How Taxbit helps FinTech

Taxbit is the leading choice for tax and accounting.

Information Reporting Features

Discover how Taxbit’s robust features streamline tax reporting for FinTech

Save time and money with turnkey digital Form W-9, W-8BEN, and W-8BEN-E collection, verification, remediation, and storage.

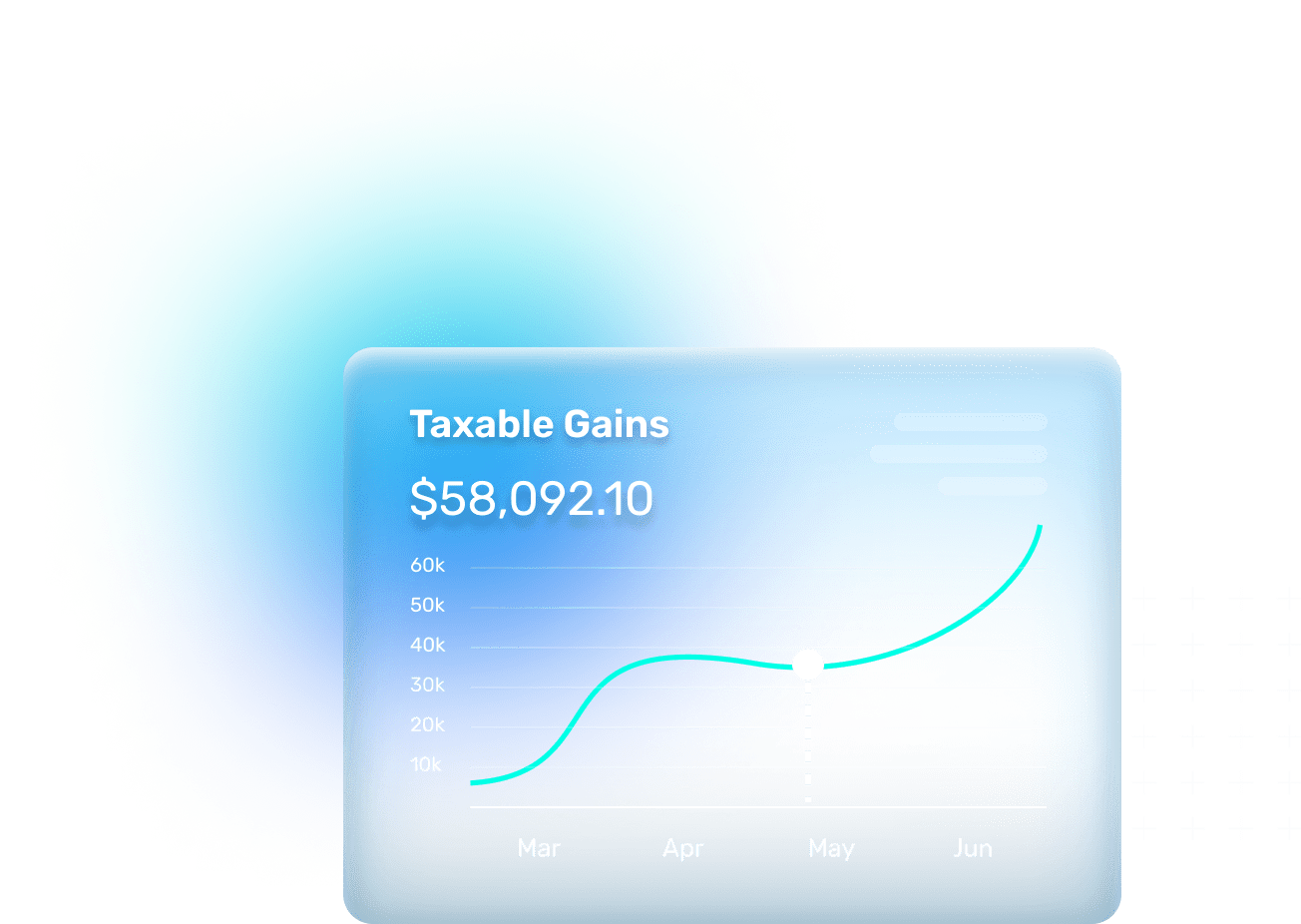

Calculate, adjust, and track accurate digital asset cost basis to power lot-level gain/loss, recording in ledger, and secure and seamless use in upstream information reporting.

A single platform to automate the collection, calculation, generation, delivery, and hosting all of your IRS-required information returns.

Give your customers real-time insights and access to tax forms by using our tax center APIs to embed information reporting into your application or customer experience.

Financial Reporting Features

Unlock powerful accounting capabilities for FinTech with Taxbit

Save time and gain confidence in your transaction data using Taxbit’s customizable rules engine to assign categories and memos. Everything automatically syncs to your ERP.

Automate tax and accounting treatments for internal transfers between multiple legal entities. Maintain differentiated books for accounting and corporate tax purposes.

PMA gives you the tools to guide price selections from particular exchanges when determining crypto fair value measurements: select the time frame, assets, exchanges, and types of trading activities that are relevant to you.

Map digital asset activity to the Chart of Accounts in your ERP system for traceability and auditability. Flexible configurations allow you to choose the accounting method (e.g. FIFO, HIFO, Weighted Average, etc.), sync cadence, and create dedicated accounts by asset type.

Stay audit-ready, with a platform that is independently SOC 1 Type 2, SOC 2 Type 2, and ISO 27001 certified.

Extensive Integrations for Effortless Accounting

Taxbit connects with a wide range of platforms to seamlessly integrate digital asset data into your accounting systems, ensuring smooth and accurate financial operations.

Latest Insights and Updates

Stay informed with our most recent blog posts on digital asset tax, accounting, compliance, and industry trends.