As digital asset adoption matures, a major shift is underway in how institutions approach payments, compliance, and reporting. In a recent webinar “Lightning, Stablecoins, and Compliance: How Voltage & Taxbit Power Institutional Adoption,” subject matter experts, Aaron Jacob, VP of Accounting at Taxbit and Bobby Shell, VP of Marketing at Voltage discussed how their new integration is unlocking enterprise-grade use cases for Bitcoin and stablecoins on the Lightning Network.

The Growing Institutional Appetite for Digital Assets

The conversation began with context: institutional momentum around digital assets has hit a new stride. According to Jacob, we’re witnessing a “dramatic shift” in tone from regulators like the SEC and Federal Reserve. “I was on the phone with some folks at the SEC… asking very thoughtful questions… What are companies struggling with? What support is needed?”

This reflects broader signals in the market. ETFs from giants like BlackRock and Fidelity now hold billions in Bitcoin. Meanwhile, states are exploring BTC reserves, and private companies are weighing the integration of stablecoins into core operations.

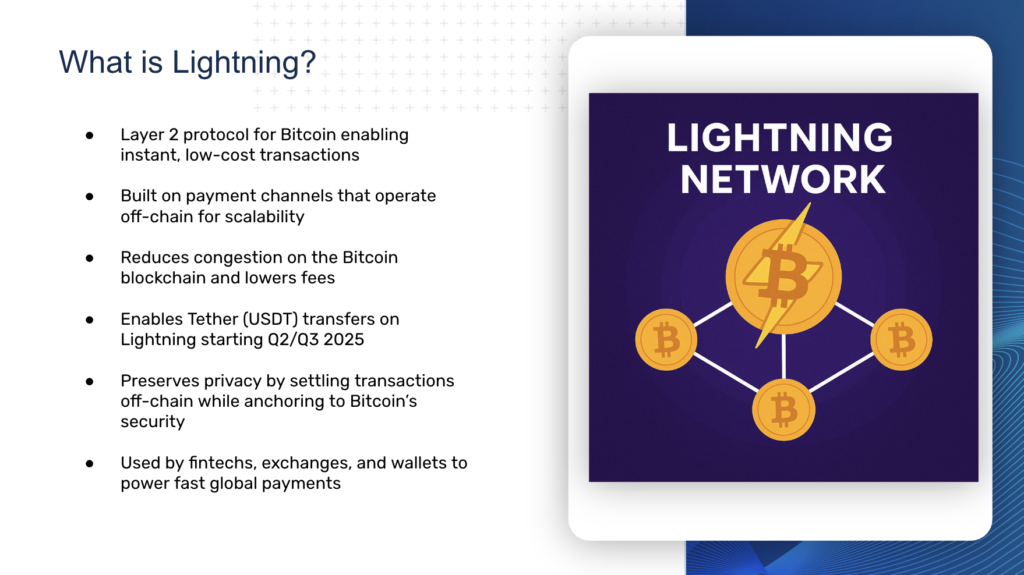

Why Lightning Network Is Emerging as Enterprise Infrastructure

At the core of this evolution is the Lightning Network — Bitcoin’s Layer 2 protocol for fast, low-cost, global payments. Shell, highlighted why Lightning is seeing serious institutional traction: “Bitcoin has been chosen by institutions as the most trusted digital asset… and now Lightning provides programmable money for instant and global payments.”

This isn’t theoretical. The Lightning Network has crossed over 600 million users via integrations with major players like Coinbase, Binance, and Cash App. The reliability and liquidity on the network have transformed it into what Shell described as “an enterprise and institutional-grade payment network.”

What’s more, stablecoin innovation is converging with Lightning. Shell noted that Tether is working to bring USDT to the Lightning Network later this year — a move that will allow companies to settle in dollars while leveraging Bitcoin’s decentralized infrastructure.

The Voltage-Taxbit Integration: Bridging Payments and Compliance

While Lightning opens new doors for real-time global payments, it also introduces complexity in tax and accounting — especially when those transactions occur off-chain. That’s where the new partnership between Voltage and Taxbit comes in.

