FASB releases an Exposure Draft for tailored digital asset accounting guidance, establishing Fair Value reporting and promoting greater financial transparency

On March 23, 2023, the Financial Accounting Standards Board (FASB) released an exposure draft as part of its ongoing project to establish tailored accounting guidance for cryptocurrency assets (you can view the exposure draft here). This project, initiated in May 2022, aims to provide clearer accounting standards for the rapidly evolving digital asset landscape.

Key points from the Exposure Draft include:

- Cryptocurrency assets will be reported at Fair Value – ending frustrating impairment charges – with certain exceptions. Non-fungible tokens (NFTs), issuer tokens, and wrapped tokens are not within the scope of this project and will continue to require impairment calculations.

- Disclosure requirements for cryptocurrency activities will be updated to enhance transparency in financial reporting.

- The proposed accounting guidance applies to both public and private companies, who will likely be able to adopt the new standards as soon as they are finalized.

These proposed changes signify a substantial improvement in accounting guidance for crypto assets, ensuring that financial reporting outcomes are better aligned with the economic realities of digital assets while simultaneously promoting greater financial visibility.

How will the guidance affect corporate digital asset adoption?

Previously, volatile crypto assets have weighed down on earnings reports for corporates such as Microstrategy, Tesla, and Block (formerly Square) that have needed to incur impairment charges against their crypto holdings whenever prices dipped below their initial cost basis. Under the new proposed guidance, companies will include both unrealized gains and losses on their income statement, rather than one-sided impairment charges.

Further, this update aims to improve gaps where current accounting guidance falls short in promoting transparency for companies that hold crypto on their balance sheets. For example, when Tesla revealed it had sold 75% of its Bitcoin holdings last summer, it left a mystery in its wake. New FASB guidance will promote greater transparency of crypto activity by requiring companies to provide additional disclosures.

