Highlighting a key change to the U.S. Individual Income Tax Return and what it means for enterprises and individuals

TLDR: The IRS 1040 Form for this year clarifies and provides education on how to report taxes for “digital assets” (which has now replaced the previous term “virtual currency”). The new term unifies with language used by Congress in the Infrastructure Investment and Jobs Act (IIJA), and is a likely sign that Treasury will soon release regulatory guidance for how the law should be specifically applied.

In 2022, an NBC News poll indicated that one in five American adults have traded or used cryptocurrency. At the same time, analysis from multinational bank Barclays has estimated that the IRS may miss out on nearly $50 billion worth of unreported crypto taxes. This immense tax discrepancy is top of mind for regulators. Over $45 billion in recent IRS enforcement funding mentions “digital asset monitoring and compliance activities” as one of its focuses.

What are the likely factors behind the crypto tax gap? To be fair, most Americans who’ve traded crypto have likely attempted to report their taxes in good faith – but it has historically been quite difficult. Instead of generating tax forms as traditional brokers do, many crypto exchanges only provide raw transaction data to their users. It is then the individuals’ burden to make sense of this data (while often combining hundreds or thousands of transactions across multiple exchanges, wallets, and protocols), and pay for third-party crypto tax software that can have radically different and potentially inaccurate results.

Regulatory clarity and education are other major factors that have deterred complete crypto tax reporting. Fortunately for the individual taxpayer, however, new legislation outlined in the Infrastructure Investment and Jobs Act (IIJA) will require exchanges (and potentially DeFi protocols and NFT marketplaces as well) to issue tax forms to individuals in the next year or so – making it much easier for individuals to accurately file. Notwithstanding the legal imperative, it is in the best interest of crypto enterprises and protocols to provide tax information reporting for their users today.

Regardless of the Infrastructure Investment and Jobs Act (IIJA)’s eventual deadline, IRS crypto scrutiny is fast-increasing.

