Whether you're a new crypto investor or a seasoned trader, this guide has you covered with a step-by-step walkthrough on just how to report cryptocurrency on your taxes.

As cryptocurrency has exploded in popularity, there’s been a lot of confusion over how to properly report cryptocurrency on taxes.

The cryptocurrency tax reporting requirements can seem intimidating, but with a little help, new investors and busy traders alike can get through the process painlessly.

This guide will show you all the necessary steps to properly report cryptocurrency activities on your tax return. To start, let’s cover some basics around how cryptocurrency is taxed.

Understanding crypto taxation

In general, the cryptocurrency tax rules are similar to those for stocks. Crypto is taxed as property, meaning there’s the potential for a taxable event whenever you acquire or dispose of your cryptocurrency. If it generates income while you own it, that will be taxable too.

Capital gains tax events

A virtual currency is a capital asset. When you dispose of a capital asset for more than your basis (usually the price when you acquired it), you generate a capital gain.

Capital gains are taxable, and they’re the type of income you’re likely to see most often from your cryptocurrency activities.

You can generate cryptocurrency gains by disposing of your cryptocurrency investment in any of the following ways:

- Selling your cryptocurrency for fiat currency

- Trading one cryptocurrency for another

- Using your cryptocurrency to purchase goods or services

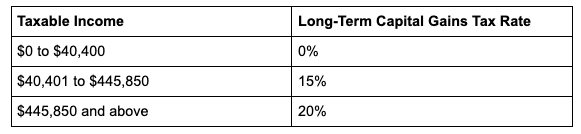

If you hold your cryptocurrency for less than a year, any capital gains will be subject to ordinary income tax rates, just like your paycheck. If you hold it for longer than a year, then you’ll receive the more favorable long-term capital gain rates (0%, 15%, or 20%).

Income tax events

If you acquire cryptocurrency through mining activities, you’ll owe income taxes on the fair market value. You’ll have to include the value of the cryptocurrency on the date of acquisition in your gross income for the year.

For example, mining $5,000 of Bitcoin is equivalent to receiving a paycheck for the same amount.

It doesn’t end there. There are several ways your cryptocurrency can generate additional ordinary income while it’s in your possession, such as:

- Crypto staking

- Hard forks or AirDrops

- Interest earnings

Each of these is taxable at the same ordinary income rates as mining and other earned income. Keep track of all your earnings and report them like you would W-2 wages or business income.

Events in which you don’t owe taxes

Fortunately, not every crypto transaction is taxable. If you ever dispose of your cryptocurrency at a loss, you won’t have to pay anything in taxes on it. While these types of transactions won’t generate any taxable income, you still need to report them on your taxes. You’ll want to anyway since you can use the losses they generate to reduce your crypto tax liability through a strategy called crypto tax-loss harvesting. That can happen in several situations, such as:

- Selling your cryptocurrency for less real currency than your cost basis

- Trading your cryptocurrency for another that’s worth less than your cost basis

- Using your cryptocurrency to buy something worth less than your cost basis

That means you won’t owe taxes on transactions like buying crypto with fiat currency, gifting or donating crypto, or transferring crypto between exchanges. If you apply the rule of thumb to these, you’ll see why:

- Buying crypto with fiat means you’re giving up cash equal to the crypto’s fair market value, by definition (no net benefit).

- You don’t receive any monetary value in return for a gift or donation, again by definition (though you may get a tax deduction).

- Transferring like-for-like crypto assets between exchanges doesn’t provide you with any additional monetary value.

If you’re receiving a net benefit from a transaction, it’s likely to trigger some sort of tax.

Long term capital gain vs. short term capital gain

When you dispose of a capital asset like cryptocurrency, the length of time you hold it determines what tax rate you’re going to pay.

If you own your cryptocurrency for at least one year, the IRS will consider any gains you receive to be long-term and tax them at significantly discounted rates.

For example, here’s what a single person would pay in capital gains taxes at each taxable income level in 2021.

Now that you understand what cryptocurrency activity is taxable and at what tax rate, let’s dive into how to report cryptocurrency on taxes in five steps.

1. Gather all cryptocurrency transaction details

Once you understand the fundamentals of cryptocurrency tax law, you can begin the cryptocurrency tax reporting process.

To start with, make sure you have all of the necessary details to fill out each of the required tax forms. Fortunately, crypto exchanges should make the information readily accessible for you.

You may receive an official tax form like Form 1099-B. Exchanges should provide a Form 1099-B at the end of each year to both the taxpayer and the IRS for tax purposes.

If you don’t receive one, you should be able to pull the information via CSV from your cryptocurrency exchange’s website.

If you receive Form 1099-B for some transactions and not others, keep them separate from each other. It’ll be helpful in step two.

To simplify this process, you could use a crypto tax software like Taxbit to easily connect to your various exchanges and wallets and automatically sync your transactions.

