Custodial Exchanges

Easily generate 1099s and other tax forms for exchanges dealing with high volume transactions.

Marketplaces

Streamline tax information reporting for high-volume, multi-vendor platforms with compliant tax solutions.

Payment Processors

Simplify tax reporting for payment processors with automated transaction tracking.

Fintech

Automate accurate tax reporting and reconciliation for fintech with Taxbit.

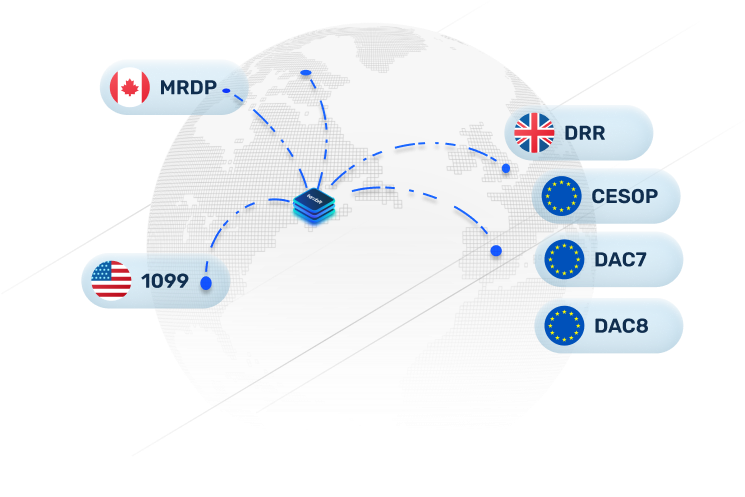

Scalable compliance, wherever business takes you

Taxbit supports global tax compliance across borders, jurisdictions and currencies, no matter where you operate.

CARF/DAC8

Taxbit gives you the tools to remain compliant with DAC8 and CARF, which require crypto-asset service providers to report information about transactions involving EU residents.

US Information Reporting

The US Treasury and IRS released finalized guidance for custodial digital asset brokers. Taxbit has the tools you need to be compliant with all US rules and regulations.

DAC7/MRDP

Effortlessly capture reporting data, automate data monitoring, and generate the necessary reports for MRDP and DAC7- compliance.

CESOP

Central Electronic System of Payment Information (CESOP) compliance that saves your business time, money, and errors using Taxbit’s CESOP Compliance Platform.

Expert-Built, Platform-Powered

Taxbit is built by tax experts who understand the complexities of global tax reporting.

Powered by advanced technology, it’s designed for the complexity of high-volume transactions across global tax regimes.

Expert-Built, Platform-Powered

Designed by CPAs and local tax experts for unparalleled accuracy at-scale.

End-to-End Automation

Seamlessly automate everything from onboarding to form generation.

API-First Design

Integrate with your existing systems quickly and efficiently.

Error-Free Reporting

Eliminate manual mistakes and ensure precise compliance across borders

How Taxbit Automates Your Tax Reporting

See how Taxbit streamlines the process from data ingestion to form generation, ensuring seamless compliance and accurate reporting for all your stakeholders.

Ingest Account Data from Various Sources

Seamlessly ingest account data from multiple sources, including self-certifications, W-9/W-8 forms, and general account information.

Taxbit consolidates your customer data into a single, unified system for efficient processing and compliance.

Automate Analysis, Calculations and Verifications

Automate the generation and verification of tax forms with precision. Taxbit handles complex calculations and ensures data accuracy at scale.

- US 1099s

- CESOP

- DAC7/MRDP

- DAC8/CARF

- Gain & Loss

Prep for Filing and Reporting

Effortlessly generate, file, and remediate tax reports across jurisdictions. Taxbit supports seamless submission while enabling compliance with global reporting standards, saving time and reducing manual effort.

Single Platform, Simple Integration

Effortlessly integrate with Taxbit’s API-first platform. With developer-friendly SDKs and real-time API responses, we ensure fast, accurate data reconciliation.

- API-First Architecture

- React-based SDKs for easy integration

- Real-time API responses to ensure accuracy

Precision Automation

Automate E2E information reporting, from onboarding to reporting through a single, platform. Taxbit integrates seamlessly into your existing systems, replacing manual work and error-prone process.

- End-to-End Automation

- Error-Free Reporting

- Expert-Built

Real-Time Analytics & Insights

Leverage real-time visibility and analytics to monitor user reporting status and transaction history, manage corrections and filings, and stay ahead of deadlines —from a single, centralized dashboard.

- Self-Service Dashboard

- Real-Time Analytics

- Centralized Control

“Working with Taxbit has been critical to PayPal’s success. Taxbit allows us to further build customer trust on multiple levels by providing ease and reliability in the new realm of digital asset trading, and education and documentation to support their tax obligations. With these contributions, Taxbit is helping PayPal to stay several steps ahead in the rapidly changing global cryptocurrency market.”

Edwin Aoki

Chief Technology Officer of Blockchain, Crypto, and Digital Currencies, PayPal

.png)