The latest tax suite news and updates from Taxbit

As we approach the end of 2023, Taxbit is pleased to announce a series of new product releases and enhancements. This year’s focus has been on developing robust solutions to assist tax professionals in optimizing efficiency, reducing errors, and adapting to dynamic regulatory environments. We invite you to explore our latest updates.

Contents

- Tax Enterprise Product Enhancements

- New Solutions for EU Regulations

- Coming Soon Product Releases

- Additional Resources

Tax Enterprise Product Releases & Enhancements

New Taxbit Dashboard Reports

Taxbit’s newly introduced reporting features are designed to facilitate efficient data processing and reconciliation. These enhancements aim to streamline your workflow during the tax season, ensuring accuracy and consistency in your data management.New Reports include the following:

Reconciliation: Designed to display key aggregated data points enabling effective identification of discrepancies between datasets and the data successfully ingested into Taxbit. Providing a comprehensive overview to ensure alignment and accuracy between your records and Taxbit.

Export of IDs: Designed to enumerate all Account IDs or Transaction IDs successfully ingested into Taxbit. This report becomes particularly useful for conducting in-depth reconciliation analysis, especially when the Reconciliation Report indicates a potential discrepancy.Providing a detailed list of IDs, facilitating a thorough review and verification process.

Forms Status: A report that will provide status and details on all Tax Forms generated by Taxbit.

Account Validation: Provides a detailed breakdown of Account’s Personal Information Validation. Identify which accounts have valid, or invalid Name, Address, and TIN data on file.

Negative Asset Balance: Identify instances where an account’s inventory balance has become negative. In line with ensuring successful data ingestion and effective reconciliation, to make it easier to pinpoint accounts exhibiting negative inventory balances.

DAC7 Compliance Solution

Taxbit added support for DAC7 Compliance, designed to automate tax compliance for online marketplaces and platforms with EU activity. This offering establishes a seamless data collection workflow for new and existing customers, streamlining the collection, storage, remediation of issues, and information verification, then generating the end-of-year report to EU member states.

This addition to the Taxbit Enterprise Tax suite enables digital marketplaces with a solution that fosters trust, accuracy, and compliance in an ever-changing regulatory landscape. See more at https://taxbit.com/dac7-compliance-solutions/

CESOP Compliance Solution

Taxbit added support for CESOP Compliance. Central Electronic System of Payment Information (CESOP) compliance is an EU initiative to combat value-added tax (VAT) fraud related to cross-border payments. Saving businesses time, money, and errors using Taxbit’s reporting solution and new CESOP Engine to enable seamless compliance.

See more at https://taxbit.com/cesop-compliance-solutions/

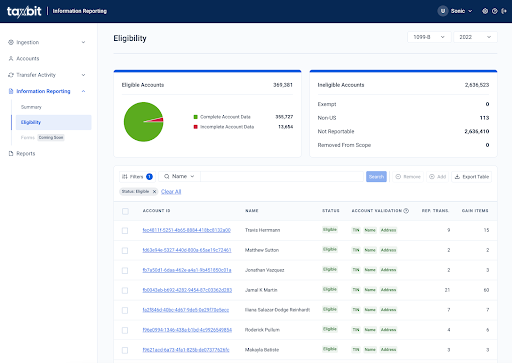

Upcoming Features- Eligibility Page

Soon to be launched, this feature will enhance 1099 compliance procedures, offering real-time insights and an efficient approval mechanism.

Key Features include:

Near Real-Time Data Insights

Comprehensive Eligibility Overview

Full Control, with Backing Data

Simplified Approval Process

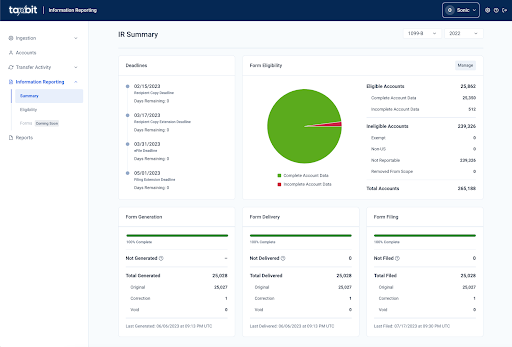

Upcoming – Information Return Summary

This upcoming addition is designed to centralize and simplify the Information Return processes, enhancing your experience during and beyond the tax season offering a more efficient place for tracking

Key Features:

Comprehensive Status Overview

Detailed Form Insights

Latest Activity Updates

Additional Resources

- Learn more about CESOP Compliance

- Navigate upcoming tax regulation timelines for the US & EU

- Understand the moving target of 1099-K reporting thresholds

- See how we partnered with Anchorage Digital to provide tax compliance for a Registered Investment Advisor (RIA)

Taxbit supports the entire tax reporting process in an automated and streamlined manner from onboarding and the associated data collection through information reporting. If you need support anywhere across your tax compliance process we are here to help. Looking forward to a smooth tax season in 2024!