2. Fill out your Form 8949

Once you gather all of the details of your cryptocurrency transactions during the tax year, start plugging them into Form 8949.

That’s where you report all dispositions of capital assets, whether or not they generated taxable gains. They serve as supporting evidence for the net capital gain or loss you report later.

You’ll need a separate 8949 cryptocurrency tax form for each of the following groups of transactions:

- Those reported on Form(s) 1099-B showing basis was reported to the IRS

- Those reported on Form(s) 1099-B showing basis wasn’t reported to the IRS

- Any transactions not reported to you on Form 1099-B

There’s no need to separate transactions in any other manner. Your bitcoin transactions can go next to your litecoin transactions without issue.

Currently, not all exchanges are sending out Form 1099-B. You’ll most likely end up having to check Box C for any transactions not reported to you on a Form 1099-B

You’ll need to provide the following details for each virtual currency transaction:

- Name of the cryptocurrency

- Dates you acquired and disposed of the cryptocurrency

- Cost basis and proceeds (fair market value on purchase and disposition)

- Any adjustments necessary (usually none)

- Net capital gain or loss

Form 8949 has separate sections for short-term and long-term capital transactions, but the reporting process is the same for both.

Note that if you were to use a crypto tax software like Taxbit to connect your exchanges, you can automatically generate your Form 8949 in a matter of minutes.

3. Transfer your details to Schedule D

Once you’ve filled out each necessary Form 8949 and tallied up the final amounts, transfer the totals over to Schedule D. That’s the supporting schedule of Form 1040 where you report your total capital gains and losses for the tax year.

Make sure to double-check that your Forms 8949 add up to the totals that you report on Schedule D.

The IRS will investigate any discrepancies, and you may have to pay penalties or interest if you accidentally underreport on your Schedule D.

Note that you can decrease your tax liability with any crypto capital losses by reporting them here. You can use these losses to offset your gains through crypto tax-loss harvesting, and even if you don’t have any gains to net them against in the tax year you incur them, you can deduct up to $3,000 against your ordinary income.

You can then carry the remainder forward for future years.

4. Report crypto income on Schedule 1 or Schedule C

Once you complete your Schedule D and the supporting Forms 8949, you’re halfway done with the crypto tax reporting process.

You’ll have finished reporting your capital gains and losses. All that’s left is to report any ordinary income from mining, interest, staking, or hard forks.

You can report income generated from mining activities on either Schedule 1 or Schedule C, depending on whether you classify your activities as a hobby or a business.

If your activities are a hobby, you’ll report the mining income on Schedule 1, Line 8. Unfortunately, you won’t be able to take any deductions against it now that the Tax Cut and Jobs Act eliminated hobby deductions.

If your mining activities constitute a business, you’ll need to fill out Schedule C. You’ll be able to deduct any ordinary and necessary expenses you incurred while mining, but be ready to verify them if the IRS decides to audit you.

While deducting the expenses incurred in mining can be beneficial, you’ll also have to pay the extra 15.3% self-employment tax.

It’s probably not worth positioning yourself as a business unless you have a significant mining operation with high expenses. If you’re not sure which status should apply to you, consult with a tax professional before filing.

Whether you consider yourself a business or a hobby, all cryptocurrency income from interest, staking, or hard forks should go on Schedule 1.

5. Finalize and file your tax return

With your Forms 8949 and Schedules D, 1, and C completed, you’ll have reported everything necessary to satisfy the current crypto and Bitcoin tax requirements. You can then move on to the rest of your tax return and file it with confidence.

If you need further assistance, consult our cryptocurrency tax guide and cryptocurrency glossary for more information.

To continue learning about Cryptocurrency Tax Basics, see the additional articles in the series:

- Cryptocurrency Taxes

- Cryptocurrency Tax Laws

- Cryptocurrency Tax Forms

- Cryptocurrency Tax Reporting

- Cryptocurrency Tax Rate

- Taxes on Cryptocurrency Gains

- Crypto Losses Tax

How to simplify your crypto taxes

Successful cryptocurrency investing comes at a price. The more sophisticated your portfolio becomes, the more difficult it becomes to keep up with every crypto tax reporting requirement.

At a certain point, a crypto tax software like Taxbit becomes a necessity. Active digital currency traders can easily have hundreds of taxable transactions each year.

You have to keep track of each virtual currency’s cost basis, fair market value, purchase and disposition dates, and gains and losses.

But if you use Taxbit, the entire process is automated. You can connect your exchange accounts to Taxbit by logging in and connecting them to your Taxbit account. Taxbit will do the rest. Form 8949? Automatically completed. Schedule D? Done in an instant.

The best part? Not only does Taxbit make it easy to file your crypto taxes, Taxbit also acts as a year-round resource to identify tax-loss harvesting opportunities and make tax-optimized trades when the market fluctuates.

Taxbit can save you hours of unnecessary work. Get started today with a free trial!

.png)