Understanding the evolving 1099-K reporting landscape across federal and state jurisdictions

On November 26, 2024, the IRS issued Notice 2024-85, introducing a phased approach to the reduced Form 1099-K reporting thresholds for Third-Party Settlement Organizations (TPSOs). These updates come amid ongoing complexities around federal and state reporting requirements. Here’s what you need to know about the latest developments, and see the press release for more information.

Key Updates to the Federal 1099-K Reporting Thresholds

New Federal Threshold Timeline

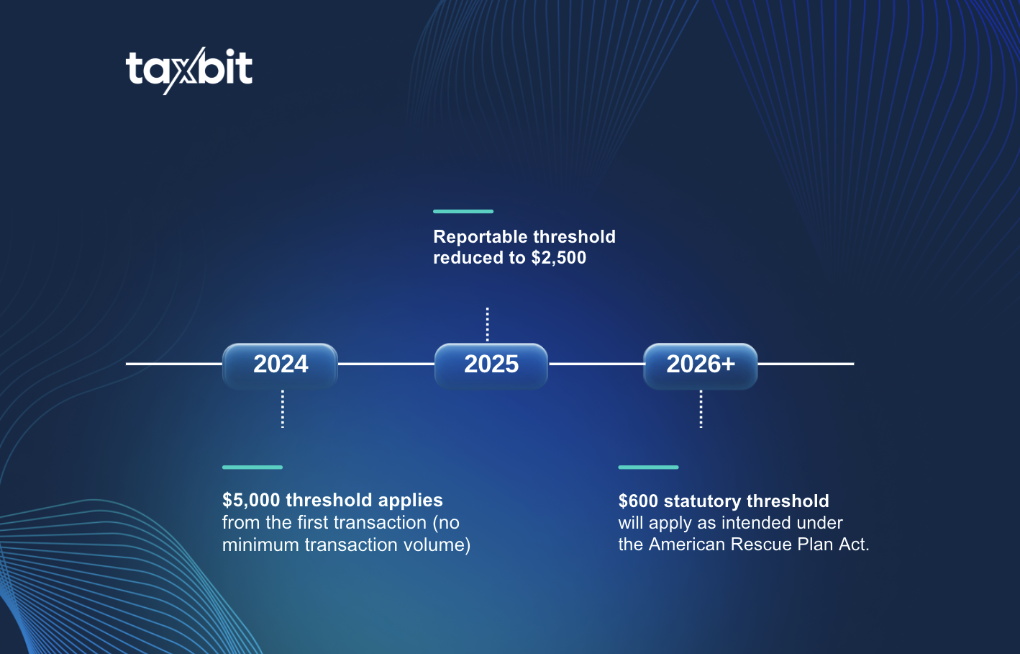

The IRS has announced the following transitional thresholds for Form 1099-K reporting:

- 2024: $5,000 threshold, applicable from the first transaction (no minimum transaction volume).

- 2025: Threshold reduced further to $2,500.

- 2026 and beyond: The $600 statutory threshold will apply as intended under the American Rescue Plan Act.

Compliance Notes

- The law requires a $600 threshold: While the IRS provides penalty relief to TPSOs who fail to comply with the $600 threshold until 2026, TPSOs can still choose to report at the $600 level in compliance with the law.

- Backup withholding requirements: TPSOs must carefully monitor backup withholding. All backup withholding done during 2024 must still be reported on Form 1099-K, even if the payments fall below $5,000.

Why the Transition Matters

Impact on Small Sellers and Casual Transactions

The reduced thresholds—especially the $600 level—have raised concerns about improper reporting of non-taxable transactions. For instance, casual sellers or individuals reimbursing friends may be mistakenly flagged, resulting in unnecessary IRS scrutiny.

State-level Reporting Challenges

Many states have already adopted the $600 threshold. This creates added complexity for TPSOs and businesses operating across multiple jurisdictions, as state requirements may differ from federal thresholds. Some states may adhere strictly to the statutory $600 level, regardless of IRS penalty relief.

Implications for Taxpayers and TPSOs

TPSOs need to:

- Monitor state-level guidance closely, as state rules may not align with federal penalty relief measures.

- Prepare for increased compliance demands, especially as thresholds decrease over the next two years.

- Educate customers about the implications of receiving Form 1099-K for transactions, including the need to maintain accurate records.

For taxpayers, the evolving thresholds mean increased vigilance in understanding what income is taxable, especially when engaging in activities like selling used goods or collecting reimbursements.

Navigating the Evolving Compliance Landscape with Taxbit

Tax compliance is increasingly complex, but Taxbit offers solutions to streamline the process. From automated data collection to form generation and filing, our platform ensures compliance with varying federal and state reporting requirements.

Stay ahead of regulatory changes and reduce the burden of managing 1099-K thresholds with Taxbit.

Speak to our tax experts to see how Taxbit can help you.

Choose Wisely. Choose Taxbit.