Unify Your Blockchain Transactions and Financial Records

Taxbit’s accounting solution seamlessly integrates digital asset transactions with your existing accounting systems. Our suite transforms complex blockchain data into organized, actionable insights, ensuring accurate financial reporting and smooth ERP integration.

Digital Asset Brokers

Transform complex Web3 transactions into organized financial records, effortlessly syncing with your accounting systems for accurate brokerage reporting.

Bitcoin Miners

Track and manage Bitcoin mining operations efficiently, automating revenue recognition, cost calculations and integrating financial data with your accounting systems.

Corporate Adopters

Simplify digital asset accounting for non-crypto native companies, ensuring accurate financial reporting and automated reconciliation.

Blockchain Protocols

Simplify financial reporting with automated tracking of on-chain transactions and validator rewards, and ensure accurate revenue recognition.

Solving Real Accounting Challenges for Digital Assets

As the digital asset space matures, companies face increasingly complex accounting challenges. Our suite solves these critical issues, providing tools to ensure accuracy, efficiency, and compliance at every stage of the financial process.

Scalable compliance, wherever business takes you

Taxbit supports global digital asset accounting across borders, jurisdictions and currencies, no matter where you operate.

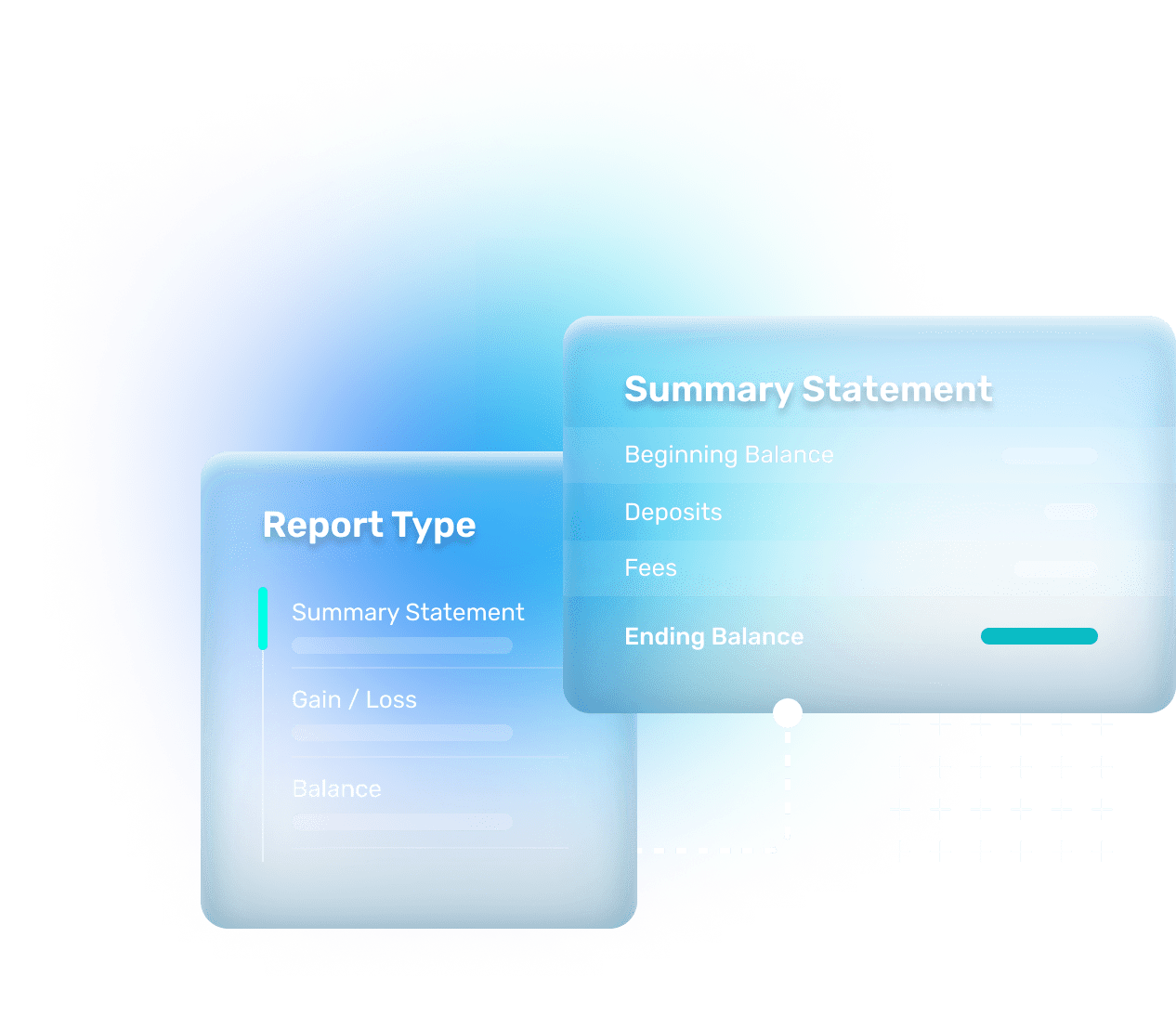

How Taxbit Simplifies Your Accounting Reporting

Explore how Taxbit seamlessly integrates data, categorizes transactions, and generates reports, ensuring your accounting processes are streamlined and audit-ready.

Explore Our Financial Reporting Features

Unlock powerful accounting capabilities with Taxbit.

Save time and gain confidence in your transaction data using TaxBit’s customizable rules engine to assign categories and memos. Everything automatically syncs to your ERP.

Automate tax and accounting treatments for internal transfers between multiple legal entities. Maintain differentiated books for accounting and corporate tax purposes.

PMA gives you the tools to guide price selections from particular exchanges when determining crypto fair value measurements: select the time frame, assets, exchanges, and types of trading activities that are relevant to you.

