term capital gains tax rate?

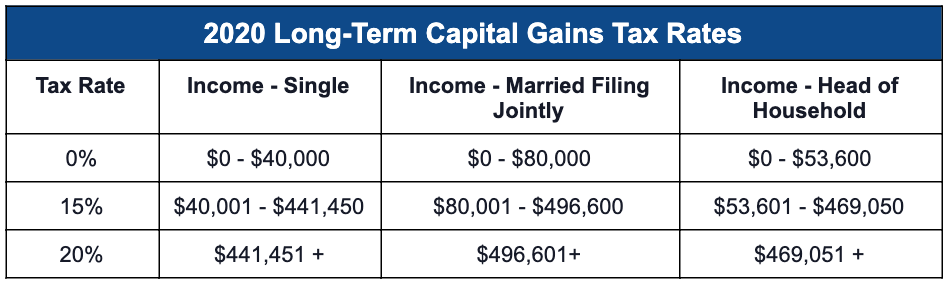

On the other hand, if you sold your crypto after holding it for over one year, these gains would be taxed at the long-term capital gains tax rate, separate from your ordinary income. These are currently taxed at 0%, 15%, or 20% depending on your income and filing status. Comparing the two charts, these rates are lower than the short-term capital gains rate, so it is considered a tax advantage to hold your crypto assets for more than 12 months.

How would an increase in capital gains tax affect crypto traders?

President Biden’s proposal to raise the long-term capital gains tax from 20% to 39.6% would only apply to those making over 1 million dollars in income. According to White House advisor Brian Deese, this would affect about 0.3% of households.

So, most crypto traders and investors wouldn’t see any change to their long-term tax rates. However, for those who are affected by the nearly doubling tax rate, the incentive to hold on to taxes long-term disappears.

Additionally, historical examples of capital gains tax hikes in the Tax Reform of 1986 and the American Taxpayer Relief Act of 2012 led to an increase in stock selling. This pattern would suggest that we could expect to see large sell-offs by crypto whales who are sitting on significant amounts of unrealized gains, hoping to lock-in the lower tax rate on their cryptocurrency gains.

While there is still much uncertainty around the proposal, we do know there are strategies that can be used to offset capital gains, and therefore reduce taxes on cryptocurrency gains in the event the rates do increase.

How to reduce taxes on cryptocurrency gains through tax-loss harvesting

No one likes to find out they owe money when tax season comes around. That’s why savvy crypto investors are well aware of the tax implications of their trades throughout the year—and they use this to their advantage through a strategy called tax-loss harvesting.

You can use tax-loss harvesting to sell your cryptocurrency assets while in a loss position to offset your capital gains, and therefore reduce taxes on cryptocurrency gains. And, even if you don’t have capital gains to offset, tax-loss harvesting could still be beneficial as a capital loss deduction from your income.

How does tax-loss harvesting work?

Let’s say you’ve sold a few coins throughout the year at a profit and are currently sitting at $10,000 in capital gains. However, you’re also holding crypto at a loss of $5,000. At this point, you have unrealized losses and could apply the tax-loss harvesting strategy by selling your crypto at the loss. This loss would offset your capital gains by $5,000, therefore reducing your tax liability by half.

If the proposed capital gains tax hike does come to fruition, it will be even more important for cryptocurrency traders to leverage tax-loss harvesting to lower tax liability.

Check out the Tax-Loss Harvesting Guide to learn more.

To continue learning about Cryptocurrency Tax Basics, see the additional articles in the series:

- Cryptocurrency Taxes

- Cryptocurrency Tax Forms

- Cryptocurrency Tax Reporting

- Cryptocurrency Tax Rate

- Cryptocurrency Tax Laws

- How to Report Cryptocurrency on Taxes

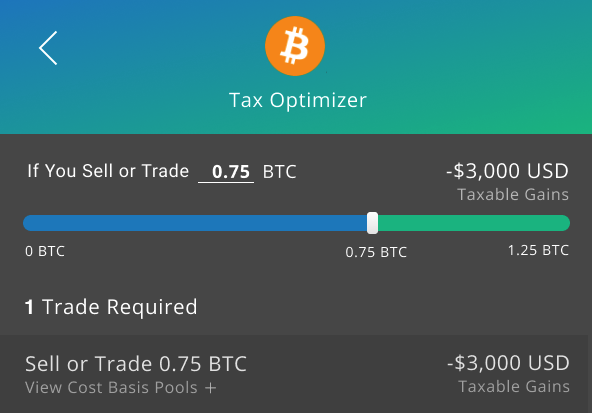

Make tax-informed crypto trades using Taxbit’s Tax Optimizer

The good news is don’t have to be an expert to nail this strategy. Taxbit’s Tax-Loss Optimizer makes it easy to apply tax-loss harvesting to reduce the taxes owed on cryptocurrency gains by automatically recommending a tax-optimized trade. With Taxbit, you not only have a trusted source to quickly calculate your taxes, you have a resource throughout the year to empower you to make informed trades and remove the burden of cryptocurrency taxes.