New guidance from the Financial Accounting Standards Board will promote much-needed transparency for companies dealing in digital assets

Key takeaways:

- The Financial Accounting Standards Board (FASB), which sets authoritative accounting guidance under US GAAP, recently voted on a series of provisions to increase transparency for digital asset activity

- After determining that digital assets should be accounted for at fair value (paving the way to end frustrating impairment charges) in October, the FASB has now voted to require certain disclosures related to cryptocurrency activity, along with distinct presentation on the face of both the balance sheet and income statement

- Companies will be required to disclose significant holdings on an asset-by-asset basis – including the assets held, the quantity of assets held, and the cost basis and fair value of those assets

- While the recent vote is not yet authoritative, in the coming months the FASB will scope further guidance specific to wrapped tokens and token issuer accounting – in addition to transition guidance determining exactly how and when the new rules should be applied

On December 14th, the FASB held a public meeting to vote on issues regarding the presentation of digital assets by public and private companies following US GAAP. The meeting further clarified their October decision to treat crypto holdings at fair value (meaning that assets will be presented according to current market value, and any changes in value will flow through earnings). Currently, digital assets on balance sheets are accounted for at their lowest valuation since the initial point of purchase – requiring impairment analysis to be performed on a regular basis.

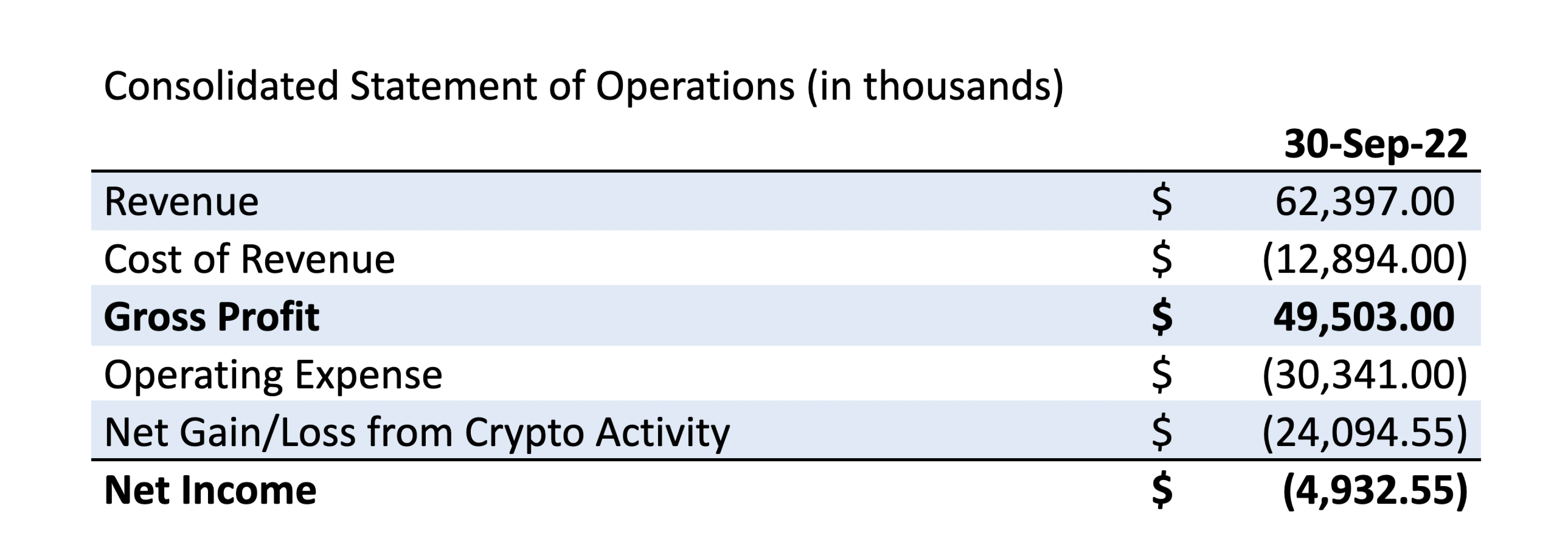

As a result of the new vote, companies should present crypto holdings separate from other intangible assets (such as patents or trademarks, or other non-physical assets) on the face of key financial statements. Balance sheets will have a separate line item specifically dedicated to crypto holdings and, as previously determined, those holdings will be reflected at their fair value at the end of the reporting period. Any changes in fair value on income statements will be reflected as a component of net income and broken out as a separate line item.

