Dubai has positioned itself at the forefront of the global virtual asset industry, driven largely by the Virtual Asset Regulatory Authority (VARA). Taxbit recently hosted an in-depth webinar featuring Vinit Shah, Senior Advisor, Dubai Economy and Tourism/VARA, Elise Soucie Watts, Executive Director, Global Digital Finance, Dr. Max Bernt, Global Head of Regulatory Affairs & Managing Director, Europe, Taxbit and Aaron Jacob, VP of Accounting Solutions, Taxbit – to delve into VARA compliance and operational considerations for Virtual Asset Service Providers (VASPs).

VARA’s Foundation and Vision

Vinit Shah provided an insightful background into VARA’s origins, highlighting its strategic role within Dubai’s ambitious D33 vision. Shah noted,

“VARA came out as one of the initiatives as part of Dubai’s D33 vision…this was one of the biggest initiatives coming out of that, focusing on everything tech and Web3.”

VARA was deliberately created as a dedicated regulator, distinct from traditional financial frameworks, specifically to cater to Dubai’s domestic market. Shah explained the careful benchmarking process involved in creating VARA, saying,

“We benchmarked ourselves to the likes of Hong Kong, MAS in Singapore, Switzerland FCA, and the US…we worked very closely with the private sector, inviting around 30 or 40 odd companies already operating in the space to understand their challenges.”

Global Reception and Industry Engagement

Elise Soucie Watts shared her global perspective, underscoring the strong industry appreciation of VARA’s efforts. She emphasized VARA’s unique advantage, noting,

“This was born around the time of COVID; they started from scratch and were able to build it from the ground up. That agility, flexibility, and genuine desire to understand the digital asset market has been really well received.”

Watts also pointed out the speed at which VARA has developed comprehensive regulations compared to other global markets:

“While we work with regulators around the world, we do have to be honest that some are ahead and some behind. We are still waiting for regulatory clarity in both the US and the UK, whereas VARA has a comprehensive regime where you can get licensed and set up your business.”

