With 2025 around the corner, the OECD’s global standard on crypto-related tax information reporting, the Crypto-Asset Reporting Framework (CARF), continues evolving, signaling a new digital asset global tax transparency era. With recent commitments from a broader range of highly relevant jurisdictions, including the UAE (Dubai), and the OECD’s Global Forum releasing a step-by-step implementation guide, CARF is solidifying its position as a universally recognized standard for crypto tax compliance.

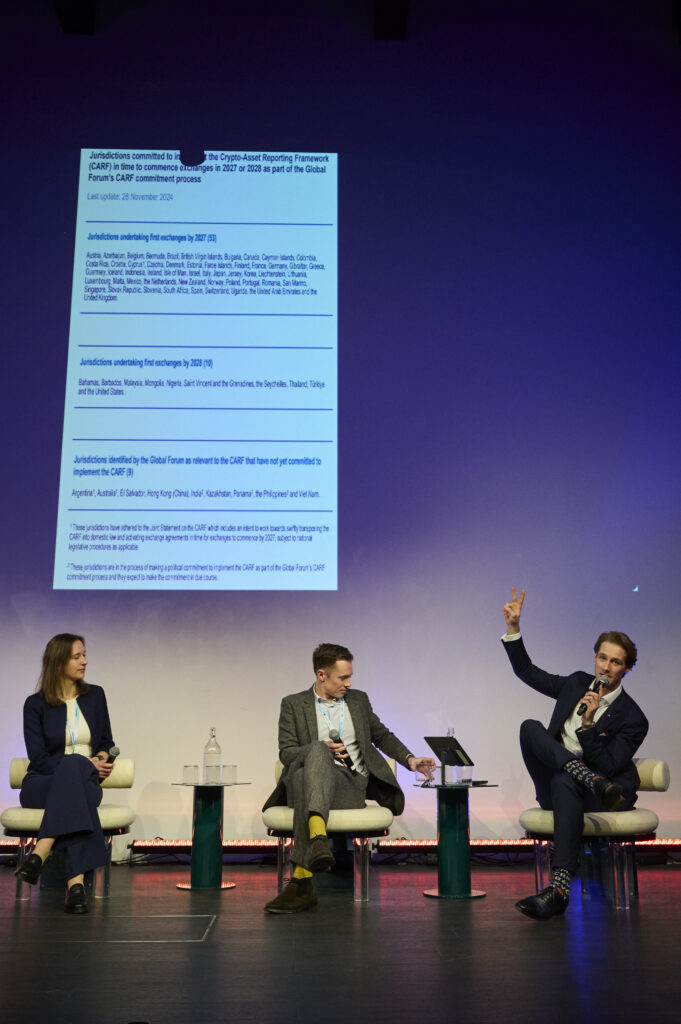

These latest developments regarding CARF and its EU counterpart, DAC8, were thoroughly discussed during a recent panel at The Blockchain for Europe Summit 2024, moderated by our European Managing Director, Max Bernt, together with Colby Mangels, Tax Policy Advisor at the OECD, and Dorina Juhász, Strategic Projects Manager and Regulatory Compliance Lead at Bitvavo.

As a leader in bridging public and private sectors, Taxbit is taking a proactive role in shaping the CARF dialogue—acting not only as a participant in negotiations with jurisdictions but also as a vital channel for collaboration between public authorities and the private sector.

This blog will delve into CARF’s upcoming implementation, its critical implications for service providers, and how it may fundamentally reshape the blockchain and crypto landscape.

What is the Crypto-Asset Reporting Framework (CARF)?

CARF is a global effort by the OECD to bring consistency and transparency to crypto-asset reporting. By aligning tax information reporting requirements with AML-standards developed for Virtual Asset Service Providers (VASPs) under the Financial Action Task Force (FATF), it seeks to create a unified system that obliges reportable entities and individuals to identify their customers’ tax residencies and to start tracking their crypto transactions. Scheduled to be enacted starting January 1, 2026, CARF thus introduces comprehensive compliance measures for most service providers in the space.

Key features of CARF include:

- Valid Tax Residency Certification: Service providers will need to conduct more comprehensive Know Your Customer (KYC) processes to collect valid tax residency self-certifications from all new and existing users.

- Account Compliance: Service providers will need to freeze accounts if no valid self-certification has been obtained to avoid harsh account and/or transaction-based penalties.

- Transaction Monitoring: Providers must have the appropriate systems in place by January 1st, 2026, to identify their customers and track all of their crypto transactions in order to report this information to their local tax authorities starting January 2027.

- Automatic Exchange of Information (AEOI): Tax administrations are obliged to exchange information on all persons with the relevant tax authorities based on the declared tax domicile.

