Understanding the importance, process, and benefits of properly documenting foreign user accounts for U.S. businesses

W-8 Collection and Management: Identifying Non-U.S. Payees for Tax Information Reporting

Understanding the importance, process, and benefits of properly documenting foreign user accounts for U.S. businesses

If a U.S. business facilitates payments to individuals or other businesses, then it is likely subject to tax information reporting. The first step in fulfilling this key regulatory requirement is collecting and maintaining specific demographic information about the recipient of the payment (“payee”) – particularly, whether or not a payee is a U.S. or foreign person.

For U.S. payees, this process requires collecting vital taxpayer information via Forms W-9 and managing a complex downstream process for Form 1099 reporting thereafter.

The process for foreign payees is similar, but nonetheless challenging. Specifically, it involves collecting the appropriate type of Form W-8, based on the payee and the type of payment being made.

The demographic information collected may be used for a variety of reasons – for example, the payor may use it for the ultimate purpose of completing Form 1042-S reporting with the IRS (which is similar to Form 1099 reporting, in that it tracks income for payees and amounts withheld for taxes), or to otherwise substantiate a payee’s foreign status for purposes of Section 6050W.

What is a Form W-8?

Forms W-8 are standardized IRS forms utilized to certify, under penalties of perjury, that a payee is a foreign person. A U.S. person will never have to complete a Form W-8.

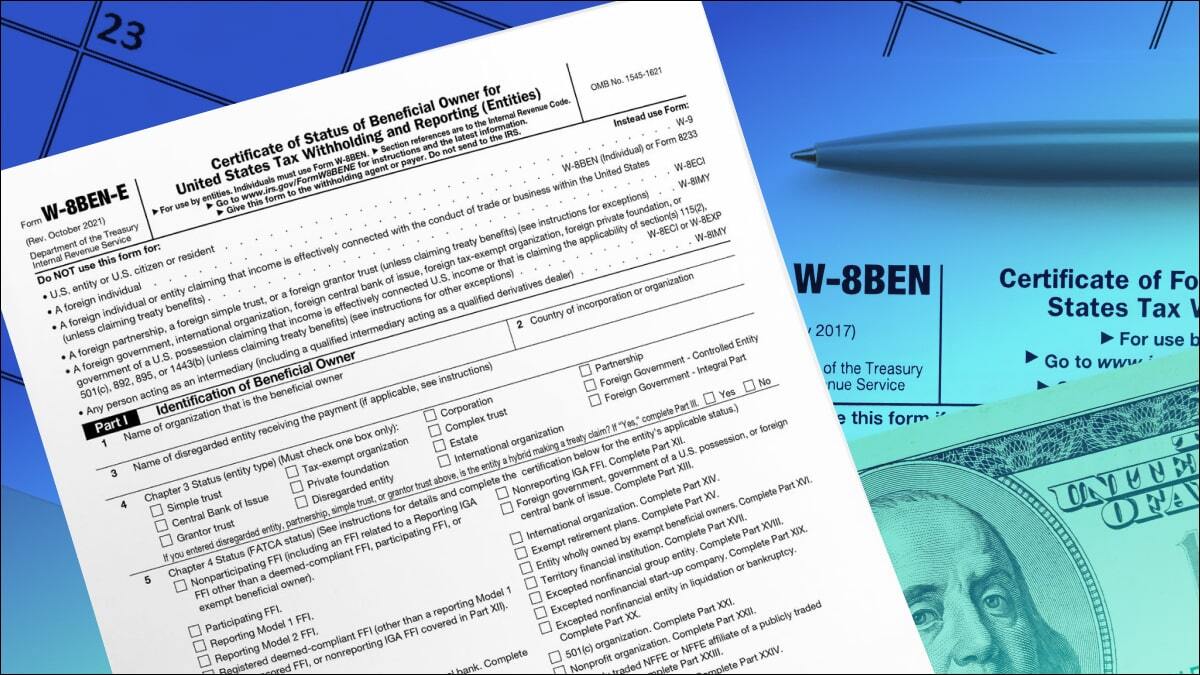

There are several types of Forms W-8, the most commonly collected typically being the Form W-8BEN and W-8BEN-E:

- Form W-8BEN, officially titled “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals),” is the IRS Form utilized to document a non-U.S. individual.

