What makes TaxBit Accounting Suite different?

Flexible Syncing Options

Want to bulk sync all your transactions in one go? Prefer to flatten them into one journal? Require an automated monthly sync? Choose what works for your business.

Don’t worry about importing or exporting a csv.

Supercharge your QuickBooks reconciliation by connecting it with existing TaxBit Accounting Suite Rules. Set it and forget it.

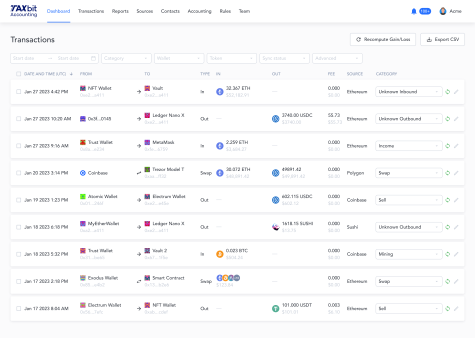

Account for everything

Can’t keep track of your fees for high volume transactions? Gain & Loss not being calculated appropriately across complex smart contract transactions?

Automated transaction reconciliation alongside our accounting system integration offers a quick way to accurately manage crypto transactions

Leave the heavy lifting to us so you can focus on the accounting.