The framework aims to ensure a level playing field across jurisdictions while laying the foundation for a coordinated global tax infrastructure.

The Major Updates: What’s New?

Jurisdictions Committed to CARF Implementation

CARF now boasts commitments from 63 jurisdictions, categorized by their readiness to commence exchanges:

- First Exchanges by 2027 (53 Jurisdictions):

Countries and territories leading the charge include, among others, the European Union Member States, Bermuda, Brazil, Cayman Islands, Canada, Singapore, Switzerland, the UAE, and the United Kingdom. - First Exchanges by 2028 (11 Jurisdictions):

A second wave of adopters includes the Bahamas, Hong Kong (China), Malaysia, the Seychelles, Thailand, Türkiye and the United States, among others.

This global participation highlights a unified effort to establish a transparent framework for crypto-asset taxation.

Jurisdictions Yet to Commit

Nine jurisdictions, including Argentina, Australia, El Salvador, India, Kazakhstan, Panama, the Philippines and Viet Nam, have not yet fully committed to CARF implementation, but are in the process of aligning with its standards. These countries are expected to announce commitments soon, emphasizing the framework’s growing global influence.

Supporting Documents

Two key resources have been introduced to facilitate implementation:

- Capacity-Building Strategy: Ensures jurisdictions have the tools necessary for effective implementation.

- Step-by-Step Guide to Understanding and Implementing CARF: Tailored for public authorities and Crypto-Asset Service Providers (CASPs).

Potential Impact on Decentralized Finance (DeFi)

One of the most heavily debated topics at the moment, thus also at The Blockchain for Europe Summit panel, is the potential inclusion of DeFi in CARF. Presently, the inclusion criteria for DeFi remains unclear, leaving room for regulatory arbitrage and legal uncertainty. It is now up to the OECD to release more guidance in the CARF FAQs.

Broader Industry Impact

The adoption of CARF is set to redefine the crypto ecosystem, with implications reaching far beyond compliance:

1. Market Consolidation

The heavy compliance burden may disproportionately affect smaller service providers, prompting a wave of market consolidation. Larger, financially robust players that prioritize compliance will likely gain a competitive advantage.

2. Global Harmonization

There’s widespread support for harmonizing global tax reporting standards to avoid fragmentation. In addition, achieving consistency in reporting schemas across CARF signatories would streamline cross-border transactions and reduce compliance costs for providers. This is why Taxbit has been leading several industry working groups dealing with these challenges to improve the overall efficiency of the new reporting regime.

Latest insights from the OECD and Industry Leaders

Colby Mangels, one of the leading Tax Policy Advisors at the OECD on CARF, emphasized that CARF is not merely designed to bring compliance to crypto markets, but also to establish a long-term framework for regulatory coordination. He underscored the importance of maintaining an adaptable system to respond to evolving technologies, such as DeFi, while ensuring robust enforcement mechanisms.

“CARF is not just about achieving compliance in the crypto markets; it lays the foundation for a long-term regulatory framework that ensures coordination and adaptability in response to evolving technologies like DeFi. It is crucial to strike a balance between innovation and robust enforcement mechanisms.” – Colby Mangels, Tax Policy Advisor at the OECD

Complementing this, Dorina Juhasz from Bitvavo stressed that service providers must engage proactively with users to ease the transition into CARF-compliant practices. She highlighted Bitvavo’s commitment to transparency and clear communication as a critical part of their compliance strategy.

“We firmly believe that proactive engagement with our users is crucial in facilitating a smooth transition into CARF-compliant practices. At Bitvavo, we are committed to upholding transparency and maintaining clear communication channels as integral components of our compliance strategy.” – Dorina Juhasz, Innovation Manager at Bitvavo

CARF and the Future of Crypto Regulation

The implementation of CARF is a watershed moment for the blockchain and crypto industry, bringing long-awaited transparency and alignment with global tax standards. For service providers, this is no longer a distant prospect—2025 will be a critical year for laying the groundwork for compliance, ahead of the framework’s full enforcement starting January 1, 2026.

The time to act is now. Service providers need to evaluate their readiness, implement robust KYC and transaction-monitoring systems, and engage actively with users to ensure a smooth transition. CARF is not just a compliance requirement; it is a chance for the crypto ecosystem to legitimize its operations and build trust with regulators, investors, and users alike.

Taxbit is committed to guiding stakeholders through this transformation. By leveraging our expertise and fostering collaboration between public and private sectors, we aim to simplify the compliance journey and help service providers adapt seamlessly to this new era of global tax transparency.

Are you prepared for CARF? Start laying the foundation now to stay ahead of these transformative regulations – visit Taxbit to learn more.

To watch the full panel “The Impact of Upcoming Reporting Requirements” from The Blockchain for Europe Summit, click here.