- Form W-8BEN-E, officially titled “Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities),” is the IRS Form typically utilized to document an entity as a foreign person. Please note, however, that depending on the circumstances, another Form W-8 may be more applicable for an entity (e.g., Form W-8IMY, W-8ECI, etc.).

What is a “foreign person”?

In short, a foreign person is any payee that does not fall under the definition of a U.S. person.

For individuals, the definition of a U.S. person includes U.S. citizens and permanent residents, including those who meet the Substantial Presence test and become U.S. tax residents as a result of spending a certain amount of time in the U.S. For entities, this includes partnerships, corporations, companies, or associations incorporated or registered in the U.S. or under the laws of the U.S., as well as estates (other than foreign estates), and domestic trusts (as defined in Regulations section 301.7701-7).

A foreign person, therefore, typically includes foreign individuals that lack U.S. citizenship (e.g., a non-resident alien), as well as foreign entities that lack U.S. residency (e.g., a foreign corporation, partnership, trust, estate).

What is a Form W-8 ultimately used for?

The need to collect a Form W-8 is typically prompted by a business making a payment of U.S.-sourced income to a foreign person. For example, a foreign individual who has completed work in the U.S. or has been paid interest or dividends from a US domiciled business will typically be asked to complete a Form W-8 prior to the receipt of payment.

Depending on the circumstances, a U.S. business may be required to report payments made to foreign persons on the Form 1042-S, which involves furnishing copies to the payee, as well as e-Filing with the IRS. In these instances, the payor would collect the demographic information required to complete Form 1042-S reporting on Forms W-8. For more details, see the Instructions for Form 1042-S Reporting.

In other instances, such as payments made by Payment Settlement Entities (“PSE”) under Section 6050W, collecting a Form W-8 from a payee may alleviate a payor from certain reporting requirements.

Consider an online auction-payment facilitator, a third-party settlement organization that transfers funds between buyers and sellers. The payment facilitator is a PSE that is typically required to report the gross amount paid to each seller (in this instance, the payee) on Form 1099-K, provided certain transaction volume and dollar thresholds are met.

Under Section 6050W, however, the definition of a “participating payee” excludes foreign persons, and therefore, collecting a Form W-8 from a payee alleviates the requirement for a PSE to complete Form 1099-K reporting any applicable payments made to that payee.

What is collected on a Form W-8?

The demographic information collected using Forms W-8BEN and W-8BEN-E is largely consistent – name, country of citizenship/organization/incorporation, address, tax identification number, etc.

It is important to review and validate the demographic information for completeness and accuracy. There may be situations where a new form must be collected, or the information provided needs to be verified by obtaining additional curing documentation. For example, address information provided must be reviewed for the inclusion of a PO box or in-care-of address, as well as for any US indicia. Further, the signature date must be reviewed upon receipt, and monitored over time, so a new Form W-8 is solicited upon expiration (a Form W-8 typically expires at the end of the third calendar year following signature).

In addition to providing this demographic information and establishing beneficial ownership, Forms W-8BEN and W-8BEN-E may also be used for purposes of claiming a reduced rate of withholding on certain types of payments (e.g., royalty/passive income), typically referred to as a treaty claim, or treaty benefits. For reference, foreign persons are typically subject to a 30% withholding tax on certain types of U.S. sourced income, unless treaty benefits are claimed.

The payer is responsible for validating any treaty claim made prior to making a payment, so the appropriate amount of withholding can be performed. This information can be immensely difficult for companies to collect, validate, and manage, especially given the complexity of the various income tax treaties. As such, it’s recommended that businesses should seek an expert partner and innovative technology-based solution to build and maintain accurate systems for Form W-8 collection, and any downstream reporting.

Taxbit as the industry-leading solution

As the critical step in fulfilling information reporting, enterprises should carefully review and implement processes for documenting foreign payees via W-8 collection and validation.

Our Digital W9/W8 solution can seamlessly collect and validate Forms W-8BEN and W-8BEN-E for non-U.S. account holders through a user-friendly Web SDK. All of the collected data and the corresponding form is stored securely within the Taxbit Dashboard for easy retrieval or analysis.

We also have a team of Subject Matter Experts ready and able to discuss any potential needs regarding the collection and validation of treaty claims.

Experience effortless form collection and validation with Taxbit’s Digital W9/W8

.png)