Your crypto taxes done right, guaranteed

File your crypto taxes knowing you’re getting 100%

accurate calculations - 100% of

the time.

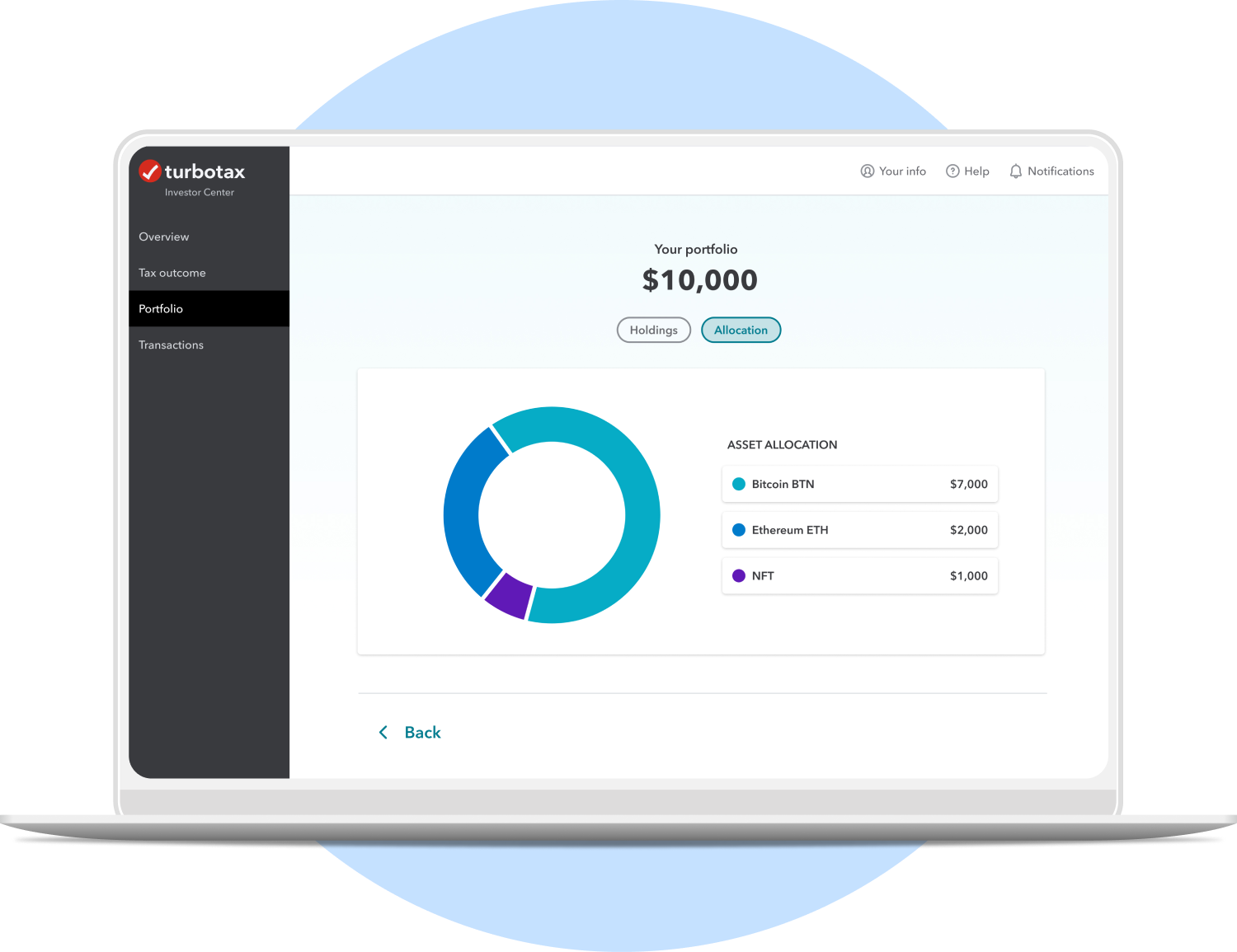

TurboTax Investor Center*

Invest smarter by tracking tax impacts and estimating taxes to avoid surprises this

tax season.

