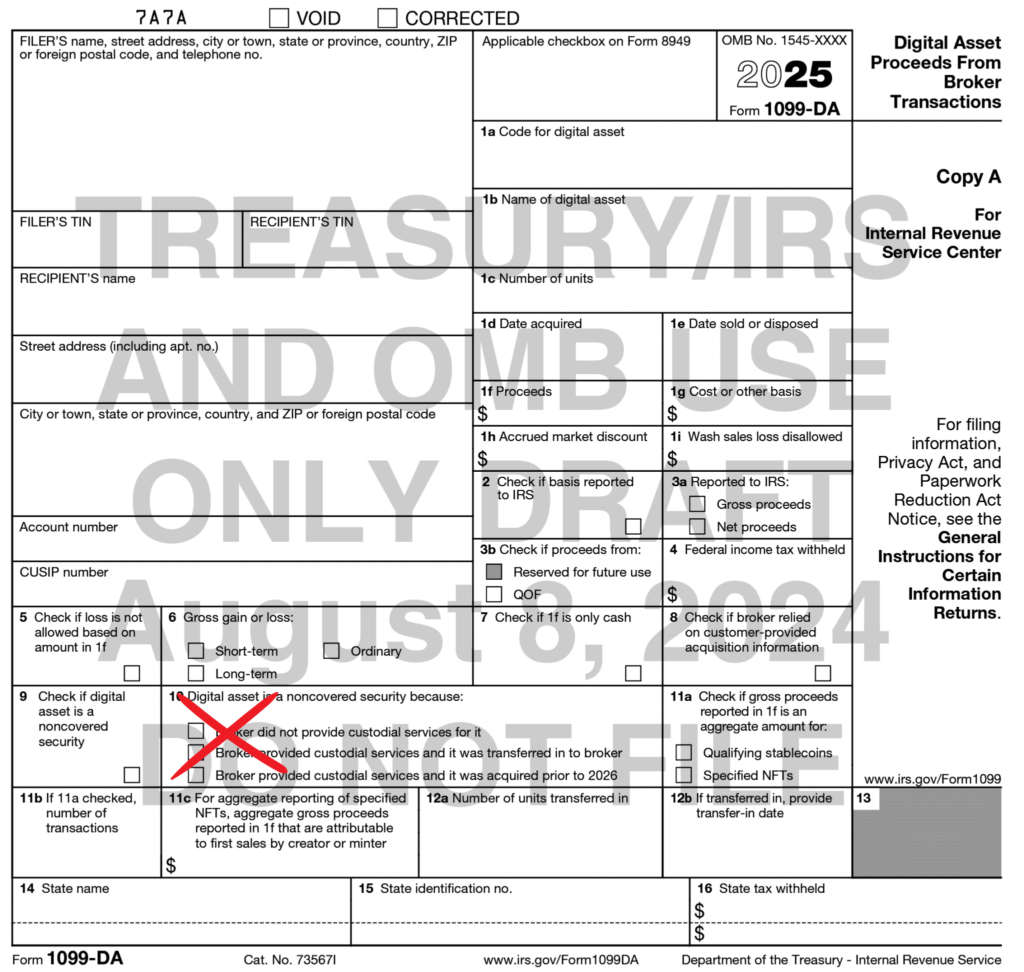

The IRS just released an updated draft, but likely final, version of Form 1099-DA. The revised form includes one primary update to the prior draft released earlier this year that aims to streamline compliance for digital asset brokers. The new updates continue to bring welcomed simplification to the reporting process for sales and exchanges of digital assets, helping brokers align more closely with the standards seen in traditional financial reporting.

Key Update: Removal of Box 10

In previous drafts, Box 10 required brokers to explain why an asset was considered a “non-covered security.” This requirement posed challenges for brokers. As previously drafted, Box 10 provided brokers with limited reasons for why a digital asset was a non-covered security. This raised concerns as to whether the reasons listed covered all possible situations, possibly leaving brokers without an accurate option. Additionally, similar information has not been solicited from brokers in traditional finance.

The IRS has now removed this question, reserving Box 10 for possible future use. This change simplifies the reporting process and ensures greater consistency across financial product types. Also, by keeping the existing form layout consistent and not updating boxes, this revision should not undermine current efforts by brokers to already begin implementing systems based on the prior version of the form.

Why This Matters

The removal of Box 10 benefits digital asset brokers. Here’s why:

- Streamlined Compliance: By eliminating the need to explain non-covered assets, brokers can focus on delivering accurate, timely reporting without additional administrative burdens.

- Consistency Across Asset Classes: Aligning digital asset reporting with traditional financial reporting practices on Form 1099-B ensures a more uniform compliance experience.

What’s Next?

Brokers are already preparing to implement reporting requirements for the 2025 tax year. As such, the IRS is under pressure to finalize the Form 1099-DA and its accompanying instructions to ensure brokers have sufficient time to implement systems and comply with reporting requirements.

For Digital Asset Brokers, this means:

- Leveraging solutions like Taxbit’s automated compliance platform to stay ahead of the curve.

- Staying informed about IRS updates and technical guidance.

- Ensuring that your reporting infrastructure is prepared for the finalized Form 1099-DA.

Simplify Your Digital Asset Compliance with Taxbit

At Taxbit, we’re here to help you navigate this evolving regulatory landscape. Our expert-built, platform-powered solutions are designed to handle the complexities of high-volume reporting and multi-jurisdiction compliance. With precision, automation, and real-time analytics tools, Taxbit ensures you’re always ready for what’s next. Learn more about how Taxbit can help your business navigate these updates. Visit Taxbit for more insights and solutions.