Key Compliance Challenges

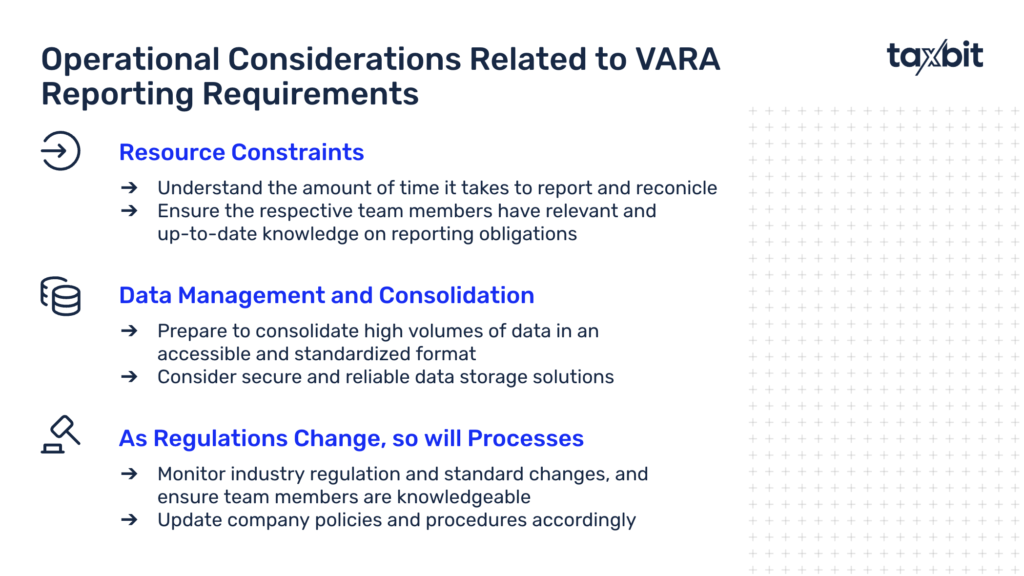

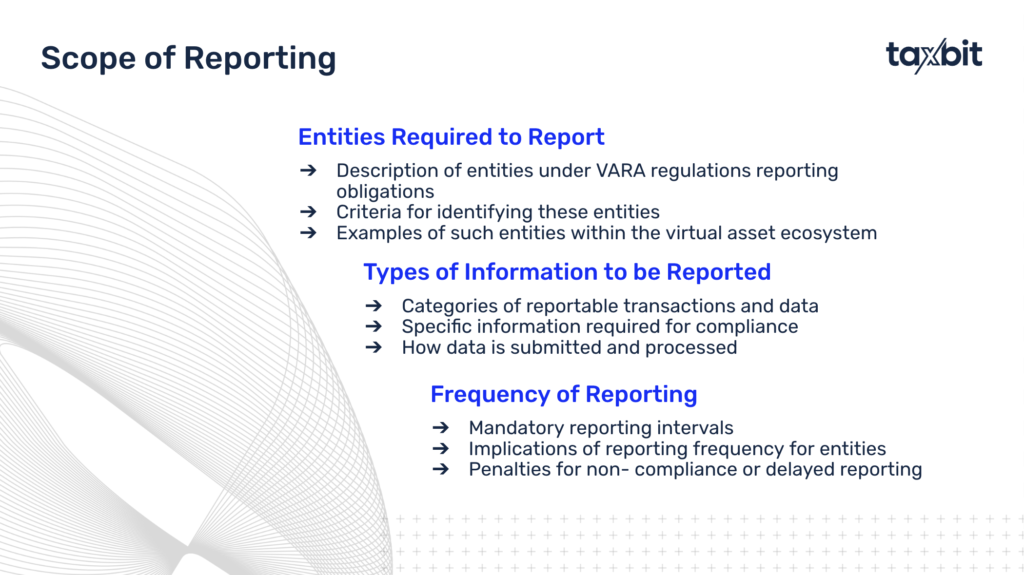

Dr. Max Bernt provided detailed insight into the practical challenges VASPs face in adhering to VARA’s requirements. Highlighting specific operational hurdles, Bernt stated,

“One of the key areas that demand extra preparation is reporting and reconciliation requirements. VARA mandates daily reconciliation, meaning companies must be able to show at any given time that their records are fully up to date and accurate.”

He further advised firms to anticipate and proactively address these requirements:

“Companies often find it easier to adapt when they invest in scalable compliance infrastructures from the start.”

Aaron Jacob reinforced this point by describing the detailed reporting requirements companies face, including reconciling fiat and digital asset holdings against customer obligations daily. Jacob observed,

“It requires a lot of work, but it’s good work…to manage their businesses with integrity and ensure market confidence.”

Detailed Licensing Process

Vinit Shah extensively detailed VARA’s licensing process, from initial submission to operational readiness. He outlined specific steps including the Initial Disclosure Questionnaire, In-Principle Approval (IPA), and ongoing supervisory requirements. Shah stressed the importance of preparation:

“Don’t submit until you’re ready…Make sure the application is complete because once you send it in and we start reviewing, it becomes a nightmare when you keep sending pieces of information back to us.”

Shah also highlighted the importance of direct applicant involvement:

“A lot of applicants use service providers…make sure you are involved in the application process because we will call you in for a fit and proper test, and if you don’t know what business you’re getting into, you will not get a license.”

Importance of Ongoing Compliance

Elise Soucie Watts underscored the importance of integrating compliance into business culture from the outset:

“Compliance should be seen not as a sunk cost but as the bedrock of business growth…it’s going to enable you to grow and scale your business globally.”

Watts emphasized continual engagement with regulators:

“Regulators are not out there to get you; they are there to ensure financial stability and protect consumers. Maintain open communications and relationships with your regulator.”

Enforcement and Regulatory Relationships

Vinit Shah discussed VARA’s enforcement focus on addressing unlicensed market participants: “Currently, our enforcement efforts focus more on clearing out market participants operating in a gray area…We’ve issued cease and desist letters, taken down websites, ensuring those without licenses do not serve UAE clients.”

Elise Soucie Watts offered crucial advice for VASPs:

“Never assume you fall outside the regulatory perimeter without clarification…Talk to the regulator. Provide more information, not less, if issues arise.”

Future Perspectives and Innovations

Looking ahead, Vinit Shah discussed VARA’s commitment to bridging the gap between innovation and regulation, including pilots in decentralized finance (DeFi) and real estate tokenization. He highlighted recent initiatives, saying,

“We are starting to look at the DeFi space. There was an announcement in Dubai about real estate tokenization by the Dubai Land Department, where the land registrar is looking at tokenizing real estate ownership, which is one of the first of its kind.”

Dr. Max Bernt reiterated that VARA’s standards could significantly influence global crypto regulatory practices, emphasizing the importance of “global regulatory monitoring and alignment” for VASPs operating internationally.

The Future of VARA with Taxbit

As VARA continues to evolve, Dubai is positioning itself at the forefront of global digital asset innovation, driven by collaboration and adaptability. Taxbit plays a pivotal role in supporting businesses through this intricate compliance landscape. According to Vinit Shah, VARA’s future strategy is clear: “The one thing that we try to aim for is to reduce the gap between regulation and innovation.” This commitment involves fostering continuous dialogue with private-sector players and industry bodies, enabling the regulator to remain agile enough to adapt to new and evolving use cases.

VARA’s recent activities, such as licensing ventures in decentralized finance (DeFi) and pioneering native real estate tokenization initiatives with Dubai’s Land Department, underscore its ambition to maintain Dubai’s competitive edge in the blockchain and digital assets arena. In alignment with VARA’s goals, Taxbit emphasizes the necessity of building a compliance-first foundation, providing technology-driven solutions, and ensuring scalable, real-time compliance monitoring.

As Dr. Max Bernt aptly summarized, “Technology is your best ally,” highlighting the critical role robust compliance technology will play in navigating VARA’s comprehensive regulatory framework successfully. For businesses looking to grow and flourish under VARA’s regulations, the combination of forward-thinking compliance strategies and advanced technological support from Taxbit will undoubtedly be indispensable.

To learn more, watch the webinar recording on-demand on our website.