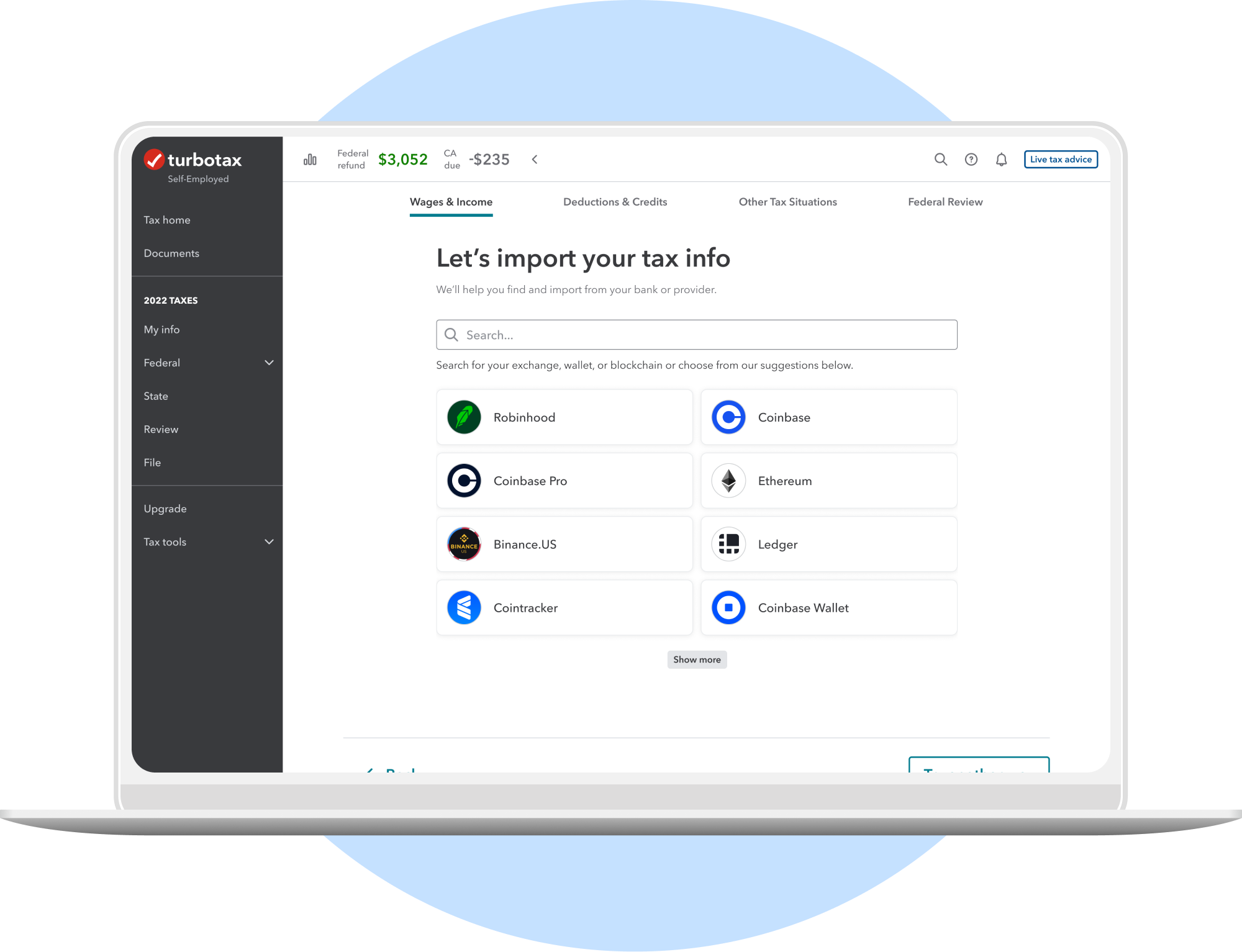

Auto-import your

crypto activity in a flash

Easily import digital asset exchanges & wallets, including NFTs, to automatically calculate capital gains and losses.

Take the work out

of cost basis reporting

We can take care of tracking down missing cost basis values for you and ensure accurate capital gain and loss reporting.

Get unlimited tax advice from crypto experts

Connect with a specialized crypto tax expert as often as you need for guidance on your investment and crypto taxes. (Included only with Assisted Premium and Live Full Service)

*TurboTax Investor Center does not provide investment advice, and is intended for informational purposes only. TurboTax Investor Center is not a tax preparation service.

Need to file your crypto taxes? We’ve got you covered.

File your own taxes

Answer simple questions

See how TurboTax works

Premium

Investments, crypto, and rental property

Expert help along the way

See how Live Assisted works

Premium

Investments, crypto, and rental property

We’ll do your taxes and find every dollar

you deserve

Get matched with a tax expert who specializes in crypto tax situations, will find every dollar you deserve, and get your taxes done 100% right, guaranteed.

Read why our customers love TurboTax

Recommended crypto resources

Frequently asked questions

Sign in to your exchange account. It’ll automatically import thousands of transactions and any tax forms you might have to calculate your gains and losses.

You’ll need to report your crypto as income if you sold it, received it as a payment, mined it, or earned it through exchange reward programs. The IRS treats crypto sales, exchanges and conversions as property and their earnings are considered capital gains.

