The IRS’ new guidance allows FIFO and Specific Identification.

On October 9th, 2019, the IRS released long awaited guidance on the taxation of cryptocurrency through Rev. Ruling 2019-24 and an associated FAQ. Specific to this article, the IRS issued additional guidance on proper cost basis assignment methods.

This article will discuss:

- Why cost basis assignment methods matter; and

- Acceptable and the most optimal IRS cost basis assignment methods for lowering tax liability on cryptocurrency;

1. Why Does Cost Basis Assignment Matter?

The IRS requires taxpayers to report their cost basis and proceeds when they trade or sell capital assets, such as Bitcoin. Simply put, your cost basis is what you paid for an investment, including brokerage fees. Your capital gains/losses are determined by the difference between the cost basis and the price you sell your capital asset.

Cost basis assignment method is the process of determining which capital assets you are selling and which assets you continue to maintain. The accounting method you choose to identify the shares you sell can make a big difference in the amount of taxes you end up owing in a particular year.

To be sure, if you sold all of your capital assets on a single day then you will have realized the same amount of gains/losses over the course of your ownership irrespective of the cost basis assignment method used. Cost basis assignment deals with the question when is the taxpayer realizing their gains/losses. Certain cost basis assignment methods may result in more immediate losses in early tax years, and potentially greater gains in later tax years.

As a general rule based on the time value of money, a dollar today is worth more than a dollar tomorrow. Absent special circumstances, choosing the cost basis assignment method that lessens tax liability in the immediate term is typically the best action. However, it is important to note that the IRS expects you to apply whatever cost basis assignment method you choose consistently in future tax years. Meaning, you cannot switch cost basis assignment methods from year to year. Whichever method you choose you should feel comfortable using going forward into future tax years.

2) Acceptable Cost Basis Assignment Methods for Cryptocurrency

After much anticipation, the IRS issued guidance on acceptable cost basis methods for calculating gains/losses on cryptocurrency. Prior to the IRS’ guidance there were numerous potential cost basis assignment methods taxpayers could choose from such as First in First Out (FIFO), Last in First Out (LIFO), Highest Cost, Lowest Cost, Average Cost, and Specific Identification. However, the IRS’ new guidance specifically allows for only two cost basis assignment methods: 1) First in First Out (FIFO); and 2) specific identification.

(i) FIFO Cost Basis Assignment

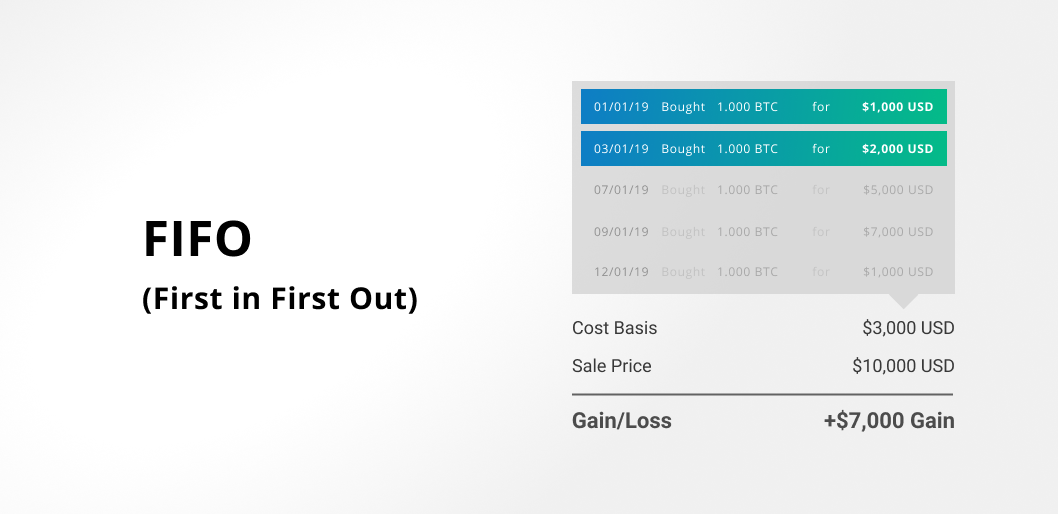

The IRS’ preferred cost basis assignment method is FIFO. Pursuant to FIFO, the first assets that you purchased will be the first assets that will be disposed.

For example, for simplicity sake assume the taxpayer purchased one Bitcoin five different times on the following dates: 1) January 1, 2019; 2) March 1, 2019; 3) July 1, 2019; 4) September 1, 2019; and December 1, 2019.

If the taxpayer sold two Bitcoin on December 12, 2019, then pursuant to FIFO the taxpayer would have disposed of the Bitcoin that was acquired on January 1st and March 1st.

FIFO is the IRS’ preferred cost basis assignment method and therefore the most conservative approach to avoid an audit. Taxbit supports FIFO tax calculations for its users.

(ii) Specific Identification Cost Basis Assignment

Pursuant to the IRS’ recent revenue ruling, taxpayers may also use specific identification to report cryptocurrency taxes. Specific identification allows taxpayers to select which assets they are disposing of. For example, in the previous example the taxpayer is able to specifically identify that they are disposing of their assets that were acquired on July 1 and September 1.

Selecting which assets you are disposing of can optimize your taxes. For example, it is typically better to dispose of assets that have a higher cost basis. Disposing of assets that have a higher cost basis will result in a lower overall tax liability. Taxbit automates the process by specifically identifying the assets with the highest cost basis and therefore lowering realized taxable gains.

If you choose the specific identification method then the IRS requires to show the specific unit’s unique digital identifier such as a private key, public key, and address, or by records showing the transaction information for all units of a specific virtual currency, such as Bitcoin, held in a single account, wallet, or address. The IRS does not require this additional information if the taxpayer uses FIFO.

Taxbit meets the IRS requirements of tracking unique digital identifiers and storing an audit trail in order for taxpayers to use specific identification. Taxbit supports specific identification and automatically disposes of a users highest cost basis assets first. By selecting specific identification taxpayers will realize less taxable gains by disposing of their highest cost basis assets first.

Conclusion

Taxbit users can easily connect their exchanges and produce their cryptocurrency tax forms. Taxbit’s team of tax experts stand ready to ensure proper tax compliance with the new IRS regulations and to legally optimize its users taxes.

Written by Cryptocurrency Tax Attorney Justin Woodward