Accuracy matters when it comes to calculating digital asset taxes

Over the past couple of years, millions of Americans have participated in the cryptoeconomy – buying, selling, trading, or simply transferring digital assets from place to place. These activities generally require fees to be paid as part of the transaction. Those fees may be paid to a centralized exchange or as a network transaction fee to the validators confirming transactions on a blockchain.

Sometimes those fees relate to the purchase, sale, or trade of an asset, while other times the fee is simply incurred to transfer units from one exchange to another or to a non-custodial wallet, DeFi protocols, NFT marketplaces, etc. Regardless, those fees are an expense incurred by individuals engaging in crypto activity. For many, the question is how those fees are treated for tax purposes—can they be deducted, or do they provide any potential benefit?

The answer, at least for certain kinds of fees, is yes. Fees incurred in conjunction with the acquisition or disposition of a crypto asset provide some tax benefit. Conversely, fees incurred simply with the transfer of crypto assets among accounts or non-custodial wallets likely provide no tax benefit.

Crypto tax interpretations can be complex – but as regulatory scrutiny increases it’s more important than ever to stay ahead of the curve. There are a lot of opinions espoused about crypto tax issues, and some of them are at odds with existing regulatory guidance, or even common practice in traditional financial transactions. Individuals should always do their due diligence to ensure they do not inadvertently put their tax filing at risk of audit.

What tax benefit can I get from fees incurred in the acquisition or disposition of crypto?

Whenever crypto is bought or sold (or converted to another asset) on a centralized or decentralized exchange, the U.S. tax code permits fees paid with respect to those transactions to be taken into account for tax purposes. This is true regardless of whether the fee is paid on a centralized exchange as part of a trade, to an on-chain marketplace as part of a DeFi protocol, or to network validators as part of a decentralized exchange transaction.

Where the fee is paid in fiat, the value of that fee will be used to offset any sale proceeds (if crypto is being sold) or will be added to the acquisition cost (if crypto is being purchased).