The cost basis is how much money you spent to get an asset and is used to calculate your taxes. It includes the purchase price, transaction fees, brokerage commissions, and any other relevant costs.

It depends on whether your cryptocurrency was considered earned income or treated as a property sale. Either way, you enter your crypto transactions in the same place in TurboTax. We'll ask you questions to figure out how to report your earnings or loss.

Investments made easy

Learn how using TurboTax Investor Center* can help you stay on top of all of your investments.

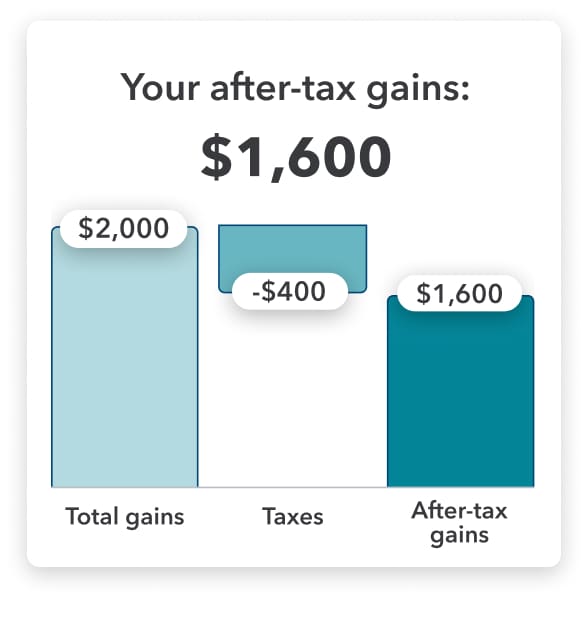

Easily estimate your crypto tax outcome

Sync crypto accounts, track your tax impacts, and estimate taxes to avoid tax-time surprises.

Ensure no money gets left unclaimed

We'll help you find missing cost basis values so you can report your capital gains and losses accurately.

Keep tabs on your portfolio instantly

Get a complete view of your digital assets by source to track your investment and sales performance.

Supports the investment accounts you already use

-

![Binance.US. logo]()

Binance.US -

![Bitcoin logo]()

Bitcoin -

![Blockchain.com logo]()

Blockchain.com -

![Coinbase logo]()

Coinbase -

![Crypto.com logo]()

Crypto.com -

![Dogecoin logo]()

Dogecoin -

![Ethereum logo]()

Ethereum -

![Gemini logo]()

Gemini -

![Kraken logo]()

Kraken -

![MetaMask logo]()

MetaMask -

![Robinhood logo]()

Robinhood -

![Tezos logo]()

Tezos

Frequently asked questions

TurboTax Investor Center is a new, best-in-class crypto tax software solution. It provides year-round free crypto tax forms, as well as crypto tax and portfolio insights that help you understand how your crypto transactions impact your taxes. You can also track your overall portfolio performance, enabling you to make smarter financial decisions and achieve their goals. TurboTax Investor Center is easy to use, free, and is separate from TurboTax’s typical tax filing services.

TurboTax Investor Center is suitable for you if you’re a crypto investor who wants year-round software to keep track of how your investment decisions impact your tax outcomes, monitor your portfolio performance, and make smarter financial decisions.

TurboTax Investor Center helps you avoid tax-time surprises by monitoring how your crypto sales and transactions affect your tax outcomes year-round. You can also track your portfolio performance and use our crypto tax software to make better financial decisions. TurboTax Investor Center also offers free crypto tax forms!

Simply sign up for an account, link your crypto accounts, and view your dashboard for tax insights and portfolio performance. As you make crypto transactions throughout the year, sign in to the TurboTax Investor Center anytime to see your tax outcome and overall portfolio. Our crypto tax software will update within 24 hours to help you keep track of your most up-to-date information.

Sign in to TurboTax Investor Center by clicking “Sign in to access” to access all our new features. We also highly recommend bookmarking this specific sign-in page for easy access. Note that if you attempt to sign in to TurboTax Investor Center from a different TurboTax page, you'll be redirected to the TurboTax product instead of the TurboTax Investor Center.

TurboTax Investor Center is a free new year-round crypto tax software solution that’s separate from preparing and filing taxes with TurboTax. It helps you continuously track both how your crypto investment decisions impact your tax outcome and your overall portfolio performance. It’s intended to be used year-round, but isn't a tax preparation service. Using TurboTax Investor Center to import your data will make it seamless to file taxes with TurboTax when tax time comes.

Yes! TurboTax Investor Center is free. You have the option to also use TurboTax to prepare and file your taxes come tax time, which typically comes with a cost. However, our year-round crypto tax software features are completely free to use.