A Complete Suite for Digital Asset Analysis, Investigation, Reporting and Tracking

From individual investigations to large, multi-person data sets requiring complex analysis and asset management, Taxbit’s suite of public sector tools are designed to support agencies across digital asset compliance and enforcement needs.

Tailored Solutions Across the Spectrum

From tax administrations, to financial crime authorities, police and law enforcement, Taxbit’s specialized tools support each agency’s unique mission—whether assessing compliance, investigating financial crimes, or managing seized crypto assets.

Tax Administrations

Use Cases: Seamless information ingestion and transfer matching across disparate on- and off-chain sources; targeted bulk data analysis and risk assessment; data and schema preparation for (international) information exchange, non-compliance detection; truly holistic civil and criminal tax examinations.

Relevant Products: DARTS, Bulk Data Analysis, UCAP/DACP.

Financial Crime Authorities

Use Cases: Identifying non-compliance with financial regulations. Combining blockchain transaction data with off-chain information from sources like banks, crypto exchanges, and individuals. Automating data analysis to create actionable financial intelligence reports. Generating exportable reports designed to support legal cases and be admissible in court.

Relevant Products: DARTS, Bulk Data Analysis.

Law Enforcement and Police

Use Cases: On- and off-chain data linking to uncover unmatched transactions and investigate significant activities. Preparing clear, court-ready documentation. Adopting a “follow-the-money” approach to trace financial flows and build stronger cases. Managing crypto assets for operations, seizures, or liquidation.

Relevant Products: DARTS, Government Accounting, Bulk Data Analysis.

Key Use Cases

Non-Compliance Detection via Bulk Data Requests

Streamline data ingestion, analysis, and risk-assessment to focus on highest-risk cases

Non-Compliance Detection via Information Returns

Standardize data ingestion for reportable entities and easily assess data for non-compliance

On- and Off-Chain Data Aggregation for Investigations

Develop comprehensive and actionable insights at the intersection of on- and off-chain data

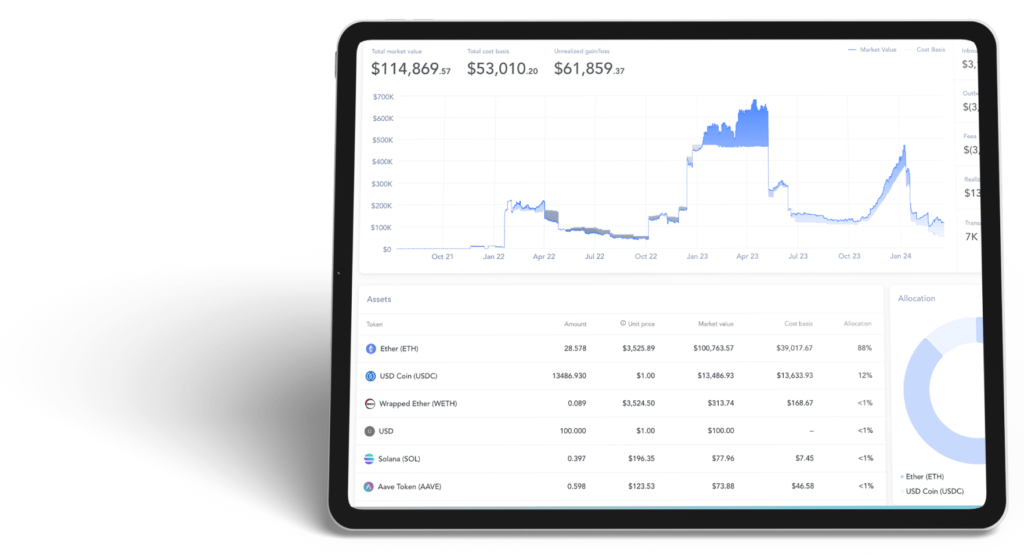

Asset Seizure and Tracking for Investigations

Manage crypto in a simple, transparent, secure manner with audit-proof documentation

Latest Insights and Updates

Stay informed with our most recent blog posts on crypto tax, accounting, compliance, and industry trends.