Crypto enterprises can improve user experience and prepare for upcoming regulations with Taxbit’s pioneering solution for sharing cost basis information

Taxbit recently launched Cost Basis Interchange – enabling digital asset brokers to share cost basis information, improve user experience, and meet upcoming regulations. Cost basis is the original purchase price of an asset, and it is fundamental to accurately reporting taxes.

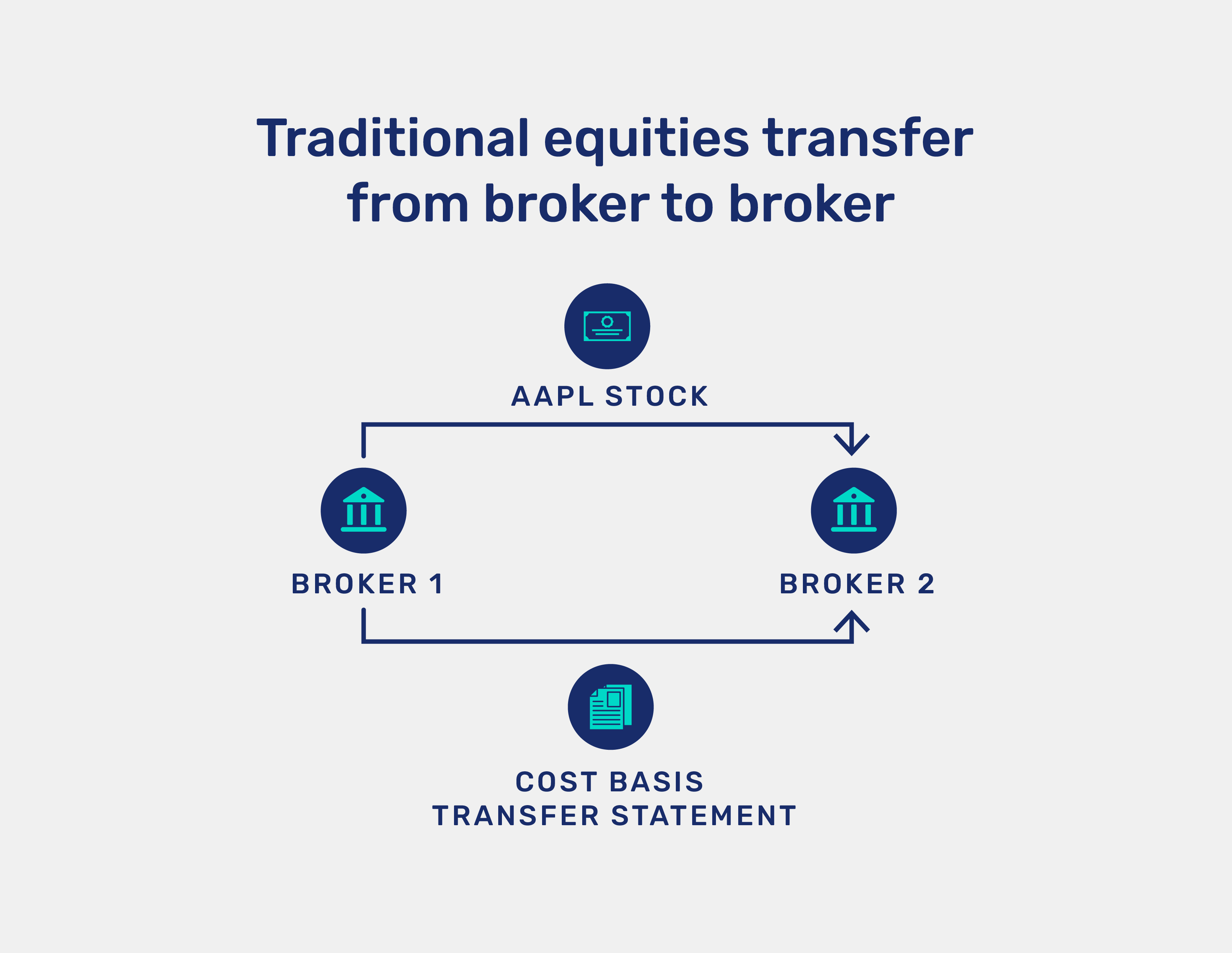

In traditional finance, cost basis sharing is largely a solved problem as traditional brokers have codified requirements within the Internal Revenue Code under Section 6045A as well as market solutions that facilitate cost basis information sharing.