“Digital assets” in the spotlight

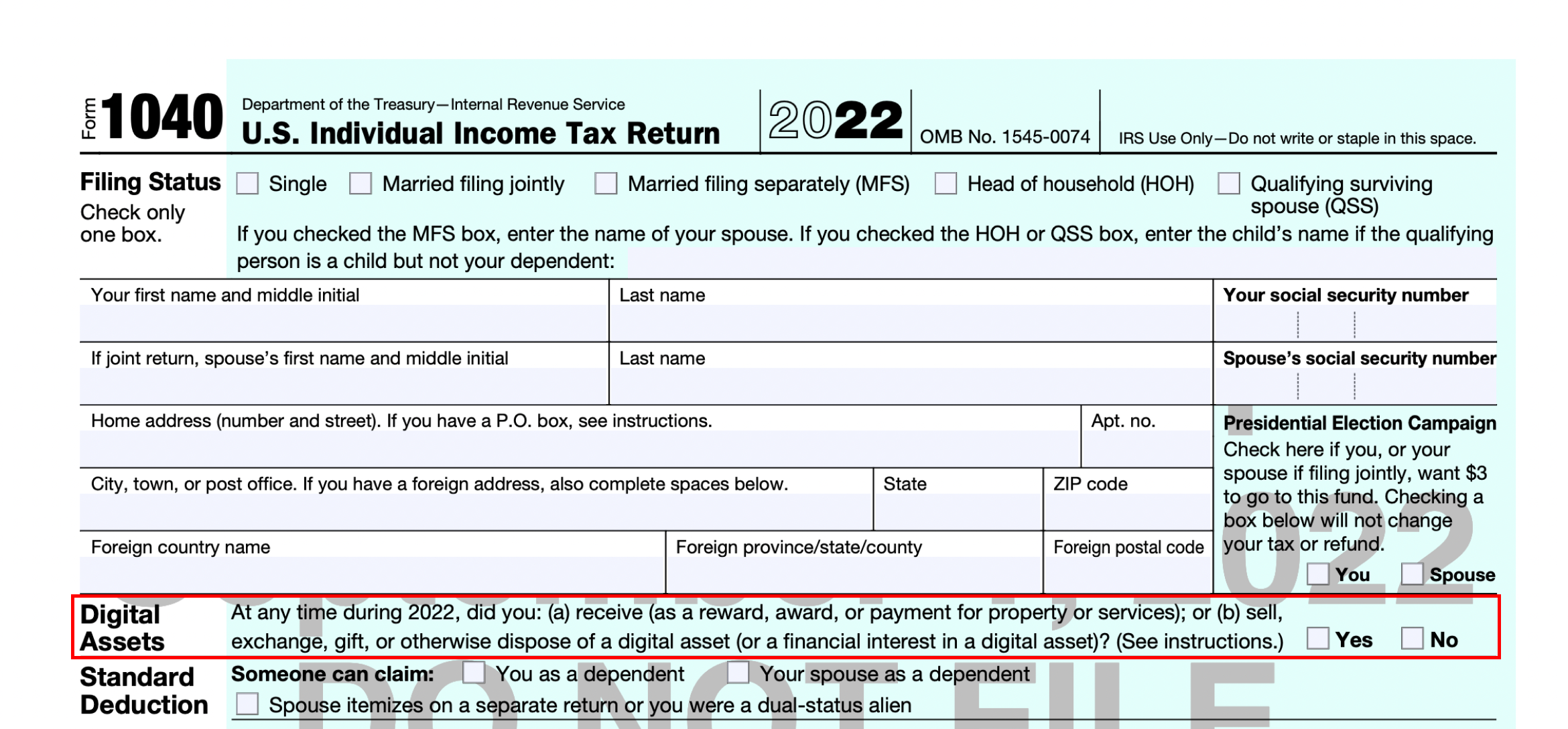

New language in the Individual Income Tax Return (IRS Form 1040) for 2022 now spotlights “digital assets” front and center:

As it prepares to implement the reporting requirements created in the IIJA, the IRS has revised the first question that hundreds of millions of Americans will see when they file their income taxes to read, “At any time during 2022 did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

Previously, beginning in 2019, the IRS 1040 Form used the term “virtual currency,” but this term was confusing. The American Institute of Certified Public Accountants, for example, noted last August:

“…in order to provide greater certainty to taxpayers and their preparers in confidently and properly complying with the question and overall reporting requirements for virtual currency… The AICPA recommends that the Department of the Treasury and the Internal Revenue Service clarify the virtual currency question on the first page of the Form 1040 and its instructions.”

Digital assets, the new term officially used by the IRS is a step toward providing clarity for the millions of Americans who have used different types of crypto but are unsure of how to report. This is also a likely sign that the Treasury will release anticipated regulatory guidance on how the new reporting laws will be specifically applied (and what types of crypto enterprises will be required to conduct tax information reporting).

Our Head of Government Solutions, Miles Fuller, recently explained to Bloomberg:

“The change in terminology is a good sign the agency is preparing more guidance… The IRS is ramping up by coalescing their terminology around this digital asset term…”

Regulatory clarity and education on “digital assets”

The new IRS 1040 Form Instructions also provide meaningful education for individuals on what exactly is covered by the new term, which notably aligns with and provides clarity on the language used in the landmark Infrastructure Investment and Jobs Act (IIJA). The 1040 Form Instructions note:

“Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology. For example, digital assets include non-fungible tokens (NFTs) and virtual currencies, such as cryptocurrencies and stablecoins. If a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income tax purposes.”

Importantly, the new language carves out cryptocurrencies (such as BTC and ETH), stablecoins, and NFTs as being covered by the term. Since non-fungible tokens may not technically fit the definition of “virtual currency,” this is an important distinction meant to cover the potentially millions of Americans who have bought or sold NFTs given the recent surge of interest.

As another important note, the 1040 Form instructs you to “Check ‘Yes’ if at any time during 2022 you: Received new digital assets as a result of mining, staking, and similar activities.” The fact that staking is mentioned indicates that the IRS likely views staking rewards as taxable events. The inclusion of “similar activities” also indicates that the IRS is likely viewing any receipt of a digital asset that was not made through a purchase with cash or exchange of other property as a taxable event.

In addition, the instructions clarify what its primary question means by “sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset).” Taxpayers have struggled since 2019 to understand what the IRS meant by a “Financial Interest.” The draft instructions finally offer some clarity, stating it means: “You have a financial interest in a digital asset if you are the owner of record of a digital asset, or have an ownership stake in an account that holds one or more digital assets, including the rights and obligations to acquire a financial interest, or you own a wallet that holds digital assets.”

Conclusion

All things considered, the alignment of Congress and the IRS arounddigital assets shows that regulatory clarity is progressing, education is increasing, and the issue is top of mind for many regulators, enterprises, and individuals alike. It is our hope that the Treasury imminently follows suit in issuing its own official guidance on how the Infrastructure Investment and Jobs Act (IIJA) should be applied as well.

Stay tuned for future updates as we continue to unpack the ever-evolving regulatory landscape for digital assets in the U.S. and abroad.

Contact us to learn more, explore partnership opportunities, or schedule a demo of our enterprise solutions.

.png)