Map digital asset activity to the Chart of Accounts in your ERP system for traceability and auditability. Flexible configurations allow you to choose the accounting method (e.g. FIFO, HIFO, Weighted Average, etc.), sync cadence, and create dedicated accounts by asset type.

Stay audit-ready, with a platform that is independently SOC 1 Type 2, SOC 2 Type 2, and ISO 27001 certified.

The Leader in Digital Asset Accounting

| Taxbit | Bitwave |

| Taxbit | Cryptio |

| Taxbit | Tres Finance |

Extensive Integrations for Effortless Accounting

Taxbit connects with a wide range of platforms to seamlessly integrate digital asset data into your accounting systems, ensuring smooth and accurate financial operations.

Save Time

Automate processes, calculations, and reporting to save valuable time. Taxbit’s efficient system handles repetitive tasks, allowing you to focus on strategic activities rather than manual work and reconciliations.

Trust Your Data

Incoming data feeds are cross-referenced for accuracy and reconciliation views make it easy to spot data gaps. Our accounting suite automatically integrates all your data and matches your records.

Audit-Ready

Taxbit ensures you are always prepared for audits with comprehensive report generation capabilities. Our suite is independently certified with SOC 1 Type 2, SOC 2 Type 2, and ISO 27001, guaranteeing the highest standards of security and accuracy in your financial reporting.

Accounting solutions for your whole team

CFO

Get a high-level view of your accounting with consolidated dashboards and roll-forward reports across multi-entity, multi-currency operations.

Controller

Automate transaction ingestion, chart of account mapping, and journal entry creation to save time and streamline period-end close processes.

Financial Analyst

Analyze stablecoin activity, cross-chain fees, and payments while running reports to uncover business trends and opportunities.

Treasurer

Manage cash flow across your digital asset portfolio and simplify cross-border fund movements with real-time visibility.

Auditor

Streamline audits by granting access to audit-ready reports, ensuring transparency and efficiency during review processes.

Latest Accounting Insights and Updates

Stay informed with our most recent blog posts on crypto accounting, compliance, and industry trends.