“Lightning allows you to reduce fees and increase speed,” Jacob explained. “But institutions still need channel-level visibility for accounting and compliance.” This integration ensures that even off-chain Lightning transactions are captured, tracked, and reported accurately — satisfying GAAP, IFRS, and tax requirements.

With the integration, institutions can sync their Lightning data directly from Voltage into the Taxbit platform. The result is what Jacob called “transaction-level visibility down to the Satoshi”, enabling precise cost basis tracking, gain/loss calculations, and journal entry automation.

Real Savings in Cost and Time

The operational upside is significant. Shell shared that clients using Voltage can shift 30% to 60% of their Bitcoin transaction volume to Lightning, resulting in “millions to tens of millions” in annual fee savings. Beyond hard costs, businesses benefit from reduced customer support tickets and faster user experiences.

On the back office side, Taxbit’s clients are already processing hundreds of millions — even billions — of transactions, thanks to automation and integrations that streamline period closes, tax filings, and audit readiness. One enterprise client saw a 75% reduction in accounting overhead after implementing Taxbit’s solution.

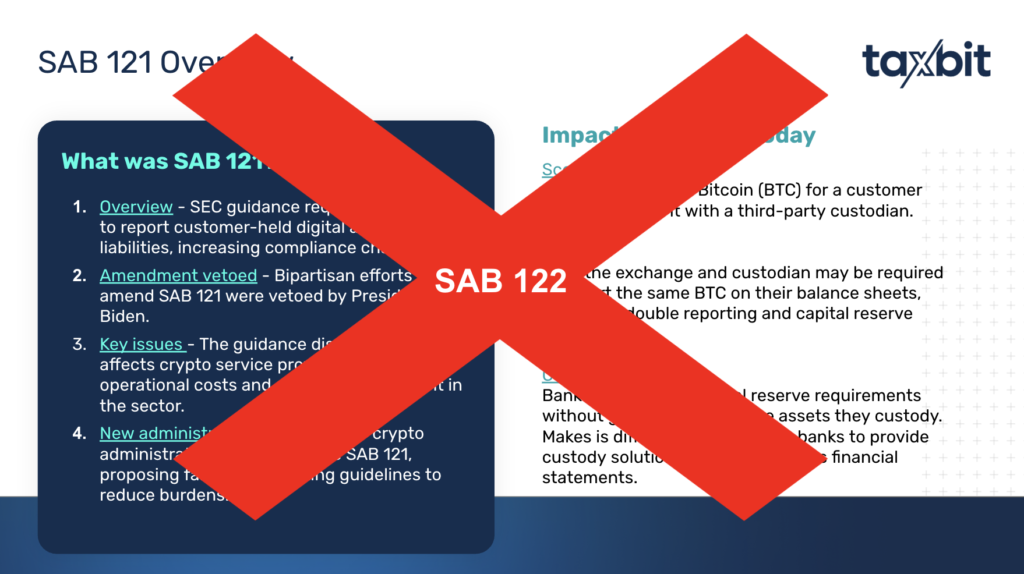

The Regulatory Shift: From Uncertainty to Opportunity

A key focus of the discussion was the repeal of SEC Staff Accounting Bulletin (SAB) 121, which had effectively blocked banks from holding crypto assets due to punitive balance sheet requirements. “SAB 122 completely nullifies SAB 121,” Jacob explained, “and that has opened the door for banking institutions to re-enter the digital asset space.”

This change, combined with improved clarity around stablecoins and custody, is driving increased institutional interest. But it also underscores the need for compliance-first infrastructure that supports both innovation and risk management.

Looking Ahead: Stablecoins, Scalability & Compliance at Scale

While stablecoins like Tether and USDC are not yet live on Lightning, Shell confirmed that integration is expected later this year: “We’re thinking late Q2, early Q3.” Once live, enterprises using Voltage’s infrastructure can begin transacting stablecoins with near-instant settlement and minimal fees — all while maintaining compliance via Taxbit’s platform.

Both speakers closed the session emphasizing the importance of building systems that serve front, middle, and back office needs. As Jacob put it, “The front office wants speed and innovation. The back office wants compliance and control. With this integration, you don’t have to choose.”

To discover the entire conversation, watch the webinar anytime, anywhere right here.