As the Financial Industry Regulatory Authority (FINRA) explains:

“You—the taxpayer—are responsible for reporting your cost basis information accurately to the IRS. You do this in most cases by filling out Form 8949 [a.k.a. Sales and other Dispositions of Capital Assets]… You’re not totally on your own when it comes to computing cost basis. In 2008, Congress passed a law that requires brokerage firms, mutual funds and others to give you a hand.”

In the cryptocurrency sector, however, no solution has existed for sharing cost basis information among enterprises – until now. Taxbit, the industry leader in tax and accounting solutions for digital assets, launched Cost Basis Interchange, a pioneering solution for cost basis sharing, transfer statements, and future IRS filings.

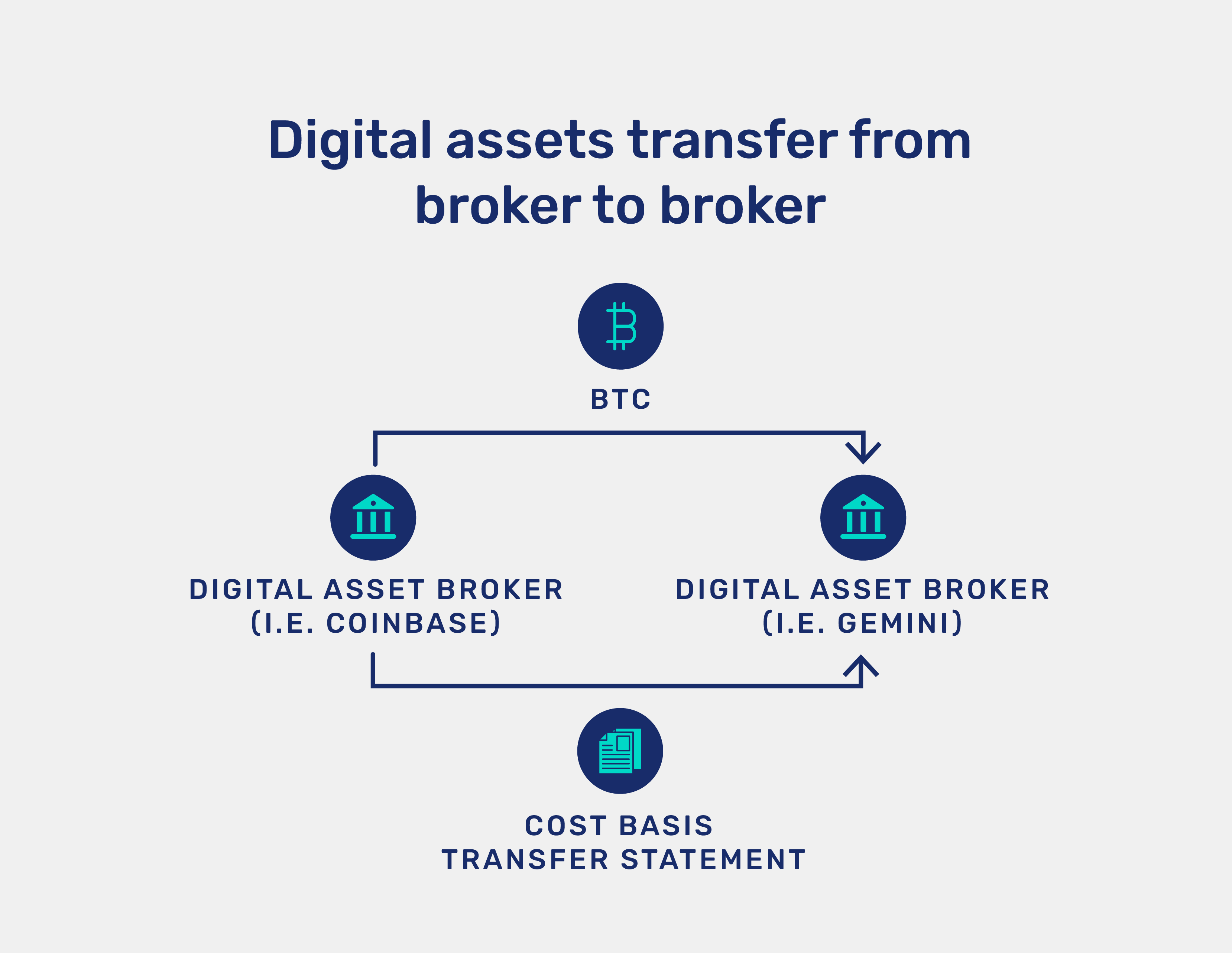

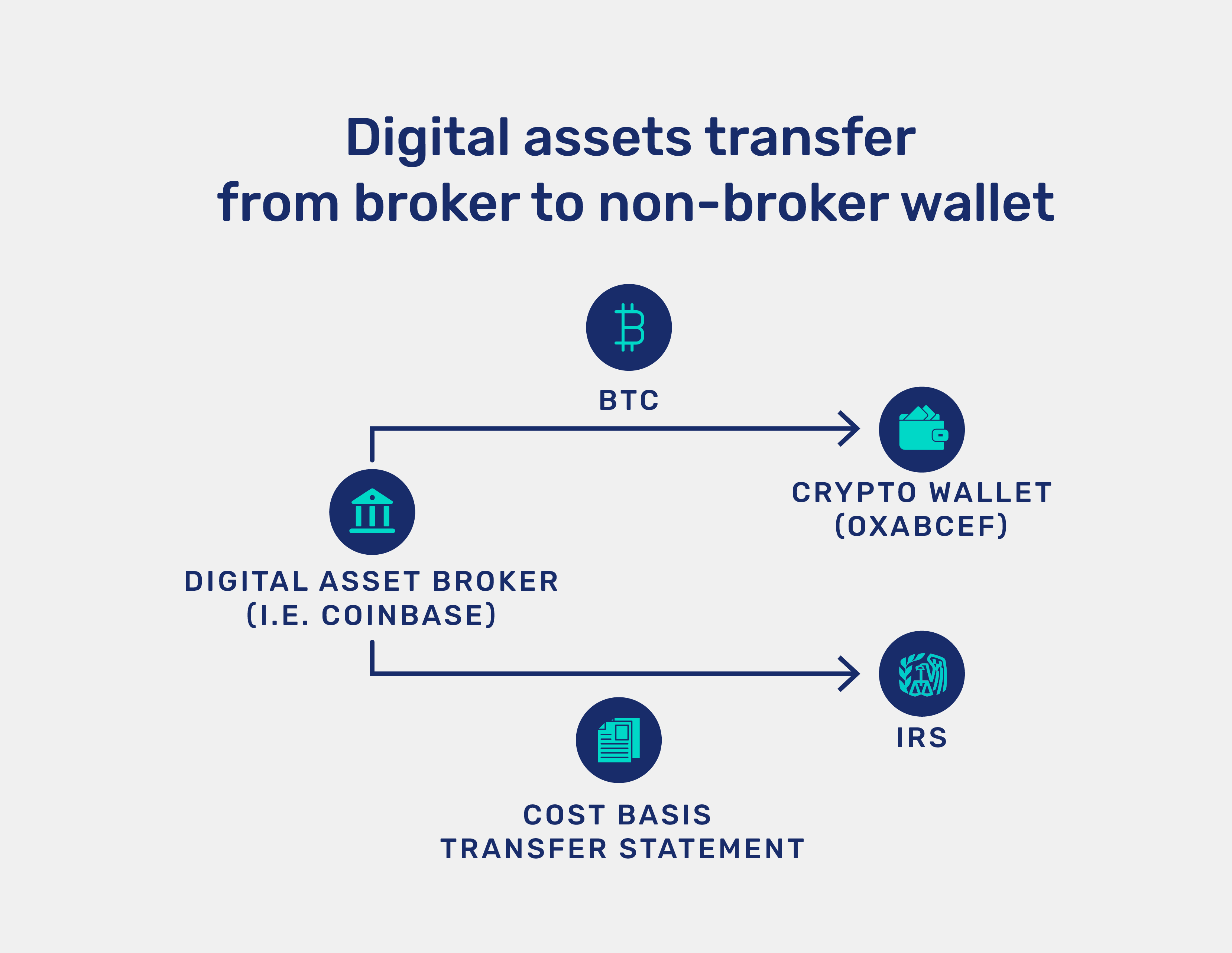

Imminent legislation outlined in the Infrastructure Investment and Jobs Act (IIJA) will soon require digital asset brokers to report cost basis similar to how traditional brokers already do, but with much greater complexity. Under the IIJA, digital asset brokers will be required to exchange cost basis information on a broker-to-broker level and require an entirely new transfer of cost basis to the IRS in the broker to non-broker context (i.e. any off-platform wallet address).

Compared to traditional equities, cost basis information tracking for digital assets requires an innovative solution.

Cost basis: traditional equities versus digital assets

Take AAPL stock for example. Every time you send AAPL from one broker to another, the originating broker is required by law to share a Transfer Statement that records the original cost basis with the other broker. (Equity Transfer Statement sharing is primarily facilitated by an intermediary called the Depository Trust and Clearing Corporation (DTCC)).