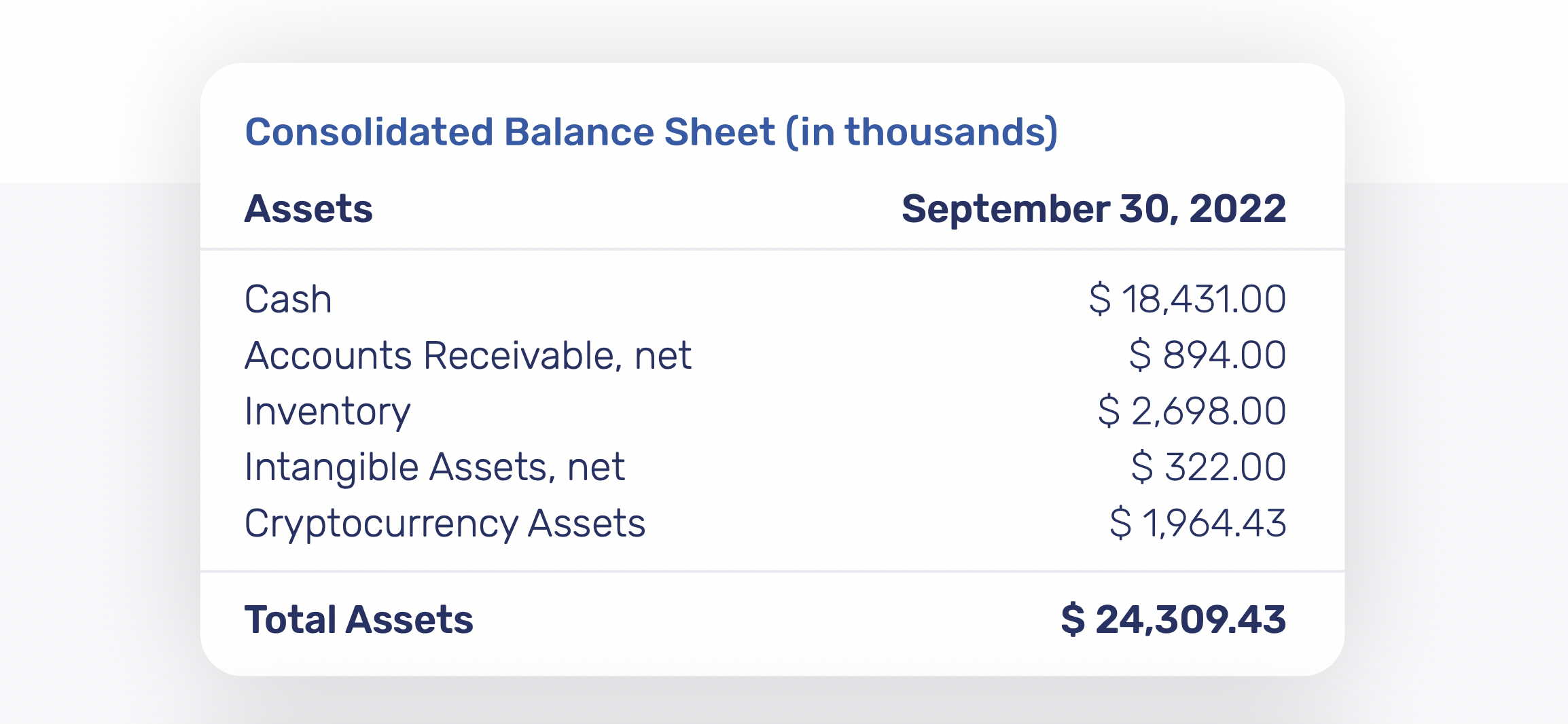

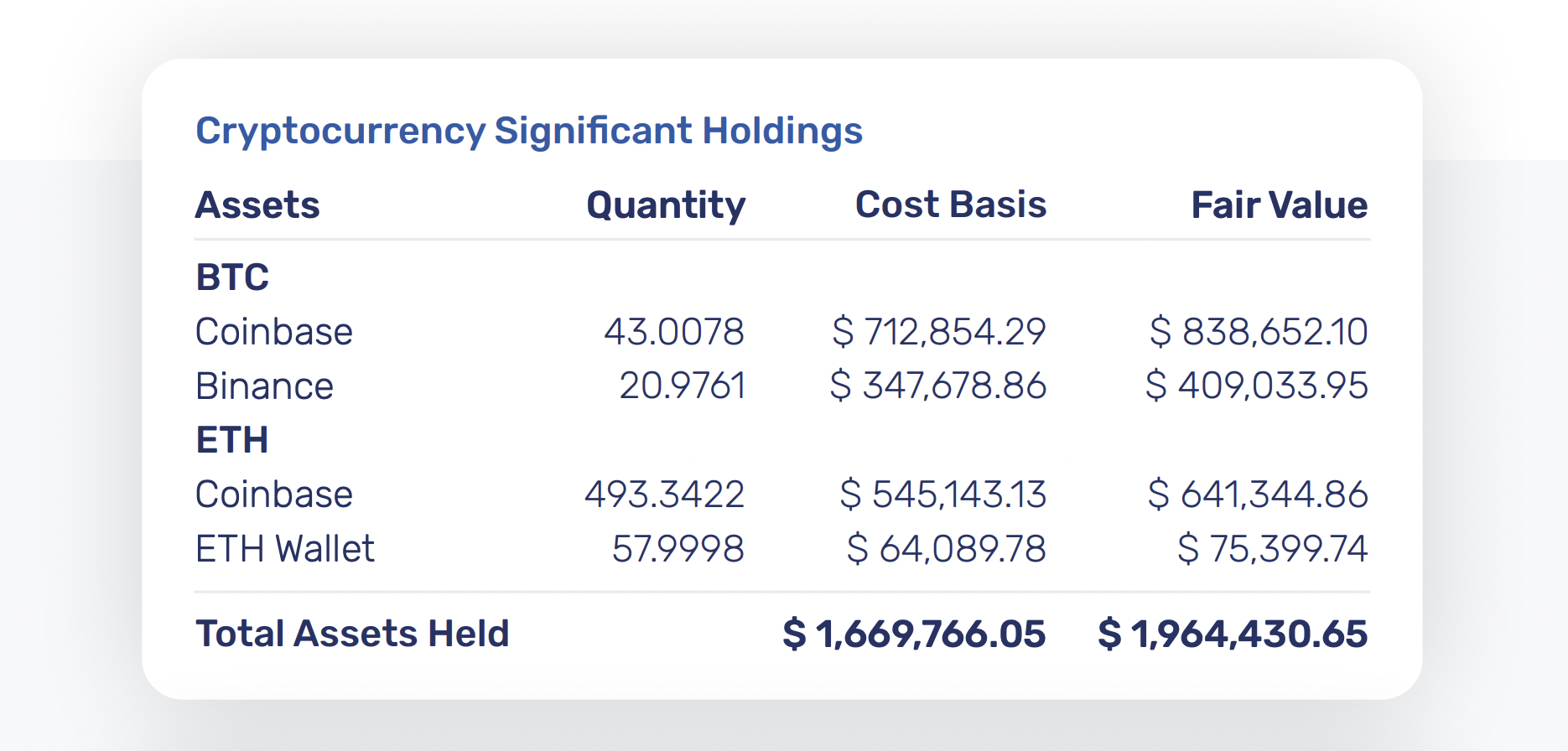

Along with distinct presentation on the face of both the balance sheet and income statement, companies will be required to disclose significant holdings on an asset-by-asset basis – including the assets held, the number of assets held, and the cost basis and fair value of those assets. Here is an example of a corporate balance sheet and crypto holdings statement under the new proposed requirements:

What are the immediate next steps?

Before the proposed guidance can become official authoritative accounting guidance under US GAAP, several crucial steps must take place:

- The exposure draft will be open for public comment for 75 days. Stakeholders interested in sharing their opinions are encouraged to submit a comment letter to the FASB. These letters will be made publicly available.

- The FASB will review the comments received, hold a public meeting to discuss the feedback and take action accordingly.

- A final vote on the comprehensive body of work for this project will be held, followed by the issuance of an updated Accounting Standards Update (ASU).

Although the FASB has stated that it expects the proposed guidance to be finalized within the calendar year, companies – and especially publicly traded ones – should continue to follow existing guidance until the proposed changes are officially enacted. In the meantime, companies are advised to prepare for these forthcoming changes and engage in discussions with internal and external stakeholders to ensure a comprehensive understanding of the implications and the adoption process.

At Taxbit, we encourage companies to reach out and discuss the potential impact of these changes on their operations – and explore how Taxbit’s solutions can help streamline your digital asset accounting.

The future of crypto accounting

We are building industry-leading solutions for digital asset accounting. Taxbit’s technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Support for GAAP-compliant journal entry and asset tracking

- Audit support that is built with auditors in mind

- Granular transaction and accounting detail transparency

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2 audits

- Industry thought leaders with technical accounting expertise; former FASB/AICPA/Big4 employees working with national offices as your partners

Learn more in our Guide to Digital Asset Accounting

.png)