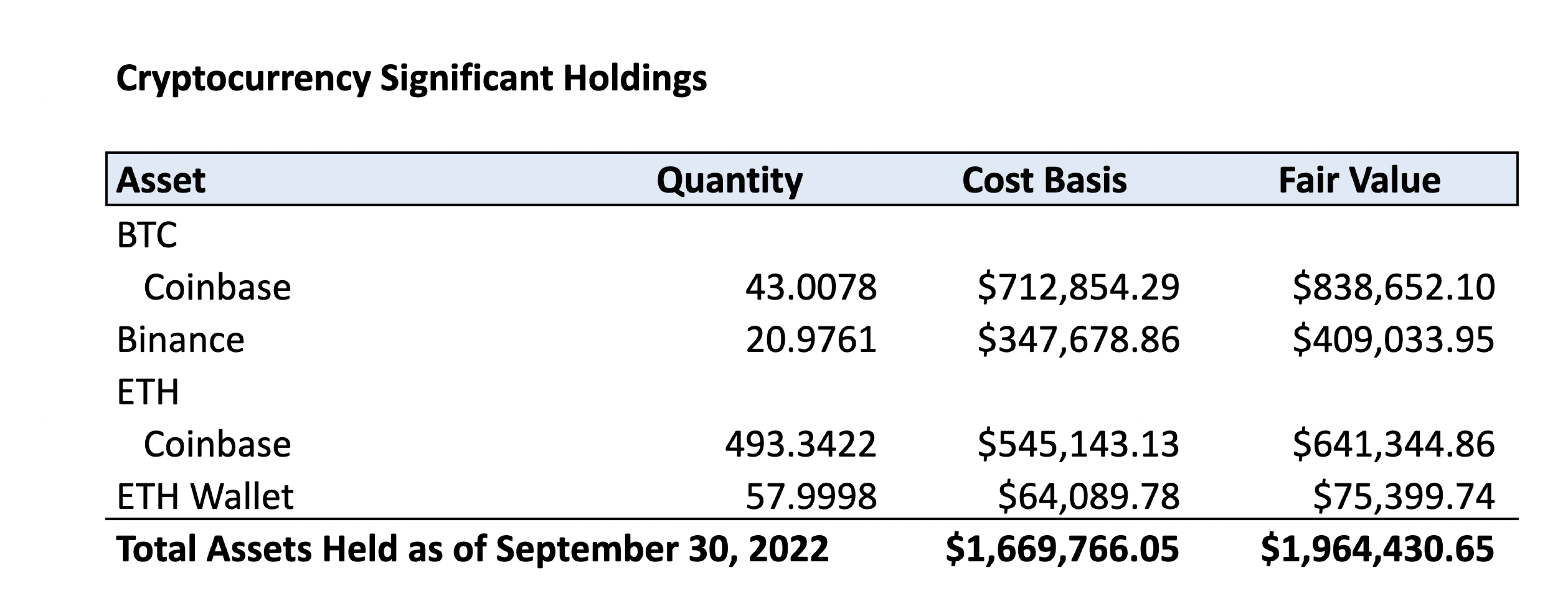

These presentation decisions will significantly increase financial transparency about the holdings and earnings impact of specific crypto assets – tracking the assets held, the quantity of assets held, and the cost basis and fair value of those assets at the time of the reporting. The FASB’s series of new decisions herald a significant positive change for companies interested in digital assets and for investors seeking greater transparency.

Here is an example of a company’s balance sheet and income statement under the future rules:

In addition to the critical decisions regarding digital asset accounting on balance sheets and income statements, the FASB also made a series of other decisions. Specifically, the FASB clarified how certain cryptocurrency activities should be classified within the statement of cash flows. For example, most cryptocurrency activity would normally be classified under the investing section of the statement of cash flows.

That classification may not be appropriate for companies that receive crypto as revenue and immediately convert those assets to cash – this is especially true for mining companies that immediately sell their mining proceeds. In that case, under the current interpretation, a company would be generating income without classifying the cash generated as part of its operating cash flows.

The FASB clarified that in those cases, it would be more appropriate to classify those cash flows related to asset dispositions as part of the operating section of the statement of cash flows.

Disclosure of crypto assets and activities

The FASB has determined that companies will be required to disclose a series of specific items regarding their crypto holdings and activity:

- Significant holdings: A company would provide a listing of the specific assets they hold (with a focus on those assets that are deemed to be significant, or material) and would disclose the asset name, the quantity held, along with the cost basis and fair value of holdings

