On June 28, 2024, Treasury released the first of what will likely be a few different sets of final regulations relating to digital assets. For the most part, this set of final rules addresses the implementation of tax information reporting for crypto by digital asset brokers.

However, tucked away in those final regulations are also some notable changes to substantive tax rules governing how taxpayers track and account for which unit of crypto is being sold in any particular transaction. Brokers need to know these rules so they can comply with reporting requirements, but companies disposing of digital assets are ultimately responsible for following these rules when filing their tax returns.

In this blog, we’ll provide some historical context for tracking the cost basis of digital assets, break down what the new cost-basis tracking regulations mean, and discuss how Taxbit’s enterprise-grade digital asset accounting platform helps you stay compliant with the updated regulations.

Cost-basis accounting for digital assets

Cost-basis accounting for digital assets has always been unclear. Companies holding digital assets were faced with three questions when tracking which digital asset unit was disposed of for cost-basis accounting purposes:

- Asset pooling – Can holdings be bucketed into a single (universal) bucket, or must they be tracked in separate buckets (based on the specific accounts or wallets where the assets are located)?

- Lot-relief method – Regardless of how the holdings are bucketed, what methods are available for deciding which units are sold—longest-owned, highest cost, or can any unit be selected?

- Timing of my selection – When does the unit disposed of need to be identified — at the moment of the disposal or possibly after the end of the year when preparing a tax return?

Historical Common Practice

Prior to October 2019, there was no guidance from the IRS regarding these three questions, leaving companies to adopt a variety of approaches. In 2019, as part of its virtual currency FAQs, the IRS provided some guidance addressing the first two questions (but not the third). That guidance focused on two different methods.

Universal Pooling and FIFO

Under the default method, a company was required to pool all of the assets into a single bucket (universally) regardless of where the assets were actually held (in various custodial accounts or non-custodial wallets). This universal-pooling approach then required taxpayers to dispose of units in chronological order from oldest acquisition to newest–known as first-in, first-out (FIFO). Under this approach, a company might dispose of a unit held on exchange A, but could be required under FIFO to use the cost basis of a unit that was actually held on exchange B.

By Account / Wallet and Specific Identification

The second method was elective. It allowed a company to segregate units into buckets based on where they were held (account or wallet), but permitted the company to specifically select which unit was being sold from that account or wallet. This approach was rarely used to its fullest extent—taxpayers deciding which unit is sold for every separate sale—but was often employed with a programmatic approach such as highest in, first out (HIFO) that was designed to reduce taxable gains. Under this approach, a taxpayer disposing of a unit on exchange A could only select to apply cost basis from the units held on exchange A.

Although the IRS’s 2019 FAQs provided some clarity around cost-basis tracking for digital assets it left many uncertainties..

How does the Treasury’s new regulations change all of this?

Treasury’s new regulations provide clarity by answering all three questions described above.

Asset Pooling

Under the new rules, universal (global) pooling is no longer permitted. Digital-asset holdings need to be bucketed by account or wallet. A unit disposed from account A cannot be assigned cost basis from a unit held in wallet B. This is a significant change from historical practice where most companies had defaulted to a Universal FIFO approach as described above. If this is the approach your business has taken historically, then you need to prepare to update your strategy.

Lot-Relief Method

Companies have the ability to continue to use programmatic approaches when selecting the lot being disposed of and calculating the resulting gain or loss. For example, companies can use a highest-in, first-out (HIFO) or first-in, first-out (FIFO) approach. The key is that companies must maintain complete records documenting the lifecycle of each held lot. This includes tracking the acquisition date and value, any transfer activity across wallets and accounts, and the disposition date and value of the lot.

Timing of Lot Selection

Finally, the new rules require a company to select which lot is being disposed of at or before the time of disposal. These selections need to be documented in real time during the tax year. In other words, companies can no longer wait until the tax year is over and then determine their lot-relief methodology after the fact.

Tracking these decisions during the year and maintaining adequate records are massively important because failure to do so could result in unsupportable realized gain/loss calculations and IRS scrutiny during audit.

“It used to be the wild west. People often pooled universally, ignoring movements among accounts or wallets, and they wouldn’t make decisions about which lots were being disposed of until they filed their tax return. Now, you’ve got to document your cost basis method and which lot you’re disposing of in real time, at the moment of the transaction.” – Miles Fuller, Director of Government Solutions, Taxbit

How Taxbit is helping companies navigate and successfully adopt these new rules

As digital asset regulations evolve, Taxbit’s enterprise-grade digital asset accounting platform is designed to help businesses seamlessly adapt to these changes. Let’s explore how Taxbit addresses the key requirements of the new regulations:

Account-Level Pooling and Real-Time Inventory Tracking

The most critical change in the new regulations is the shift from universal (global) to by-account or by-wallet pooling. Taxbit’s platform handles this new requirement. It automatically segregates assets by account or wallet, keeping an accurate inventory of all transactions and holdings in real-time. Whether you hold Bitcoin across multiple wallets or exchanges, each wallet’s assets will be tracked individually, ensuring compliance with the IRS’s requirements for by-account pooling.