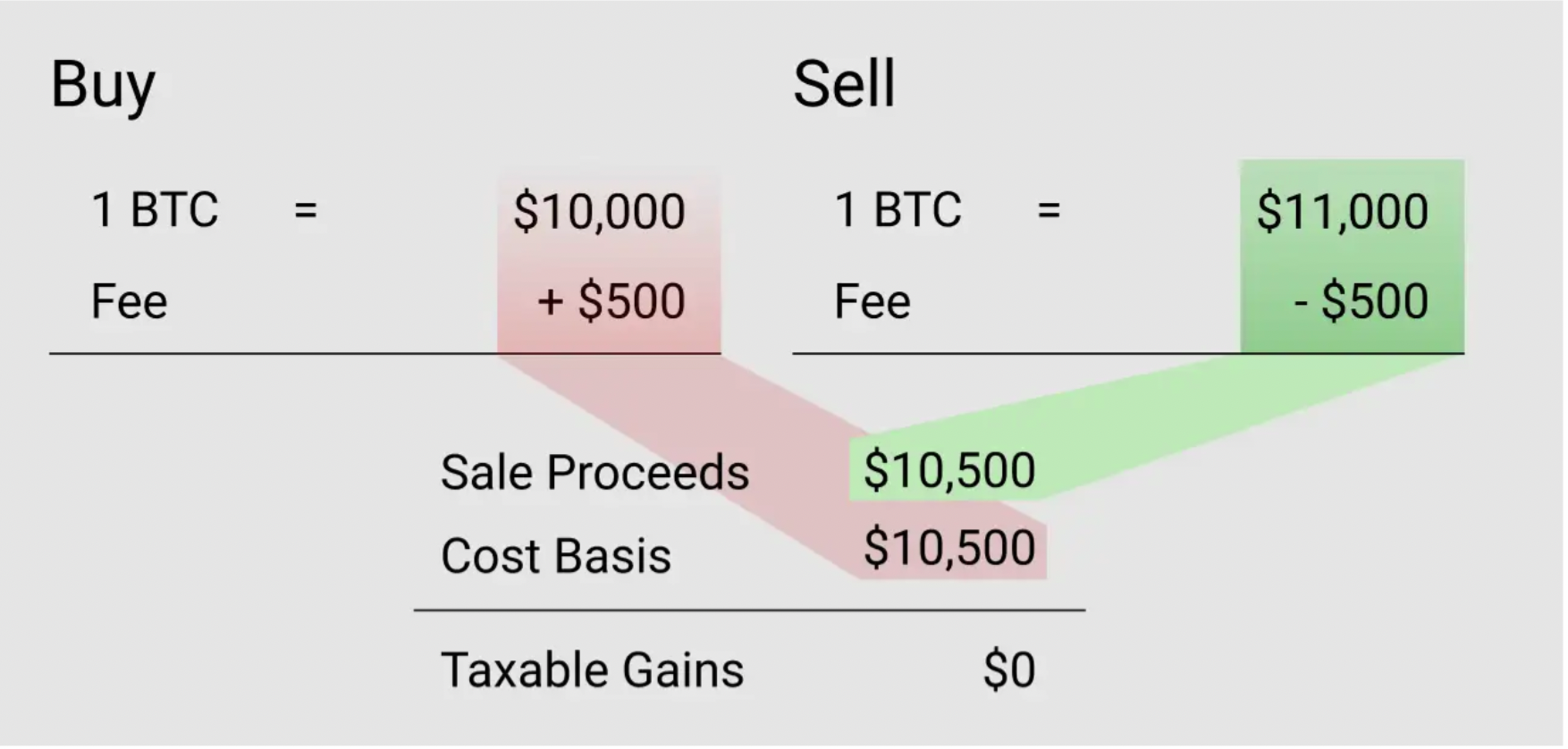

For example, if you use fiat to buy $10,000 of BTC and incur a $500 fee, the value of that fee will be added to the acquisition cost of the BTC. Conversely, if you sell $11,000 of BTC for fiat and incur a $500 fee, the value of that fee will reduce your sale proceeds.

In the graphic below, 1 BTC is purchased for $10,000 cash plus a $500 purchase fee, resulting in a cost basis of $10,500. Later that same 1 BTC is sold for $11,000 cash with a $500 fee. Both $500 fees operate to reduce the taxable gain on the sold BTC to zero.

Where the transaction does not involve fiat and the fee is paid in crypto, the crypto given up to pay the fee provides a tax benefit. It would either be applied to reduce the gain on the crypto that was disposed of, or increase the acquisition cost basis of the crypto being acquired. The IRS has not provided any guidance on which approach is correct, but the most practical approach that is likely to draw the least amount of scrutiny is to apply the fee against whichever side of the transaction that the fee is paid in.

For example, if you buy 10 BAT using $10,000 worth of ETH and pay a 0.5 BAT fee, you can net the fee quantity against the BAT received, so it would be as if you bought only 9.5 BAT with a cost basis of $10,000. By netting the fee quantity, the cost basis per BAT is higher, providing a tax benefit when the BAT is ultimately sold.

Separately, if you buy $10,000 worth of BAT using 1 ETH and incur a fee of 0.05 ETH, the fee quantity would be added to the quantity of ETH disposed of while the proceeds on the disposal is unchanged. It would be as if you disposed of 1.05 ETH with proceeds of $10,000. Disposing of a larger quantity of ETH for $10,000 proceeds reduces your overall gain on the ETH.

On popular centralized exchanges, where fees may often be paid in fiat, accounting for fees is easy. Where a fee is paid in crypto, it can be a little more complex. Regardless, fees incurred with respect to the acquisition or disposition of crypto always provide some tax benefit and should be accounted for in some way.

What about fees incurred when I am just transferring my crypto?

While many people are familiar with the tax treatment of fees relating to the buying and selling of crypto explained above, fees associated with simply transferring crypto across the ecosystem are different and likely provide no tax benefit.

Fees incurred to simply transfer crypto assets around the ecosystem likely provide no tax benefit because they are not incurred in direct connection with the acquisition or disposition of property. Further, any crypto disposed of to pay transfer fees needs to be included in your calculation of gains and losses.

As an example, let’s say you are holding ETH with a cost basis of $10,000 on a centralized exchange and want to transfer that ETH to a non-custodial wallet so you can get it into cold storage, or move it into a DeFi protocol. When you transfer (withdraw) that ETH from the centralized exchange, you pay a transfer fee in ETH worth $25.

The ETH used to pay the transfer ETH should be included in your tax calculation as a disposal of ETH. The gain or loss would be calculated as $25 proceeds less the cost basis in that ETH.

Separately, you have incurred a $25 fee for the transfer—paid in ETH. This $25 expenditure likely has zero tax implications. As an initial matter, the fee is not paid in conjunction with the acquisition (or disposition) of property (crypto) so the value of the fee is not going to be added to the acquisition cost basis of the property. There is no basis in the tax code to add the cost of moving (or transferring) property into the cost basis of that property.

You could try to deduct the fee on your taxes for the year in which it was incurred but the IRS would likely view the fee as a non-deductible personal expenditure, akin to paying an expense to move any other personal property you own. Notably, fees paid for personal financial transactions are also generally not deductible unless they relate to the acquisition or disposition of property.

If the transfer fee can be characterized as relating to an individual’s investment activity, the tax code historically had allowed investment-related expenses to be deducted as miscellaneous itemized deductions. But since 2018, deductions for those expenses are no longer allowed, and won’t be allowed again until 2026.

Ultimately, the tax treatment can be nuanced, but the IRS likely would argue that moving crypto around the ecosystem is simply a personal activity and therefore non-deductible.

How Taxbit Can Help

At Taxbit, we are building industry-leading solutions for digital asset compliance. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and Fortune 500 companies with features such as:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2

- Audit support that is built with your auditors in mind

- Leading expertise from our team of IRS, AICPA, and Big-4 alumni

.png)