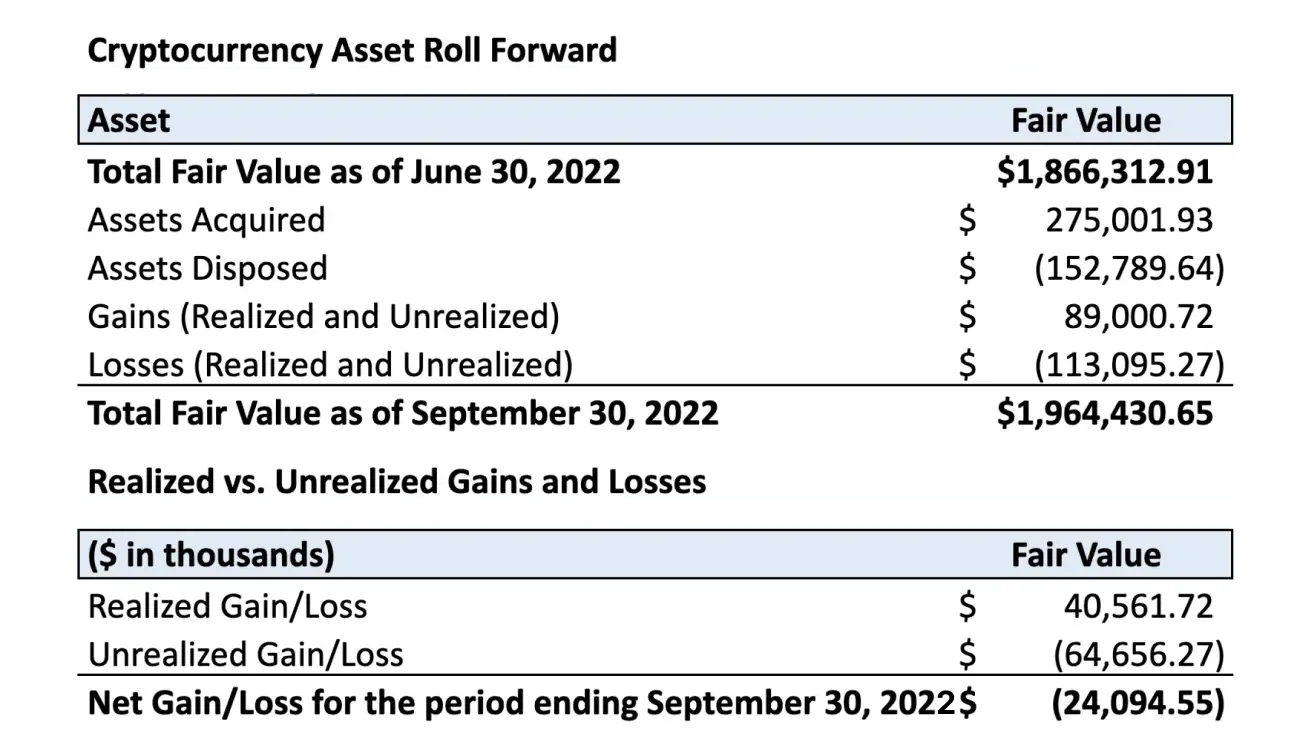

- A reconciliation or roll-forward of crypto assets for the respective period: This would include beginning balances, along with additions, dispositions, gains/losses (whether realized or unrealized), etc. that have occurred during the period to arrive at the ending balance at the end of the period. The Board may also require that companies provide supplemental information stating the cumulative gains/losses of a company’s current holdings

- The fair value of restricted assets and the nature of those restrictions: A company may have tokens that are locked up and otherwise inaccessible to them. In that case, the company would need to disclose this in the disclosures so users of financial statements are able to gain an understanding of which assets are liquid

- Follow the existing disclosure requirements outlined in ASC 820 for fair value measurements more broadly: This would specifically include classification levels within the fair value hierarchy and disclosures of related party transactions

Here are a series of example disclosures based on the FASB’s preliminary decisions:

In addition to these new major disclosures, companies would need to follow existing disclosure requirements outlined in ASC 820, including classifying assets as Level 1, 2, or 3. The Board determined that these will largely be required on a quarterly basis and that these disclosure requirements are applicable to both public and private companies.

Next steps and upcoming formal guidance

While the recent votes are not yet authoritative, in the coming months the FASB will discuss additional provisions related to wrapped tokens and token issuer accounting. In the wake of FTX’s collapse and with regard to accounting for tokens created by a company, this question is more relevant than ever. They will also address transition guidance outlining exactly how and when the new accounting rules should be applied.

Regulatory transparency and better accounting standards can help restore the future of digital assets. Recent and future developments from the FASB will mark critical milestones toward this end. Companies should be preparing for this pending change now to be ready when the official rules are set – likely within the next six months.

The future of crypto accounting

At Taxbit, we are building pioneering solutions for digital asset accounting. Our technology is trusted by some of the world’s largest regulatory agencies, accounting firms, and crypto enterprises as we enable the following:

- Scalability to handle tens of millions of transactions

- A controlled environment to support robust control frameworks such as ISO 27001 or SOC 1 & 2 audits

- Support for GAAP-compliant journal entry and asset tracking

- Audit support that is built with your auditors in mind

- Transparency into transaction and accounting details

- Industry thought leaders with technical accounting expertise; former FASB/AICPA/Big4 employees working with national offices as your partners

.png)