Flexible Disposal and Lot Relief Methods

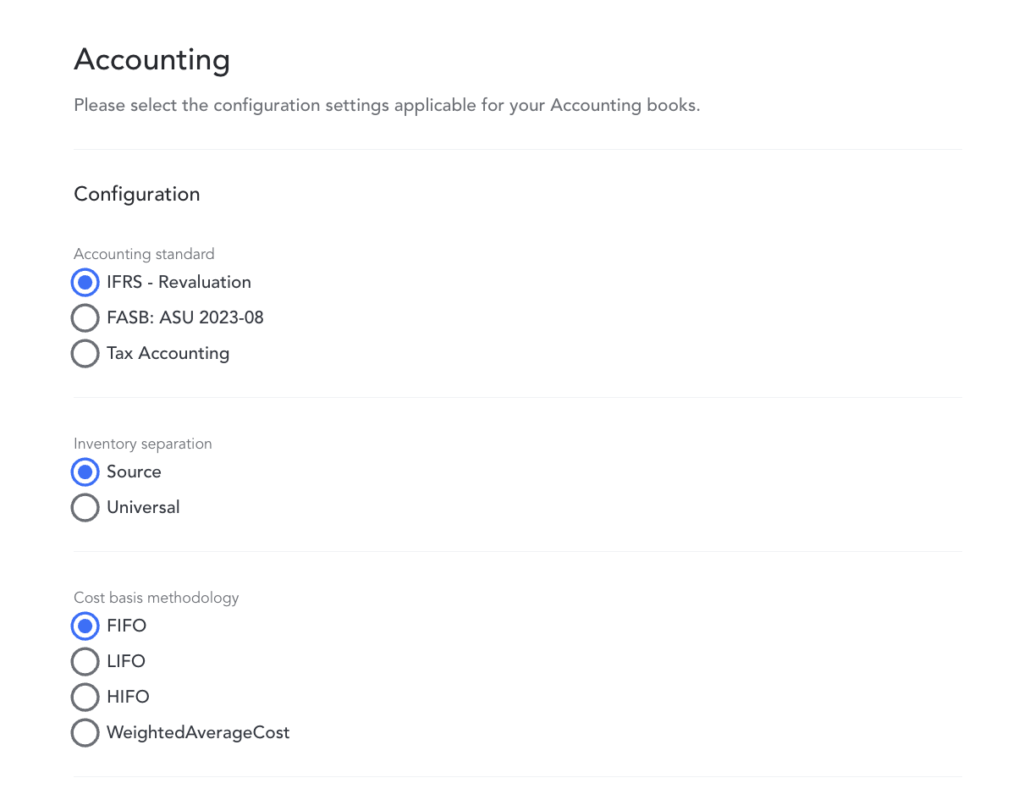

The new regulations clarify, but do not significantly change, the permitted methods for selecting which cost basis unit is being disposed of. Taxbit’s software provides users with flexible cost basis relief methods including first-in-first-out as a default for the ability to programmatically manage specific identification.

In addition to source-based FIFO, Taxbit’s tool also supports other account-based programmatic lot relief methodologies including, highest-in-first-out, weighted average, last-in-first-out, and a first-of-its-kind retroactive approach tailored for the needs of organizations that support short positions and need to manage their gain/loss calculations for accurate results.

Real-Time Documentation and Audit Trail

The other critical change made in the new regulations relates to both the timing of when a company decides which cost basis lot is being disposed of, as well as the documentation supporting that decision. Taxbit’s system addresses both of these new requirements by enabling a user to make real-time decisions as to which cost-basis lot is being disposed of and ensuring that all disposal decisions are documented with timestamps and stored in the system as part of the audit trail.

This functionality ensures that taxpayers can prove to the IRS that their decisions were made in compliance with the new regulations at the time of each transaction. For assets held at a broker, where a standing instruction can be relied upon, the system will track these decisions. For self-custodied assets, the platform captures and tracks each decision in real time.

Prepare for the New Normal in Digital Asset Accounting with Taxbit

Treasury’s final regulations bring cost-basis tracking for digital assets in line with traditional finance. The era of retroactively choosing how to account for digital assets is over. By enabling account-level tracking, documenting lot disposal in real-time, and providing flexible cost basis relief methods, Taxbit’s software is designed to keep your organization compliant with these new regulations. The importance of choosing the right digital asset accounting platform cannot be overstated. With the ability to track, document, and report digital asset transactions accurately, Taxbit ensures you’re not only IRS-compliant but also ready to optimize your tax position in the ever-evolving digital asset landscape. Contact our team today to learn more about Taxbit’s accounting platform.