Compared to digital assets, the movement of traditional equities is relatively limited. The cutting-edge technology of cryptocurrency enables holding, sending, or receiving value without requiring a third party, custodian, or broker in the middle.

In other words, BTC can be easily and near-instantly sent from broker-to-broker, or to a non-broker wallet address that is outside the control of any institution. As another advantage over traditional equities, digital assets are natively fractionalizable (which further compounds the challenge of accounting cost basis for digital assets).

To meet upcoming legislative requirements under the IIJA, digital asset brokers must capture and track cost basis at the transaction level, and will then need to share that cost basis via a Transfer Statement with other digital asset brokers.

Digital asset brokers must also ensure that they can identify a transfer to a non-broker, and ultimately file that information with the IRS. The format and timing of that IRS filing is something that will be clarified with the anticipated U.S. Treasury regulations.

In the world of digital assets, transfers happen in much greater relative frequency versus traditional equity markets (which don’t operate 24/7) and therefore require a powerful tracking solution. Whether from broker-to-broker or broker to non-broker, Taxbit’s CBI can automatically record and share cost basis information with key parties.

Benefits of cost basis sharing

Missing cost basis is a customer support issue that dominates the nascent crypto industry. The historic challenge of tracking cost basis has also been a significant factor driving the estimated $50 billion crypto tax gap between what is owed and what is reported to the IRS. Taxbit’s Cost Basis Interchange enables digital asset brokers to track cost basis similar to how traditional equity brokers do today.

Filling in the blanks for “missing cost basis” will significantly improve user experience when making transfers, filing taxes, and understanding portfolio performance for digital assets. With Taxbit’s new solution, digital asset brokers can ensure a better user experience, reduce customer support costs, and comply with upcoming regulations regarding cost basis sharing.

Taxbit’s Cost Basis Interchange (CBI) is an accurate solution to eliminate missing cost basis data gaps for all transfers within a single, industry-standard data model and API. CBI enables cost basis sharing for digital assets between brokers in near real-time, in addition to Transfer Statement generation and IRS form-filing for all broker to non-broker wallet address transfers.

This novel solution makes it exceptionally easy for exchanges to classify broker and non-broker wallet addresses in order to stay aligned with ever-evolving regulatory requirements. In advance of the announcement, Taxbit’s CEO Austin Woodward noted:

“With the launch of CBI, digital asset brokers now have a forward-looking solution to address not only compliance needs but also one of the industry’s largest user experience challenges – missing cost basis. CBI is one seamless API that makes cost basis interoperable.”

Learn more about Cost Basis Interchange and its key features:

- The safest, most accurate, and scalable solution on the market

- All customer PII and transfer data hosted in Taxbit’s secure servers

- Supports unlimited transactions

.png)