Embracing UK Crypto Regulations

Fostering trust and advancing the industry

Published on:

Embracing UK Crypto Regulations

Fostering Trust and Advancing the Industry

In the ever-evolving world of cryptocurrencies, regulatory frameworks play a pivotal role in ensuring the stability, security, and growth of the industry. The United Kingdom has positioned itself as a global crypto asset technology hub by introducing comprehensive regulations for crypto companies operating within its purview. These regulations foster trust, protect consumers, and advance the crypto industry as a whole, providing a solid foundation for innovation and responsible practices.

Developing a Regulatory Framework

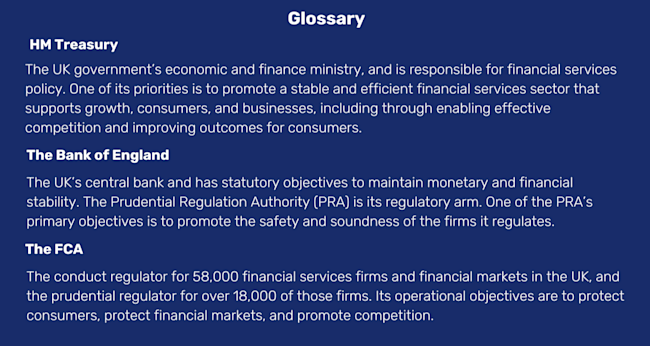

The UK's CryptoAssets Taskforce, established in 2018, brought together regulatory powerhouses like HM Treasury (HMT), the Bank of England, and the Financial Conduct Authority (FCA) to evaluate the potential influence of crypto assets and distributed ledger technology (DLT) within the United Kingdom. This collaborative effort aimed to deliberate on suitable policy actions and develop a joint, cohesive approach to crypto regulation. The taskforce's report, published on October 26th, 2018, emphasized the significant potential benefits of cryptoassets and DLT, particularly in the financial services sector and other industries. It also recognized the importance of addressing the range of risks prevalent in the current cryptoasset market, including risks to market integrity, financial crime, and consumer protection.

All three authorities involved in the taskforce expressed their commitment to supporting the advancement of the digital asset industry, and coordinating with various regulatory bodies, both domestic and international, to promote effective regulation. This collaboration includes engagement with many domestic and international organizations such as HM Revenue and Customs (HMRC), the Organisation for Economic Co-operation and Development (OECD), and the Financial Action Task Force (FATF). By aligning efforts and sharing insights, the UK aims to protect consumers, foster innovation, and drive positive developments in the crypto industry, both domestically and globally.

Strengthening Market Integrity

Three critical regulatory and financial bodies have been driving market integrity with their actions in lobbying for regulatory clarity and promoting collaboration amongst key stakeholders. The key activities of each are summarized below.

FCA

In July 2019, the FCA published initial Guidance on Crypto Assets, aimed at offering regulatory clarity and creating greater market integrity and consumer protection within the cryptoasset market.

FCA has since introduced several other regulations to provide further clarity and stability in the crypto market, focused on licensing requirements for cryptoasset businesses, anti-money laundering and counter-terrorist financing (AML/CTF) regulations, and regulations on marketing and selling crypto derivatives to retail consumers.

HMT

In April 2022, HM Treasury committed to introducing new regulatory measures to further strengthen the sector. As part of this commitment, they issued a public consultation in 2023 on the Future financial services regulatory regime for cryptoassets, specifically focusing on the UK regulatory framework for cryptoassets used within financial services. This consultation period allowed industry stakeholders to provide input, ensuring that the regulatory framework aligns with industry needs while addressing potential risks.

The final publication of the regulatory framework is pending, but it demonstrates the UK government's dedication to understanding the crypto landscape and applying reasonable regulations to foster a healthy and transparent ecosystem.

Bank of England

The Bank of England, in collaboration with the FCA, emphasized in 2022 that all UK financial services firms, including the cryptoasset sector, are expected to comply with existing sanctions regulations.

Bank of England has also collaborated with HMT to establish a Central Bank Digital Currency (CBDC) Taskforce. This taskforce aims to coordinate the exploration of a potential UK CBDC, the Digital Pound, for which consultation is ongoing. These collaborative efforts highlight the Bank of England's commitment to actively participate in shaping the regulatory framework and exploring innovative possibilities within the crypto industry.

Addressing Financial Crime and Protecting Consumers

The activity in the UK is a clear indicator of the importance that is being placed on the overall goal of combating financial crime within the crypto industry, while simultaneously protecting consumers. It will be incredibly interesting to see the evolution of this activity, beyond what has already happened as described below.

In October 2019, the FCA confirmed that crypto companies must adhere to an extensive anti-money laundering and countering the financing of terrorism (AML/CFT) regime. These regulations not only hold crypto companies accountable for their actions but also help minimize the risk of fraud, scams, and illicit activities within the sector.

In March 2023, the UK government confirmed that combating criminal abuse of cryptoassets is a priority as part of its 3-year Economic Crime Plan.

To strengthen measures against financial crime, the UK House of Lords recently approved the Economic Crime and Corporate Transparency Bill. This bill aims to improve the effectiveness of investigations, seizures, and the recovery of proceeds of crime in the realm of cryptoassets. It provides law enforcement agencies with the necessary legislative framework to prevent criminals from benefiting from their ill-gotten gains and to impede the use of these assets in funding additional criminal and terrorist activities.

The FCA banned the sale, marketing, and distribution of derivatives referencing unregulated cryptoassets to retail consumers in June 2020.

More recently, as of October 2023 companies promoting cryptocurrencies to UK customers will be required to adhere to existing financial promotion regimes, ensuring that consumers receive clear and accurate information about the risks involved in crypto investments. These measures protect consumers, reduce the potential for misinformation, and enhance confidence in the sector.

Developing Robust Tax Guidance

Tax implications surrounding cryptocurrencies have been a global challenge marked by confusion and inconsistency. However, the UK has been proactive in providing clarity and reasonable tax treatment for crypto activities.

In March 2021, HMRC published the Cryptoassets Manual, which provides guidance on the tax treatment of various crypto activities. The manual has undergone regular updates to expand and clarify the guidance, ensuring that individuals and businesses have a better understanding of their tax obligations in relation to cryptocurrencies. The UK government recognizes the need to strike a balance between appropriate taxation and avoiding undue burdens on crypto participants, facilitating a fair and transparent tax system within the crypto industry.

Positioning for the Future

TaxBit is paving the way for businesses to streamline and automate their tax compliance processes while at the same time reducing operational risks and manual error-prone processes that weigh down too many organizations. Our platform enables a single system of record to unlock scalable tax compliance that meets your business needs and complies with an ever-changing regulatory landscape. Reduce the burden on your internal teams and customers with a best-in-class experience.

See our UK Crypto Tax Guide for more details on the UK tax implications of the most common crypto transactions.

Learn more about what TaxBit can do for your business today.